Announcements

Drinks

UK sovereign rating affirmed, but fiscal pressures intensify; tariffs harm growth

By Dennis Shen and Elena Klare, Sovereign and Public Sector

The UK’s robust institutional framework, the standing of sterling as a reserve currency, and the role of gilts as safe assets alongside deep domestic capital markets support the sovereign’s credit ratings. But increasing levels of public debt, elevated financing costs, multiple recent episodes of gilt market volatility and a weak external sector with recurring current-account deficits present challenges.

The measures announced in the Spring Statement restored the UK’s fiscal headroom to GBP 9.9bn, regaining the level projected as of last October, but this headspace is limited and leaves budgetary policies exposed to economic developments beyond the government’s direct control, presenting significant risks at a time of heightened global geopolitical and economic uncertainties.

There are also risks to the government’s fiscal and macroeconomic forecasts, making it likely that the Chancellor of the Exchequer might need to further adjust her policies in the upcoming Autumn Budget. Market expectations already reflect the possibility of additional tax measures, which could dampen the economy.

The “reciprocal” tariff announcements of the US government are set to further weigh on the UK’s open economy. The newly imposed 10% US tariffs on UK exports (on GBP 60bn of exports to the US last year or 2.1% of GDP) alongside 25% tariffs on steel and aluminium effective since last month present downside risks for our UK growth forecasts of 1.0% for 2025 and 1.3% for 2026.

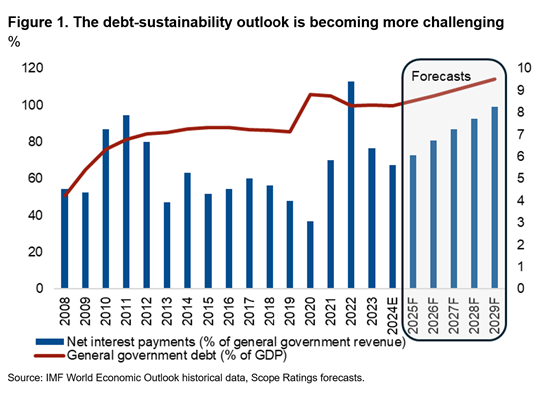

Borrowing costs have increased since last October: higher interest expenditure having effectively used up all of the GBP 9.9bn fiscal headroom left from the 2024 Autumn Budget. We forecast net interest payments increasing to 8.3% of general government revenues by 2029, a near tripling from the 3.1% at their 2020 lows.

The higher military spending anticipated to aggravate the public-sector deficit

An increase in NATO-qualifying expenditure to 2.5% of GDP by 2027 is a constraint on the UK’s sovereign ratings. Although the announced increase in UK military expenditure is not as significant thus far as that announced by many other European governments, any further rise aggravates the already elevated public-sector deficits. Political necessity aside, much of the currently-budgeted defence spending is classified as capital expenditure so does not count towards the UK fiscal rules to balance the budget by fiscal year 2029-30.

The Chancellor remains committed to reducing public-sector net financial liabilities. However, a more relevant market indicator: net debt excluding the Bank of England continues to rise. In view of continued subdued output growth, higher financing costs and significant spending requirements, we see an increase in UK general government debt to 114.2% of GDP by 2029, from the estimated 99.5% as of end-2024 (Figure 1).

Read the latest United Kingdom sovereign rating announcement (published on 28 March).