Announcements

Drinks

US tariff increases to have uneven direct cashflow, credit impact on European corporates

President Donald Trump’s administration has imposed a baseline tariff of 10% on imported goods from its trading partners but unexpectedly suspended much higher extra levies on Wednesday, except in the case of China, which is now subject to duties of up to 145%. The implementation of trade measures has not been uniform, with no new tariffs applied to pharmaceuticals, whereas automotive imports now face a 25% tariff.

“Should the temporary suspension of the so called “Liberation Day” tariffs be lifted after the current 90-day pause, US tariff levels could return to levels last seen in the early 20th Century. However, our current assessment is that even under this scenario, the direct cashflow and credit impacts for investment grade European corporates are likely to remain relatively moderate in the short term,” says Sebastian Zank, head of Corporates Ratings Production at Scope.

“To be sure, the longer the tariffs remain in place, and the higher they rise, the more significant their impact will be. Beyond direct impacts on companies, there are broader macroeconomic concerns about the adverse impact of US trade policy on global growth, inflation and interest rates, risks to which European companies and households are exposed. These pressures are more pronounced for small and medium-sized, highly leveraged companies than for larger investment-grade firms,” says Zank.

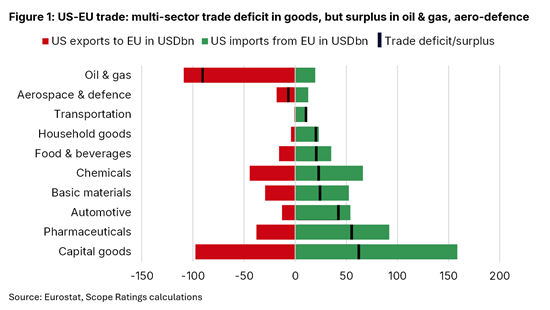

“It is important to note that the US runs persistent trade deficits with Europe for structural reasons. American corporates and households rely on European suppliers for many products which will be hard to substitute in the short to medium run, hence the exclusion of pharmaceuticals from the tariffs so far,” says Zank (Figure 1).

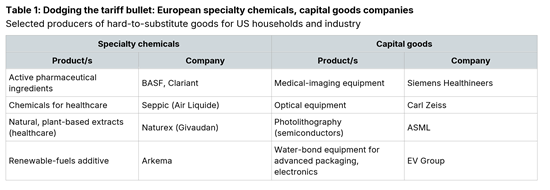

Capital goods, specialty chemicals companies among tariff-resistant specialist corporates

For other European companies, the specialist nature of their exports to the US should ensure that demand holds up despite the tariffs because they supply materials and equipment that are difficult for US customers to source elsewhere in the same quality and quantity, if at all.

In addition, the lack of domestic manufacturing capacity for these products is unlikely to be resolved quickly, since companies may be reluctant to make the large, multi-year investments necessary without some assurance that tariffs will stay in place long term.

Auto makers among most tariff-vulnerable companies

The most vulnerable companies are those exporting more commoditised or mass-market products, typically made along global supply chains, from cars and jewellery to machinery and commodity chemicals.

Blue-chip goods exporters to the US in this category include Volkswagen AG (DAX40); Schneider Electric SE, Stellantis NV (CAC40); Inditex SA, ArcelorMittal SA (IBEX); Pirelli SpA, CNH Industrial SpA (FTSE MIB); Electrolux AS, Pandora AS (Nordics 40); Philips NV (AEX).

Europe’s car makers are particularly vulnerable due to the special 25% US tariff on automotive imports and prior investments in production capacity in Canada and Mexico to the supply the US, the world’s second-largest car market after China.

However European governments may adjust regulatory frameworks and industrial policy to mitigate the impact on vulnerable exporters, by introducing measures such as relaxing the timetable for the introduction of zero-emission vehicles, as the UK is planning.

That said, should President Trump’s tariffs tip the US economy into recession, the resulting demand shock would be felt widely across sectors, with adverse implications for all US-exposed European companies as well as for companies with little to no export exposure due to rising competition among European and non-European manufacturers in their core markets.

Related research: