Announcements

Drinks

Germany’s borrowing to rise by EUR 625bn for infrastructure and defence

By Eiko Sievert, Sovereign and Public Sector

The planned fiscal stimulus and expected structural reforms could help reverse Germany’s economic stagnation while strengthening Europe’s security and defence especially as the EU faces growing tensions with the US over trade and security.

The initial results of the exploratory talks among likely future coalition partners in Germany’s new government point to an annual borrowing increase averaging EUR 50bn for infrastructure and EUR 75bn for defence. However, actual spending could be lower in the first years of implementation. This would include defence spending increasing from 1.2% of GDP in 2024 to around 3%.

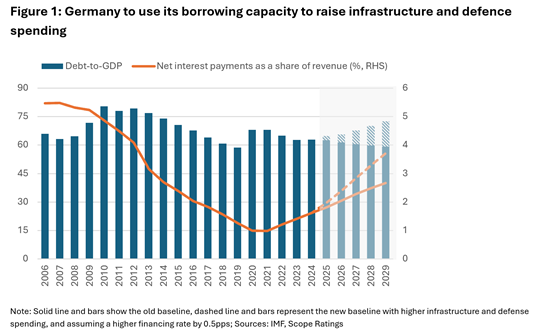

If approved and implemented, Germany’s government debt would increase to around EUR 3.7tn or around 73% of GDP by 2029, assuming average economic growth of 1% and inflation close to the target value of around 2% (Figure 1).

This would keep Germany's debt ratio below the previous peak of 80% of GDP, reached in 2010 after the global financial crisis but slightly above levels after the Covid-19 pandemic of around 68% in 2020/21.

Higher debt levels will lead to higher interest expenses

Germany’s interest expenses were already rising before the proposed changes to debt brake provisions given the end of the low-interest rate environment in 2022. This trajectory is now likely to accelerate, although given an average debt maturity of around 8 years, the full impact will take some time to materialise. Yields on German government bonds increased sharply following the announcement of higher future debt issuance, with the 10-year Bund jumping to 2.9% from 2.5% previously.

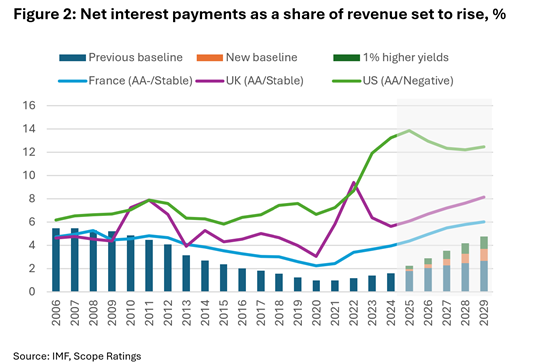

Compared with other countries, Germany’s net interest payments as a share of government revenue are relatively low at around 1.6% in 2024, compared to France (4.0%), the United Kingdom (5.7%) or the United States (13.2%).

By 2029, this share could rise to around 3.7% for Germany under our new baseline, which reflects the adjusted bond yields. However, if yields increased further by an additional 1pp and remain elevated over the coming years, net interest payments as a share of government revenue could rise to around 4.4%.

Even in this stressed scenario, Germany’s interest payments would remain below those observed prior to the financial crisis and significantly below those of other major economies (Figure 2).

Nonetheless, the rising interest burden underlines the importance for political reform to realign Germany’s budget and boost productivity. Further progress on a more permanent change to the debt brake will also be crucial as continuously circumventing fiscal rules using special funds could otherwise place Germany's debt ratio on a sustained upward trajectory.

Growth impact depends on capacity constraints and share of domestic procurement

The direct impact on growth from the expected EUR 625bn expenditure on infrastructure and defence over the next five years in Germany and Europe will take time to materialise and partly depends on resolving capacity constraints and the share of domestic procurement.

For infrastructure spending, existing spending priorities on rail and road networks should speed up implementation and enhance the broader economy. Additionally, a 10-year time horizon of the special fund for infrastructure would signal to the private sector that Germany is focussed on supporting growth over the coming years. This should strengthen confidence and encourage private investment.

The impact of defence expenditure is likely going to be lower and ultimately depends on the extent that these funds will be spent on either domestic production or foreign imports, including purchases from the United States.

However, the planned exemption of defence spending from the restrictions of the debt brake would also allow Germany to achieve a NATO defence spending target of more than 3% of GDP if needed, even if military spending in the annual budget remained unchanged (at EUR 52 billion in the 2024 budget, around 1.2% of GDP).

Risk of lower momentum for budgetary reprioritisation and other structural reforms

The agreement reduces pressure on coalition partners to adjust budgetary spending priorities to support long-term debt sustainability and address structural pressures, such as pension reforms. It also discourages the next administration from incorporating permanently higher military spending within the regular budget.

Further structural reform remain essential to tackle high energy prices, cutting red tape, labour market reforms to increase the participation rate, immigration controls that do not negatively affect Germany's attractiveness to skilled immigrants, and tax reform to encourage business investment.