Announcements

Drinks

Political instability heightens risks to French banks’ profitability outlook

By Carola A. Saldias Castillo, Financial Institutions

The political landscape in France continues to be marked by volatility following the confidence vote announced for 8 September. This has knocked market confidence and pushed out government bond spreads. While wider sovereign spreads could affect French banks’ refinancing costs, political fragmentation will lead to a less conducive landscape for domestic market operations, as it could hinder fiscal consolidation and dampen growth.

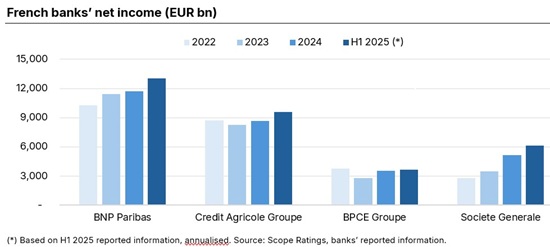

French bank profitability has improved consistently and continued to show a positive trajectory to the first half of 2025: net profits improved for the four largest banks (BNP Paribas: AA-/Stable; Crédit Agricole: AA-/Stable; BPCE and Société Générale). Profitability had lagged that of EU peers in 2023 and the first half of 2024 but stronger loan production at higher yields since the second half of 2024 has strengthened the revenue base in retail and commercial banking.

However, renewed political uncertainty could slow the positive momentum. A prolonged crisis is likely to lead to a more cautious approach to borrowing by households and businesses, reducing credit demand and stalling loan growth.

Higher refi costs: limited effect on profitability but will test funding strategies

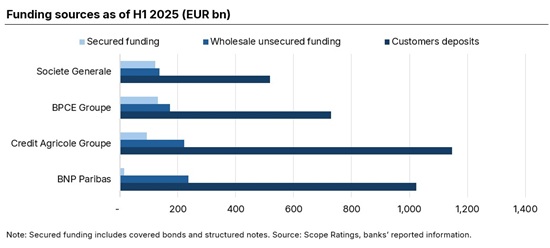

Conversely, we do not expect higher funding costs to materially affect the near-term profit outlook for French banks. The largest banks have a well-diversified funding structure that includes a significant base of customer deposits, secured debt (mostly covered bonds) as well as senior preferred and non-preferred unsecured debt.

While deposits (including regulated savings) should continue to benefit from the recent reductions in policy rates, covered bonds have proven to be less sensitive to changes in sovereign funding costs. Banks have almost completed most of their planned funding for the year, which should mitigate the impact of a temporary increase in unsecured funding costs.

However, given that French banks are the largest issuers of wholesale debt in the EU, if the political crisis drags on and results in a permanent widening of spreads, higher wholesale funding costs will add to headwinds for profitability and funding planning in the medium term.

Valuation of sovereign exposures could impact capital if volatility continues

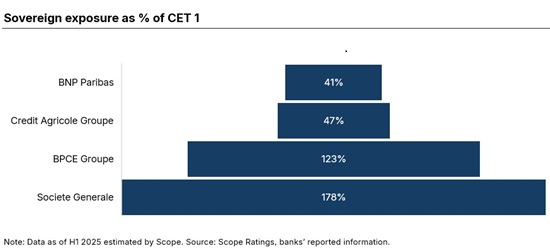

An additional risk of a more permanent widening of French government bond spreads for French banks is the impact of volatile valuations of their sovereign exposures on CET 1. French bank have large direct holdings as well as indirect exposure through their insurance subsidiaries.

French banks’ exposure is material in absolute terms (ranging from EUR 40bn to EUR 100bn) and in terms of CET1, as it has been historically for large Italians and Spanish banks. But while we take comfort that the French sovereign rating (AA-/Stable) does not add credit-risk concerns, the large concentration of sovereign debt could add volatility to capital ratios in the case of Societe Generale and BNP Paribas, as both groups maintain more optimised capital targets (13.5% and 12.5%, respectively), compared to BPCE and Credit Agricole (above 15%).

Stable credit fundamentals supported by diversification, strong financial profiles

Notwithstanding the increased political and market uncertainty, French banks’ credit profiles remain among the strongest in Europe, owing to their well-diversified business models, anchored in stable domestic retail franchises and supported by significant revenues from corporate and investment banking, bancassurance and asset management.

International diversification further strengthens the banks’ business models, mitigating the effects of a weaker performance in the domestic economy. This is also supported by recent market transactions: BNP Paribas acquiring AXA Investment Managers, Credit Agricole increasing its stake in Italy’s Banco BPM, and BPCE acquiring Novobanco in Portugal.