Announcements

Drinks

Corporate ESG performance: high-scoring blue-chip firms still face big impact-reduction challenge

By Thong Huynh, Scope ESG Analysis

This is one of the main conclusions drawn from our ESG-performance analysis of the companies which make up Germany’s benchmark DAX40 stock-market index.

Our research suggests that that the companies with the best ESG profiles outperform in all three dimensions of impact, risk, and strategy, even if they are not necessarily the most sustainable in absolute terms, but impact scores tend to lag those for risk and strategy also for the top performers.

Join a Scope webinar for a full discussion of our conclusions on Wednesday 6 November: Corporate ESG performance: why a 3D view of impact, risk and strategy is crucial

Nearly all top-performing DAX40 firms still have considerable room for improving their environmental and social impacts particularly with regards to the use of renewable energies and occupational safety. Companies also have room to increase ESG-related strategy performance through initiatives to further reduce future scope-3 emissions by 2030 to align themselves more closely with the Paris agreement.

Similarly, while the capacity to manage ESG-related risks is generally high across the DAX40, what differentiates some companies from others is their involvement in ESG-linked controversies – product-related litigation, regulatory breaches – or revenue generation from controversial sectors such as armaments.

In our sustainability-analysis methodology – ESG Performance Score – we look at the double materiality of impacts and risks in addition to the systems and strategies that companies have in place to mitigate the impacts and manage the risks. The final score is a weighted sum of the scores in the three dimensions, where impact and risk account for 40% and strategy 20%.

Impact: top companies perform above average, but with room for improvement

The 20 leading DAX40 firms have an average impact score of 56.7, whereas the bottom 20 companies have an average impact profile of 34.1. This disparity indicates that the top-performing companies are more proficient at mitigating negative externalities, whereas the lower-ranked companies are laggards. Nevertheless, it also highlights that the leading DAX40 companies still have a potential to enhance their impact performance, with the average impact score of the top 20 only slightly above 50.

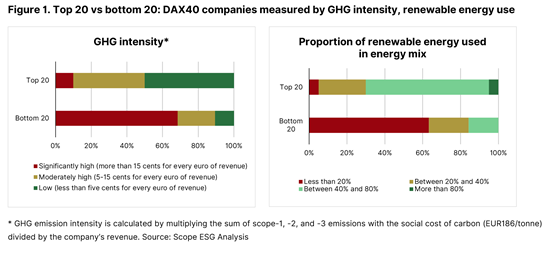

GHG emission intensity* and energy consumption** are the two key metrics that are material for almost*** all the companies in the DAX40. Assigned relatively large weights amongst environmental metrics, the two indicators play an important role in evaluating companies environmental impact profile. DAX40 companies in the bottom 20 tend to have significantly larger GHG footprints relative to revenues. In contrast, the leading 20 are less GHG intensive while using a greater proportion of renewable sources in their energy mix (Figure 1).

However, only half of the upper-half companies in the ranking achieve what we consider as low GHG intensity (smaller than five cents for every euro of revenue), whereas only Deutsche Telekom AG attains the highest score for the use of renewables by having more than 80% green energy. This suggests that even leading companies can further reduce their footprints and increase the use of renewable sources in their energy mix.

In addition, it is remarkable that nearly all DAX40 companies score negatively on occupational safety, either due to non-zero work-related injury and fatality rate or lack of reporting***. This highlights a critical area where firms can enhance their social impact with policies and training to avoid workplace injuries.

ESG-related risks: controversies expose discrepancies in scores

On ESG-related risk, the top-performing DAX40 firms have an average score of 72.5 compared with 62.8 of the bottom 20. ESG-related risks include the risks of reputational damage and litigation after being involved in controversies; operational disruption and stranded assets due to chronic climate change or extreme weather events; human rights violation along the value chain; or corruption and lobbyism in business activities.

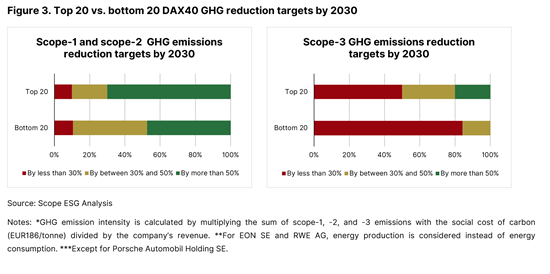

Overall, DAX40 companies exhibit solid risk management scores, with no firm receiving the minimum score for risk governance. Besides risk exposure intrinsic to a firm’s business model, much of the overall risk score variation is attributed to involvement in controversies, such as those related to product safety, property and personal damage caused by products, labour practices in the upstream supply chain, or unethical business activities. Controversies often expose discrepancies in the risk scores of companies within a given sector.

Seven of the bottom 20 companies receive the lowest score on controversies following numerous ESG-related disputes, compared to one for the top 20 (Figure 2). Though not as severe, half of the companies in the top 20 are also involved in a smaller number of controversies which lowers their risk score. In addition, five among the bottom group generate a significant proportion (larger than 10%) from controversial sectors such as weapon manufacturing, palm oil production, or fossil fuels. Controversial sectors face more stringent regulations and dwindling demand, which can negatively affect a company’s financial performance.

Strategy: top companies aim at more ambitious reductions in GHG emissions by 2030

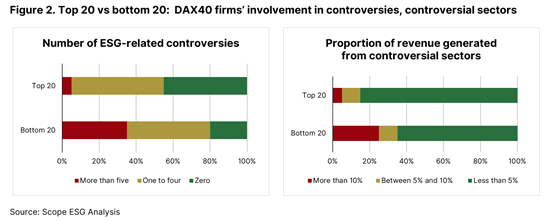

The top 20 companies have an average strategy score of 57.8, while the bottom 20 are not significantly behind with an average score of 44.5. Although the strategy assessment influences the final score to a lesser extent as it only has a 20% weighting, it is noticeable that leading firms tend to have more clear and ambitious reduction targets to mitigate their GHG footprints by 2030 (Figure 3).

For scope-3 reduction targets, none of the companies in the bottom 20 aims at cutting emissions by more than 50%, while only four out of the top 20 commit to this objective. More specifically, 16 out of the bottom 20 plan to reduce their GHG footprint by only 30% or less, with some not reporting a quantitative target.

This highlights a critical area where even leading companies can perform better, by virtue of developing initiatives and setting higher targets to lower their future scope-3 as well as scope-1 and scope-2 emissions. Reduction in scope-3 emissions is crucial to achieve the objectives of the Paris agreement by 2030.

Visit the ESG Performance Score home page.

Get a preliminary ESG Impact Score

Stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.