Announcements

Drinks

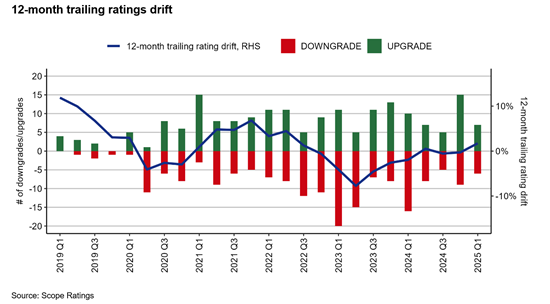

Structured Finance Activity Report: ratings drift shifts into positive territory

Of the 341 monitoring reviews conducted in the 12-month period across 147 outstanding transactions, 9.8% led to rating upgrades, 8% to downgrades.

Scope assigned new ratings or ancillary services to 86 instruments on 45 structured finance transactions in the 12-month period to the end of Q1 2025, raising rated new-issue volume by 12.1%.

NPLs continued to see most downgrades, mainly attributable to depressed sales prices, disappointing collections, and the general downward review of original business plans by servicers. Upgrades were distributed across sectors with a particularly strong showing in RMBS and consumer ABS. Upgrades were mainly driven by deleveraging and low levels of borrower insolvencies in the case of performing ABS and better-than-expected performance of unsecured NPL exposures.

Less downward ratings pressure on NPLs, and more upwards pressure across most asset classes contributed to the positive shift in ratings drift.

Overall, Scope’s structured finance team covered 338 instruments across 175 transactions in the 12-month period. The major asset classes were NPL (87 instruments), Other (mainly CLN & Repackaged-debt and Reverse Mortgages, 66), and CDO/CLO (43). By the end of the period, Scope had assigned ratings to almost EUR 322.9bn-equivalent in structured finance instruments since 2014.

Download the Structured Finance Activity Report here.

And sign up here to watch Scope’s Auto ABS in Europe – performance and outlook webinar on Monday, 7 April at 13:00 CET. Speakers include analysts from Scope’s structured finance team and panellists from DWS, CA-CIB and ING.