Announcements

Drinks

Hybrid bond outlook: busy call schedule, tight spreads to drive corporate deal volumes

By Azza Chammem, Corporate Ratings

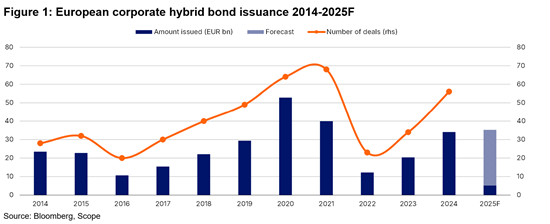

We expect primary European corporate hybrid flows this year to exceed supply of EUR 34bn in 2024, which was already 70% higher than the year before. Enel SpA, ENI SpA, La Poste SA, Deutsche Lufthansa AG, and debut issuer Iren SpA had issued a combined EUR 5.25bn in hybrids by early March 2025.

Upcoming calls will drive refinancing and liability management activity over the year while issuers pre-financing next year’s calls will add transactions to 2025 volumes. Investor engagement has generally been robust, although with spreads narrower, buyside demand has fallen compared with 2022 and 2023.

Utilities to use hybrids to manage balance sheets as capex continues to rise

From a sector perspective, utilities with negative free operating cash flow will continue to be the most prominent issuers of hybrids to help them ease mounting balance-sheet strains caused by heavy and steadily rising capex requirements.

The capex challenge is widespread, from issuers with exposure to transmission and distribution to those investing in new generation capacity. As capex bites into free operating cashflow, issuing hybrid bonds can be an important means of reducing ratings pressure.

Less balance-sheet pressure on oil & gas, telecoms; real estate firms return to market

In contrast, companies in the oil and gas and telecoms sectors are likely to be less active issuers of hybrid bonds as they typically have big cushions and less stressed balance sheets. For telecoms operators, capex loads tend not to fluctuate year on year, so operating cashflow is typically sufficient to finance capex needs.

Refinancing will mostly determine hybrid debt issuance from the oil and gas and telecoms-sectors. The telecoms sector accounted for 14% of European hybrid issuance in 2024, down from 26% in 2023. That was purely a function of call schedules.

For oil and gas companies, their share of issuance rose for the same reason, but the trend may not continue given the strength of their balance sheets. In fact, we expect that some oil and gas companies will use call dates to repay hybrids with cash.

The improvement in the real estate outlook and the narrowing spread between hybrids and conventional bonds has created a more favourable environment for hybrid issuance and refinancing. Some real estate companies had previously opted to extend their hybrids, but the improved outlook and better investor appetite suggest more companies might call and refinance their hybrids at upcoming call dates.

30-year tenors increasingly common

When it comes to tenors, the emergence in the US and increasingly in Europe of hybrids with 30-year maturities, alongside ultra-long-dated or perpetual instruments, was driven by investors looking to avoid extension risk. Thirty-year tenors also offer companies more manageable payment schedules given the advantageous interest-rate differential relative to perpetual instruments.

Lufthansa’s EUR 500m 5.25% hybrid issued in January 2025 was a 30-year instrument, as were issues in 2024 from Bayer, Aptiv, Energias de Portugal, SES SA, Centrica, and BT.

Equity credit retained after coupon step-ups

Obtaining equity credit from rating agencies will continue to make hybrids a popular funding option for companies, particularly those in capital-intensive sectors. Hybrids offer companies better control over leverage, so they will continue to be attractive relative other channels such as lower shareholder distributions or spreading capex over multiple years.

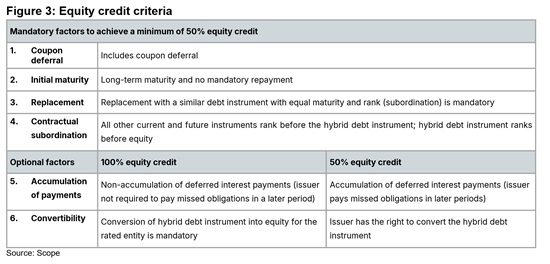

For Scope, it is important that issuers show commitment to their hybrid instruments to ensure they retain the equity credit assigned to their debt loads. At the same time, Scope does not remove equity credit from hybrids that are not called and where coupon step-ups are triggered.

Our approach is based on the notion that call or non-call decisions do not impact debt positions and are a core component of the hybrid instrument’s flexibility, alongside other factors such as coupon deferral. In our General Corporate Rating Methodology, step-ups do not impact the mandatory features required for instruments to be classified as hybrids hence obtain equity treatment.

We flag certain mandatory features for the consideration of equity credit to be applied in the computation of Scope-adjusted debt and Scope-adjusted interest. Hybrid instruments must meet certain mandatory criteria to be granted equity credit. If optional features are also met, we would typically grant higher equity credit. If an instrument does not meet all of the mandatory requirements, it is treated as debt. We also adjust interest paid on hybrids in proportion to the equity credit given.

Embedded options typical part of hybrid debt instruments

Hybrid debt instruments typically have a more complex structure than most fixed-income instruments and contain embedded options. These options typically allow issuers to either redeem securities before their specified maturity, avoiding a step-up of coupon payments, or to convert the securities into ordinary shares. Instruments that exclusively include a mandatory conversion at maturity, such as convertible shareholder loans, are not grouped under hybrid securities.

In case of a permanent write-down of principal or forced conversion into equity, we would likely rate the hybrid debt instrument at ‘D’ and subsequently withdraw the rating since the instrument ceases to exist.

Coupon cancellation does not necessarily trigger rating action

When it comes to coupon cancellation, we would evaluate the reasons for the cancellation and assess whether this is a temporary or more permanent change in the issuer’s ability to make distributions. If the reason for the coupon cancellation is a one-off event that does not impair the issuer’s future capacity to make payments, we may not change the hybrid security’s rating. More specifically, we will not automatically consider the instrument to be in default.

Neither of the instances above would lead to an automatic default on the issuer rating. The issuer rating may, however, be adjusted downward in case of a deterioration in the issuer credit profile.