Announcements

Drinks

Sovereign credit: US policy shifts point to tariff-light, trade-war, economic-crisis scenarios

“The recent announcement of US trade tariffs marks a notable escalation in the protectionist policy adopted by the Trump administration,” says Alvise Lennkh-Yunus, head of sovereign and public sector ratings at Scope. Download the report.

“If implemented, the tariffs would represent the biggest peacetime trade shock to the global economy in more than 100 years. If sustained, this policy shift will have important credit implications for both the US (AA/Negative) and for sovereigns globally,” says Lennkh-Yunus.

“Conversely, even their full reversal, though unlikely, would not fully restore the confidence of previous alliances and supply chains, indicating a degree of durable economic loss,” he says.

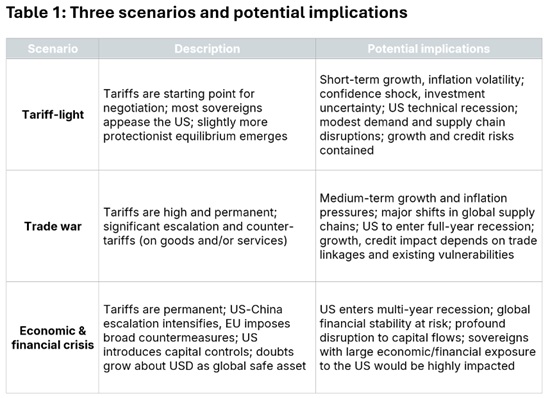

Given such uncertainty, Scope has identified three scenarios to inform the credit rating agency’s forthcoming update to its growth and fiscal forecasts as well as other credit-relevant factors: i) ‘tariff-light’ scenario, ii) a full-scale trade war, and iii) economic and financial crisis.

US trading partners face multiple options in tariff response

The eventual impact on growth, inflation, public debt, external credit metrics and thus sovereign credit ratings, will ultimately depend on the macro-economic environment that emerges from the polices the US adopts, the responses by trading partners, and the underlying credit strengths and vulnerabilities of sovereigns before this trade shock.

Possible responses among the US’s trading partners range from appeasing the Trump administration through tariff negotiations to a mix of adopting countermeasures, striking free trade agreements with each other and deepening domestic economic reforms to at least partially offset the adverse impacts of US tariffs.

“In our assessments, we will evaluate both the scale of the trade shock as well as the adequacy and quality of regional and national monetary and fiscal policy responses, focusing on the fiscal adjustment capacity and underlying economic resilience of sovereigns to absorb and reverse the impact of the shock over the longer run,” says Lennkh-Yunus.

Questions to grow over dollar’s status if trade war worsens

One of the most exposed sovereigns is the US itself as the epicentre of this unorthodox policy shift, particularly in Scope’s more extreme scenarios.

“In a scenario of a protracted trade war and/or the introduction of US capital controls, viable alternatives to the dollar could emerge. For example, China and the EU could decide to deepen their trade relationship, and/or China could decide to further open its capital accounts, and/or the EU could accelerate its Savings and Investment Union. These developments are unlikely to happen swiftly, but if doubts about the exceptional status of the dollar were to increase, this would be very credit negative for the US,” says Lennkh-Yunus.

Countries with significant trade surpluses and/or financial exposure to the US are also highly vulnerable to adverse consequences from the shift in US trade policy, though the impact in Europe will be uneven.

Overall, sovereign vulnerabilities include: (i) high openness to global trade and business cycles (e.g. Ireland), (ii) sensitivity to higher financing rates (e.g. Italy), (iii) exposure to weaker currencies (e.g. Turkey, Georgia) and/or (iv) dependence on oil prices (oil-exporting sovereigns) that could materialise in a scenario of a synchronised trade war and/or an economic and financial crisis.