Announcements

Drinks

Türkiye: tight monetary policy drives disinflation, eases external liquidity pressures

By Thomas Gillet, Sovereign and Public Sector

The policy pivot initiated by the Central bank of Türkiye (CBRT) 18-months ago should pay further dividends and help mitigate challenges to Türkiye’s long term foreign currency ratings (B/Positive).

However, the authorities have little room for complacency. Türkiye’s annual inflation at 52% in August 2024 remains among the highest across emerging markets – for example, inflation in Egypt (B-/Stable) running at 26% –, albeit below the 75% peak in May 2024.

As inflation remains well above the official target of 5%, the CBRT still needs to demonstrate it can drive real interests durably into positive territory, a critical factor for sustaining a significant turnaround in financial conditions for the domestic economy and providing fresh impetus for growth and investment.

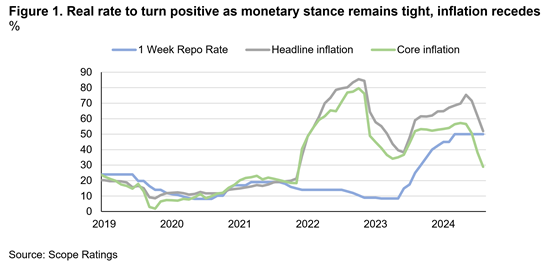

For now, the disinflation process is expected to enable the CBRT to lower gradually its one-week policy rate, from 50% currently, assuming inflation recedes more firmly, pushing the real rate back into positive territory (Figure 1).

Improved fiscal-monetary policy coordination needed to sustain disinflation

A continued decline in Türkiye’s annual inflation, projected to reach 55% in 2024 and 30% in 2025 will likely require enhanced coordination between monetary and fiscal policies. We expect the central government budget deficit to remain wide, at 5.2% of GDP in 2024, unchanged from 2023, driven by double-digit inflation that triggered wage adjustments and cash transfers.

Fiscal discipline is expected to tighten only slowly as the authorities use the leeway offered by a modest general government debt-GDP of about 30% to help cushion the economy from the impact of a prolonged period of higher interest rates. Credit growth in local currency decelerated to 30% YoY in August 2024, down from 69% one year before.

A more restrictive policy mix is expected to prolong the near-term economic slowdown, with real GDP growth of 3.5% in 2024 (although higher than a previous projection of 3.2%), and 3.2% in 2025 (unchanged), down from 4.5% in 2023.

Carefully managed policy adjustments unwind external imbalances, rebuilds buffers

The continued benefits of Türkiye’s monetary policy pivot, assuming the authorities hold their course, remain significant in putting the economy on a sounder footing in terms of financial stability and potential growth.

One key indicator of progress is moderating tensions on the balance of payments, due to lower financing requirements and more diversified funding sources.

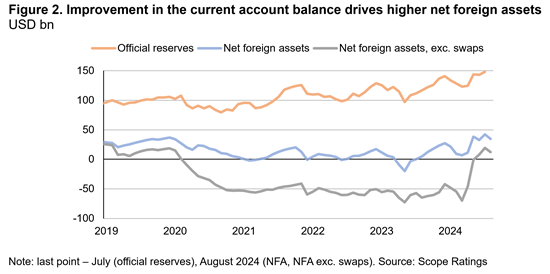

The current account turned positive in June-July 2024 and the surplus will widen further should the current policy stance be maintained. On a yearly basis, the current account deficit will likely narrow to 1.8% of GDP in 2024, down from 4.0% in 2023.

This improvement in the current account is largely supported by a stronger trade balance, underpinned by lower energy and gold imports, alongside dynamic good exports and tourism receipts as the depreciation of the lira boosts external competitiveness, further supporting these trends.

Growing confidence in the authorities’ willingness to stick to a balanced policy mix also points to lower foreign currency protected deposits and higher future foreign capital inflows, helped by the removal of Türkiye from the FATF’s grey list and lower US interest rates. Non-residents’ holdings of domestic debt rose from about 2% in December 2023 to 9% in July 2024, a sign of confidence in lira-denominated assets and less dollarisation of the Turkish economy.

In a baseline scenario, net foreign assets will continue recovering from historical lows, assuming no reversal in policies and no domestic or external shocks materialise, which remain a downside risk given heightened regional instability and Türkiye’s high short-term external debt (USD 176bn as of July 2024) relative to official reserves.

Despite these favourable developments, Türkiye’s recent record of unconventional monetary policy and still large budget deficit point to a long and challenging disinflation course, regardless of the country’s resilient growth and improved economic governance.

Scope’s next calendar rating review date on Türkiye is on 6 December 2024.

Stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.