Announcements

Drinks

CEE Sovereign Outlook 2025: risk balance to ratings broadly neutral for 2025

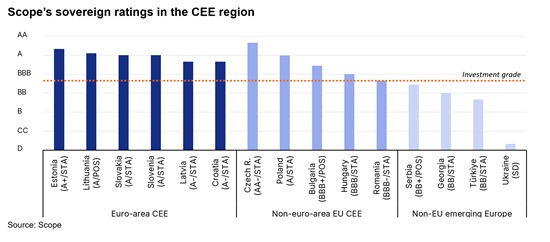

“We made several rating adjustments in 2024, which have resulted in a convergence of ratings for euro-area CEE sovereigns, which are now all rated in the A+ to A- range,” said Jakob Suwalski, a senior director at Scope Ratings and co-author of Scope’s CEE Sovereign Outlook 2025. “We see greater rating divergence among non-euro area EU sovereigns, led by the Czech Republic (AA-/Stable) with Romania setting the rating floor at BBB-/Stable”.

Scope currently rates all non-EU CEE sovereigns non-investment grade, although Serbia’s BB+ rating was assigned a Positive Outlook while Türkiye was upgraded to BB-/Stable this year. Ukraine remains in Selective Default given ongoing Eurobond debt restructurings.

“The CEE-region is set for a rebound in growth in 2025, driven by stronger domestic demand, easing inflation, and rising real wages, though external demand and fiscal tightening present challenges,” Suwalski said, “Geopolitical risks from the war in Ukraine and structural demographic shifts pose challenges to long-term growth prospects.”

Scope expects inflation in the 11 CEE EU member states (the CEE-11) to ease through 2025, driven by a subsidence of external shocks and the impact of disinflationary pressures. Euro-area CEE countries are converging toward the 2% target, though challenges remain. By contrast, non-euro EU countries like Poland (A/Stable) and Hungary (BBB/Stable) face persistent inflation, partly fuelled by fiscal imbalances while non-EU CEE sovereigns face continued geopolitical risks.

“The CEE-11 face weak foreign demand, particularly from Germany, impacting exports and current account balances. While trade weakness may hinder FDI inflows, robust EU funding and resilient services exports provide support. Trade linkages remain concentrated on Germany, with generally contained direct exposures to the US,” Suwalski said.

The fiscal outlook for the CEE-11 remains challenging, with deficits staying above pre-pandemic levels especially due to social and defence spending. Fiscal tightening will be slow, with several countries under excessive deficit procedures. While most debt ratios are set to rise and fiscal space is curtailed by raising interest payments, moderate debt levels and EU support provide stability.

“Growth in CEE EU countries is bolstered by EU funding, but its effective use also depends on governance and administrative capacity,” Suwalski cautioned. “The region also struggles with balancing energy efficiency and renewable adoption, requiring sustained policy efforts to ensure fiscal and environmental resilience.”