Announcements

Drinks

Sovereign Outlook 2025: robust fundamentals, rising fiscal pressures and geopolitical uncertainty

Download Scope's Sovereign Outlook 2025

In line with Scope’s continuing expectations for a soft landing of the global economy after the sharpest rise in interest rates in modern times, growth in output is likely to steady at around 3.3% in 2025 and 2026, broadly in line with the 3.2% this year.

“However, medium-term downside risks to the global expansion have increased, while Europe’s contribution to global growth has fallen markedly,” says Alvise Lennkh-Yunus, head of sovereign and public sector at Scope.

“Throughout 2024, Scope’s sovereign rating actions were largely concentrated within the euro area, driving the sustained credit-rating convergence between core European and former crisis affected countries. This trend was primarily driven by positive credit rating actions on lower-investment grade rated euro-area sovereigns and selective negative rating actions on highly rated core euro-area sovereigns,” says Lennkh-Yunus.

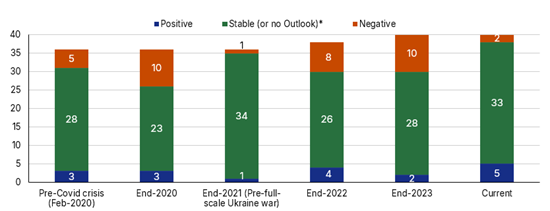

At year end, Scope’s rated portfolio currently has two sovereigns – the United States and Belgium – on a Negative Outlook and five sovereigns – Bulgaria, Greece, Lithuania, Serbia and Türkiye – on Positive Outlook. This is a significant shift compared with last year, where 10 sovereigns were on Negative Outlook against only two on Positive (Figure 1). That most Outlooks are Stable underscores the balanced overall sovereign sector outlook for 2025.

Figure 1: Scope sovereign ratings Outlooks (number of sovereigns)

*No rating Outlook currently assigned on Ukraine in selective default. Displayed are Outlooks on long-term issuer ratings in foreign currency. Source: Scope Ratings.

US policy shifts raise significant risks for the sovereign outlook

The expected policy shifts in the US with the re-election of Donald Trump as president are likely to prove crucial for the credit trajectory of the US and for sovereigns globally.

“Countries most exposed to these shifts are those having an elevated trade surplus with and/or significant exports to the US (countries such as China, Germany, Japan and Ireland), significant dollar-denominated borrowings (such as emerging markets like Ukraine, Egypt, Türkiye), and/or an elevated dependence on US military aid, especially given the geopolitical tensions with Russia (Ukraine and Georgia),” says Dennis Shen, Senior Director.

“These dynamics could exacerbate credit risks reshaping sovereign risk globally,” Shen says.

Sticky inflation, diverging central bank policies drive financial stability concerns

Another concern of Scope’s is the danger that persistent core inflation could necessitate prolonged higher steady-state rates leading to elevated global borrowing rates.

Potential corrections in overvalued financial markets alongside increased de-regulation in the US in 2025 increase financial stability risks. The interplay of these factors poses challenges for macroeconomic stability.

Elevated public debt and rising interest payments challenge the fiscal outlook

In 2025, fiscal resilience will rely heavily on governments’ capacity to navigate rising debt-servicing costs, address structural policy reform, and prioritise investment balancing short-run stability with longer-term challenges.

“Governments with stable parliamentary majorities and strong reform mandates will be better positioned to address sustained fiscal imbalances in coming years. The management of elevated public debt will play a critical role in determining sovereign credit-rating trajectories,” says Shen.