Announcements

Drinks

Türkiye: political uncertainty clouds inflation outlook

By Thomas Gillet, Sovereign and Public Sector

Higher financial volatility in Türkiye (BB-/Stable) could be credit negative should it lead to higher inflation or lead to a reversal of the current orthodox macro-economic policy mix that the authorities have consistently pursued since the general elections of May 2023.

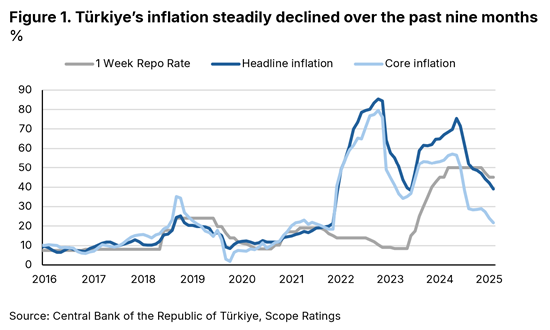

Scope upgraded the long-term ratings to BB-/Stable in December 2024 based on more effective monetary policy driving inflation lower, helping rebuild international reserves, and raising prospects for tighter fiscal policy.

However, significantly higher political uncertainty, following the recent arrest of a leading opposition politician, coupled with a more challenging international environment (trade, geopolitical tensions) could make it much harder for officials to contain inflation.

In response to the Turkish lira’s sharp depreciation of 4% against the US dollar, on 20 March the Central Bank of the Republic of Türkiye (CBRT) raised its overnight lending rate, suspended one-week repo auctions and injected liquidity into local markets.

Political uncertainty comes as policy normalisation started to pay dividends

The impact on the inflation outlook could be even bigger as the CBRT started to ease financial conditions in December 2024, reducing its policy rate from 50.0% to 42.5%.

Higher sustained uncertainty is also expected to diminish the economy’s growth prospects. After 3.2% growth in 2024, real GDP growth is likely to slow to 3.0% in 2025. Household consumption, the main driver of domestic growth, is sensitive to higher inflation and borrowing costs.

A more pronounced economic slowdown also increases the risk that fiscal policy remains expansionary, challenging the government’s ability to reach its objective of a primary balance in 2026. We expect a budget deficit of about 3.6% of GDP in 2025 and in 2026, and a debt-to-GDP ratio of 26%.

External and financial risks remain significant

To be sure, the Turkish economy is more resilient hank a few years ago, able to accommodate some volatility due to higher international reserves and more effective macroeconomic policies, which have eased the strains on public- and private-sector balance sheets.

Non-resident holdings rose to more than 10% of government debt in January 2025, up from 2% in January 2024. Net assets of the CBRT, excluding foreign currency swaps with commercial banks, have reached multi-year highs of more than USD 40bn.

However, Türkiye’s BB- ratings reflect prominent external and financial risks, as reflected in downward pressures on the net foreign position of local banks. Local banks’ balance sheets could deteriorate if they are called upon by the authorities to continue supporting the local currency.

If sustained over a prolonged period, the interventions of the CBRT to contain the depreciation of the lira will also erode its reserves and lower resilience against future external shocks. This could reduce confidence into lira denominated assets and encourage higher dollarisation.

Although Türkiye’s public finances have proven to be resilient to domestic political uncertainty in the past, the country’s rating trajectory remains vulnerable to challenging macro-economic conditions and sudden shifts in domestic economic policy.

Scope’s next review date is on 30 May.