Announcements

Drinks

United States: debt-ceiling crises and fiscal imbalances cloud outlook despite strengths

By Alvise Lennkh-Yunus, Sovereign and Public Sector

Unless the party of the winning presidential candidate secures majorities in both the House of Representatives and the Senate, the US is headed for another debt-ceiling crisis in early 2025.

Negotiations around the debt ceiling are likely to be protracted as lawmakers seek political concessions from each other given the country’s adversarial political climate rather than using the opportunity to implement much needed budgetary restraint.

The recurrent threat of debt-ceiling standoffs and the associated risk of a near or technical default represent an unresolved flaw in the US fiscal framework and an important credit weakness driving Scope’s AA credit rating and Negative Outlook for the US.

Limited incentives to reduce deficit, despite rising spending

Both the Democrats and Republicans show little appetite to contain or reverse the government’s expansionary fiscal stance.

Kamala Harris’s proposed policies would add around USD 1.2 to 2.0trn to the deficit over the next 10 years while Donald Trump’s policies are estimated to add up to USD 4.1 to 5.8trn. While these estimates are uncertain, it is clear neither candidate has a concrete plan to consolidate US public finances.

Despite these challenges, markets appear sanguine on how much the US can borrow given the reserve currency status of the dollar and the country’s deep capital markets.

In fact, the dollar’s status remains unmatched in its global role, with the euro a well established but distant second. There has been only slightly less use of the dollar internationally since the first Trump administration and the imposition of sanctions on Russia after its escalation of the war in Ukraine in 2022.

The US also benefits from the world’s deepest capital markets, with US stock market capitalisation three times the size of Europe’s (relative to respective GDP), facilitating easy and ample financing for US companies. This contrasts with Europe’s largely bank-based financing, driving EU policymakers’ long-held ambition to foster Europe’s capital markets union to facilitate financing and support Europe’s growth outlook.

Widening fiscal deficit is inflationary; healthcare-related contingent liabilities are rising

However, despite these two unparalleled strengths, in addition to ample energy resources and the US economy’s size and capacity for innovation, the significant US fiscal deficit is a growing concern.

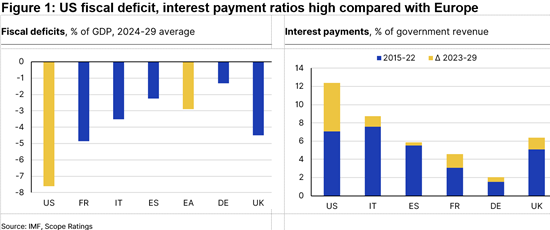

It is inflationary, increases risk premiums at the longer end of the yield curve and reduces private investment. Higher interest rates, despite the recent policy rate cut, combined with persistent budget deficits of 6% to 8% of GDP, result in a rising debt stock and thus higher interest payments, which are set to exceed 10% of government revenue over coming years. The US’ fiscal outlook is thus characterised by a high and rising level of general government debt-to-GDP which will exceed 130% in coming years, and debt servicing costs above those of Italy (BBB+/Stable).

Further weakening the fiscal outlook are substantial contingent liabilities related to healthcare spending, mostly on Medicare and Medicaid, which are much higher than the ageing-related expenditure faced by euro area member states.

Looking ahead, 88% of the projected increase in government spending from 2024 to 2034 will come from rising spending on social security, Medicare and Medicaid, and interest payments, areas for which policymakers are either unwilling or unable to contain spending.

Near-term vs medium-term risks to the US outlook

It is these medium- to long-term pressures that will inform our credit outlook, rather than the expected volatility in US politics surrounding the upcoming November election, which we expect to persist until the inauguration of the next administration.

In the short term, a key risk is a narrow Democratic victory set to be potentially challenged by Trump, and likely to lead to social unrest and another test of the strength of US institutions. Our baseline view is that these near-term risks will eventually be overcome, just as they were in 2020.

The US credit outlook will thus depend more on medium-term factors once the new administration settles in. Despite the robust and resilient US economy, we expect fiscal imbalances to deteriorate, but more pronounced under a Trump than a Harris administration.

Critically, if former President Trump wins, there is the additional risk of a further weakening of US institutions, including the rule of law, further politicisation of the judiciary, and even a challenge to the independence of the Federal Reserve and hence the dollar’s global reserve currency status. These factors may test the market’s long-held view of the global role of the dollar, and thus one of the main pillars supporting the sustainability of US public finances.

Scope’s next scheduled rating publication date of the US is November 22.

Register here for the Scope Rating webinar at 11.30 CET on Thursday 31 October: US elections: implications for the US and EU

Stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds.