Announcements

Drinks

France: upcoming confidence vote raises further uncertainty over budgetary outlook

By Thomas Gillet and Brian Marly, Sovereign and Public Sector

The confidence vote called by France’s (AA-/Stable) Prime Minister Francois Bayrou on 8 September, ahead of the parliamentary debate around the 2026 budget, comes amid strong political opposition to the government’s proposed multi-year budget set out in July.

Left-wing parties, including the Socialist Party, and the far-right Rassemblement National – holding a combined 298 seats, above the 289 constituting an absolute majority in the National Assembly – have said they will vote against the government.

Highly fragmented parliament raises the risk of renewed political instability

The government’s collapse – which would be the second in less than a year – is the most likely outcome under the current parliamentary setting.

The consequences would be credit negative given the choices it would leave President Emmanuel Macron with. Either Macron appoints a new prime minister – the fifth in four years – tasked with forming a new government or he calls for another snap legislative election – the second in two years.

Political deadlocks weigh against fiscal consolidation

To date, appointing a new prime minister who will need to make concessions on the 2026 budget appears more likely than another dissolution given the risk of deadlock resulting from another hung parliament dominated by far-left or far-right parties. Passing next year’s budget under the current parliament requires watering down the Bayrou government’s saving plan of EUR 44bn or around 1.5% of GDP.

The political impasse thus undermines the planned reduction of the budget deficit to 5.4% in 2025 and 4.6% in 2026 from 5.8% of GDP in 2024. Instead, our baseline is for France’s budget deficit to decline only to 5.6% of GDP in 2025 and 5.3% 2026.

We are also more conservative than the government regarding the prospects for longer-term fiscal consolidation, notably due to France’s higher refinancing rates.

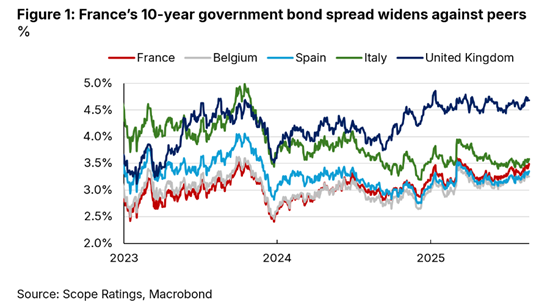

Net interest payments are set to rise to about 4% of government revenue in 2025 from 3.6% in 2024, in line with that of Belgium (AA-/Negative, 3.8%) but still below that of Spain (A/Stable, 5.2%) and the United Kingdom (AA/Stable, 6.6%). Similarly, France’s 10-year government bond yields have moderately but steadily risen to 3.5% (Figure 1), converging with those of Spain and Italy (BBB+/Stable).

Given these weaker fiscal projections, we expect France’s debt-to-GDP ratio to continue to increase to around 122% by 2030, from 113% in 2024, above the government’s target of 117% in 2029.

While not our baseline, a favourable outcome of the government winning the confidence would constitute a significant breakthrough and support near-term budgetary trade-offs.

Still, political uncertainty ahead of municipal elections in March 2026 and the presidential election in April-May 2027 remains a key credit challenge. France’s medium-term fiscal outlook thus remains constrained by a fragmented political landscape, heightened political polarisation and an electoral calendar working against political compromise on economic and budgetary reforms.

Scope’s next calendar review date for France is on 26 September 2025.