Announcements

Drinks

Growing supply-demand imbalance threatens housing affordability in Europe

By Mathias Pleissner, Covered Bonds

Over the past decade, average house prices in Europe have surged by 50% while wages have only grown by 36%, with consumer prices rising 29%. This illustrates the increasing strain on affordability for households that are reliant on mortgage financing.

The exceptional price growth in European housing is largely attributable to persistently high demand that has outpaced a sluggish supply response. Demand pressures are unlikely to ease, driven by factors such as immigration, urbanisation, an ageing housing stock and a social shift towards more spacious living environments. Housing supply, meanwhile, is constrained by limited public and private investment.

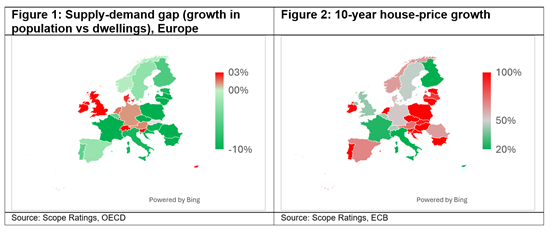

The supply-demand gap is particularly acute in certain countries where construction activity has failed to keep pace with population growth. This dynamic is exacerbating affordability pressures. Between 2011 and 2022, population growth in countries such as the Netherlands, Austria, Denmark, and Germany has outstripped the growth in new housing stock by 1–2 percentage points. The UK has faced an even greater imbalance, with population growth exceeding new housing supply by four percentage points.

Affordability of housing finance will in particular remain stretched in countries where the supply-demand gap intersects with sharp price increases. Notable examples include:

- Netherlands: a 1.6% housing under-supply alongside a doubling of house prices over the past decade.

- Austria: a 1.3% under-supply with prices rising over 70%.

- Denmark: a 2.4% under-supply and a 50% price increase.

- Germany: 1.1% under-supply and a 50% price increase.

- Luxembourg and Ireland: also show pronounced imbalances and affordability risks.

A rapid supply-side response appears unlikely. Geopolitical tensions, competing fiscal priorities and/or budget deficits are expected to limit public investment in housing. Private-sector activity remains subdued due to high financing and construction costs, alongside limited incentives.

On the latter point, governments could do more to incentivise the private sector, through tax incentives, less stringent building standards and requirements, and/or more liberal private rental markets with less strict rent controls.