Announcements

Drinks

European real estate: funding squeeze forgotten; refinancing challenge lies ahead

By Philipp Wass, Corporates Ratings

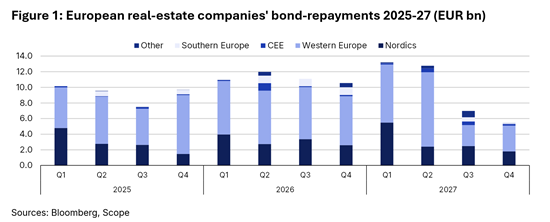

The improvement in funding conditions is likely to last, but the sector still has EUR 120bn of capital market debt to roll over between 2025 and 2027, an increase of more than 40% compared with the three years between 2022 and 2024 (Figure 1).

Another headwind is the structural pressures which are lowering asset values in some segments, notably for owners of second-tier assets.

In Europe as a whole, with borrowing costs two to three times higher than in 2021, some European real estate issuers will be priced out of the capital markets and need to shift to secured funding, for which a prerequisite may be more deleveraging.

Easier financing conditions take pressure of real estate firms’ balance sheets

For the time being, financing conditions in the sector have improved, primarily due to better visibility on the direction of interest rates, which have fallen steadily from their peak in Q4 2023, as market participants expect no resumption of monetary tightening. In addition, investor confidence has improved.

Swap rates have fallen from their peak in Q4 2023, while margin expectations are lower than a year ago as investors regain confidence in the sector. Both factors are leading to lower all-in financing rates. Spreads over benchmark rates for corporate real estate debt have stabilised at around 100-200 bps. All-in funding costs for investment-grade issuers have fallen from above 5% a year ago to around 3-4% at end-January 2025 (for a 5-year bond), as central banks across Europe have cut policy rates.

Easier financing conditions have seen a generalised return of real estate companies to capital markets, including weak investment grade as well as strong non-investment grade rated borrowers.

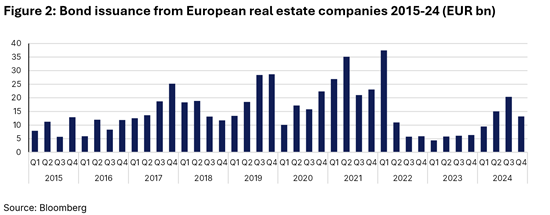

Bond issuance continued at a healthy pace this year, with around EUR 9bn issued so far in Q1, almost much as was raised in the same period last year, after rising by around 160% in 2024 from the year before. Investor appetite for real estate corporate debt is a sign of declining refinancing risk, which was significantly higher when monetary tightening was in full swing (Figure 2).

High-yield borrowers are not out of the woods yet

However, weaker non-investment grade rated corporates face significantly higher all-in funding costs than before the monetary tightening that started in 2022. They remain cut off from the debt capital markets, with borrowing costs starting at 6.5%, at least three times higher than at the end of 2021 and likely well above real estate yields.

These issuers remain dependent on secured financing – more attractive for diversified companies than for those focused more on office real estate – as well as some form of mezzanine financing, hence the pressure on selling assets at a discount to deleverage, raising fresh equity, buying back bonds below par - or a combination of the above.

Overall, in Europe, restructuring efforts by real estate companies have paid off, leading to renewed confidence in the sector. With interest rates on the decline, Z-spreads – a measure of average funding conditions – have narrowed sharply over the past few months.

Market valuations reflect prime, non-prime property divergence

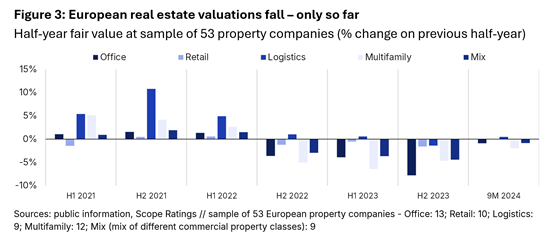

At the same time, greater visibility on interest rates, and hence a stabilisation of risk-free yields and lower financing costs, have significantly reduced the pressure on valuations of European real estate companies.

The positive spread between prime yields of 4.9% to 5.4% and all-in financing costs also makes investment in real estate assets margin accretive, leading to limited fair value adjustments in 2024, and has supported, and will continue to support transaction activity. We see this in the growth in trailing 12-month investment volumes since Q1 2024, which increased by around 20% YoY in 2024.

The positive spread between prime yields of 4.9% to 5.4% and all-in financing costs also makes investment in real estate assets margin accretive, leading to limited fair value adjustments in 2024, and has supported, and will continue to support transaction activity. We see this in the growth in trailing 12-month investment volumes since Q1 2024, which increased by around 20% YoY in 2024.

While property valuations have stabilised in many European countries as financial conditions have eased, one source of long-term pressure remains: the greater differentiation between prime and non-prime assets.

Property values are yet to fully adjust, especially for non-prime assets whose owners will have to invest heavily to meet tightening regulatory requirements and/or changing tenant requirements. We estimate that between EUR 225bn and EUR 600bn per year will be needed across the European real estate stock to meet the EU's target of carbon neutrality by 2050.

To avoid compromising their social role in providing affordable housing and commercial space, real estate firms’ investment may be achievable only with a significant downward revaluation of property assets and a loss of economic wealth for owners – unless additional government support emerges: e.g., financial support, incentives and/or policy changes.

Banks important but cannot replace debt capital market finance

Given the refinancing challenge ahead, real estate firms will have to turn to banks for some of their financing, aware that lenders have become more cautious and selective though willing to roll over existing financing for operationally sound properties/portfolios. The banks are providing new lending if the collateral is solid and covenants are tight, if not perhaps as tight as they were two years ago.

Still, secured bank lending can cover only a small part of the refinancing of maturing bonds, leaving non-investment grade issuers under pressure to restructure assets or liabilities – or both – to protect creditworthiness, most likely at a high cost to equity and debt holders.