Announcements

Drinks

Greece’s debt profile supports resilience but improving market liquidity remains key

By Jakob Suwalski and Alessandra Poli, Sovereign and Public Sector Ratings

In May 2025, Greece announced plans to repay the remaining EUR 31.6bn from the 2010 Greek Loan Facility (GLF) by 2031, a decade ahead of schedule. This follows the early repayment of EUR 20.1bn in IMF loans, completed in 2022, and early GLF repayments in 2023 of EUR 5.29bn. The accelerated repayment should smooth Greece’s debt servicing profile and reduce post-2032 debt-rollover risk.

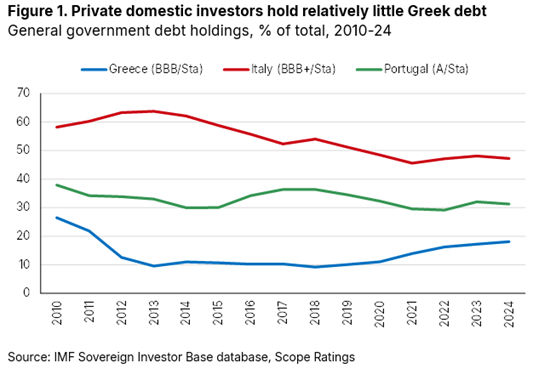

Increasing the share of tradable securities in Greece’s borrowing mix, while keeping fiscal discipline, would strengthen the sovereign financing framework even if it implies relying on a potentially more volatile investor base – private domestic and foreign investors – than the official European sector (Figure 1).

A higher share of marketable debt instruments in Greece’s debt composition would also help deepen domestic capital markets, improve market access for banks and corporates and make the financial system more flexible. A more liquid sovereign yield curve would also provide a better pricing benchmark, facilitating more efficient capital allocation across the Greek economy.

Greece’s (BBB/Stable) sovereign debt profile remains shaped by its highly concessional structure, with an average maturity of 18.9 years. Around 73% of the debt is held by the official sector. The European Stability Mechanism (ESM, AAA/Stable) and the European Financial Stability Facility (EFSF, AA+/Stable) currently hold about half of Greece’s public debt, both at highly favourable interest rates.

This structure results in low debt servicing costs: interest payments amounted to just 2.3% of GDP in 2024 and are expected to rise only modestly to 2.7% by 2030. Greece also maintains a substantial cash buffer of around EUR 42bn (roughly 17% of GDP), among the highest in the euro area, which provides a critical cushion against refinancing risk.

The clear advantages of Greece’s concessional debt structure still involve trade-offs

Official-sector debt, while stable and cost-efficient, is non-tradable and limits secondary market liquidity. Greece's sovereign bond market thus remains relatively shallow, constraining price discovery and the development of a benchmark yield curve, which hinders market participation and ultimately reduces financial flexibility.

This contrasts, for example, with Italy’s (BBB+/Stable) debt profile, which reflects strong domestic investor demand and provides the Italian government with significant liquidity in the secondary debt market.

Italy can sustain a high debt burden – at least for now – because it benefits from one of the largest and most liquid (domestic) sovereign bond markets in the euro area, despite the comparatively shorter average debt maturity (still around seven years) compared with Greece and higher interest payments, equivalent to 3.9% of GDP in 2024.

Italy’s debt is almost entirely market-based, supported by a large, stable and diverse private domestic investor base—including banks, other monetary financial institutions (MFIs), non-MFIs and households—and a broad stock of tradable securities.

For Greece, holdings of government debt securities by private domestic investors have been historically lower than for Italy, but also those of Portugal (A/Stable), which also benefits from significant official sector debt. This implies that an accelerated withdrawal from official support (e.g. early voluntary repayments), while signalling a sustained return to capital markets, could increase rollover risk if not accompanied by the parallel development of domestic bond markets.

Converging debt trajectories of Greece and Italy

Given the still moderate depth of the domestic bond market and the still elevated public debt, a declining public debt trajectory is critical to ensure the sustainability of Greece’s public finances.

Public debt stood at 153.6% of GDP in 2024, down from 210% in 2020, and remains on a steady downward path, supported by strong nominal GDP growth and substantial primary surpluses, which are aided by anti-tax evasion measures.

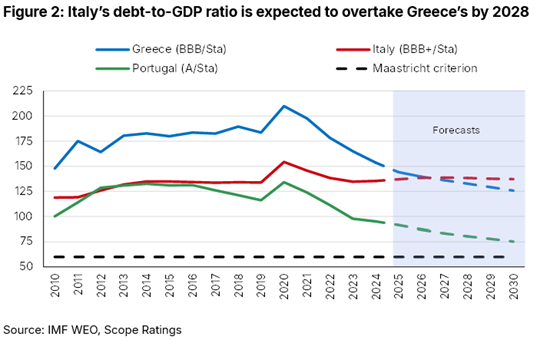

We expect the debt ratio to fall further, towards around 125% by 2030, driven by an improved fiscal position and a still-low effective interest burden, bringing it significantly below Italy’s (Figure 2)

In contrast, Italy’s public debt stood at just over 135% of GDP in 2024 but is expected to remain broadly stable in the medium term, edging up marginally to around 137% by 2030. This reflects structurally weaker nominal growth, restricted fiscal space, and limited primary surpluses.

Slower-than-expected fiscal consolidation or unexpected increases in government spending could weigh on debt dynamics of Greece and Italy, particularly in the event of external shocks. This also underlines the importance of developing a deep, liquid secondary market for government bonds to enhance sovereign debt sustainability.

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.