Announcements

Drinks

Romania: election of centrist candidate supports structural reform momentum; fiscal pressures remain

By Brian Marly, Sovereign and Public Sector

The election of pro-EU, centrist candidate Dan to the Romanian (BBB-/Stable) presidency should support policy continuity and ease recent governance concerns. His decisive victory - securing nearly 54% of the vote amid record high voter turnout - and the clear concession by radical right candidate George Simion have helped dispel fears of a contested election, which could have triggered renewed political instability. The result provides a measure of relief after an extended period of political uncertainty, which began last November with the cancellation of the initial presidential runoff due to concerns over foreign interference.

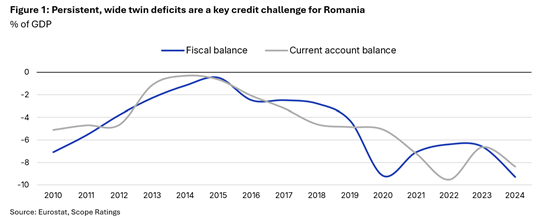

Dan’s election is also likely to foster a continued constructive relationship with EU institutions - a critical factor for Romania's economic resilience. Continued EU fund inflows remain vital to finance the country’s persistent structural current account deficit, projected at 8.4% of GDP in 2024 (Figure 1). Access to EU balance-of-payments assistance facilities offers an important safeguard against potential episodes of market stress.

The second round of the presidential election occurred against the backdrop of growing concerns over Romania’s fiscal position. The fiscal deficit widened to 8.6% of GDP in 2024, the highest in the EU (Figure 1). Credible and ambitious fiscal consolidation is essential to reverse this deterioration and meet the targets set out in Romania’s medium-term fiscal plan and the National Recovery and Resilience Plan agreed with the European Commission. Failure to deliver on these commitments could jeopardize access to EU funding and weaken the country’s growth and fiscal outlooks.

Election outcome to influence medium economic and fiscal outlooks

While the Romanian presidency has limited formal authority over economic policymaking, the election outcome will nonetheless influence the medium-term macro-economic and fiscal trajectory. The defeat of the governing coalition’s candidate, Crin Antonescu, in the first round triggered the collapse of the government earlier this month. Coalition negotiations are now expected to begin among the main pro-EU parties, along with representatives of Hungarian ethnic minority groups.

The focus now shifts to two main issues. First, the speed of coalition formation, as prolonged negotiations could delay critical fiscal and structural reforms, and secondly the credibility of the new government’s plan for fiscal consolidation, which may be challenged by a fragmented parliament and the difficulty of building consensus.

Romania’s medium-term fiscal plan, endorsed by the European Commission last fall, targets a reduction in the fiscal deficit to 7% of GDP in 2025. However, we have flagged rising risks around this target, driven by weaker-than-expected economic growth and low EU fund absorption. Despite consolidation measures introduced this year, continued fiscal slippage is a key risk, with the deficit reaching 2.3% of GDP in Q1 2025, about 0.3 percentage points higher than the same period last year.

While the presidential election outcome thus offers near-term relief, the fundamental challenge of forming a stable parliamentary majority willing and able to implement a credible multi-year fiscal consolidation plan remains to be addressed.

Scope’s next calendar review date is in July 2025.