Announcements

Drinks

Climate-risk impacts on UK ERM: orderly scenario produces highest excess credit losses

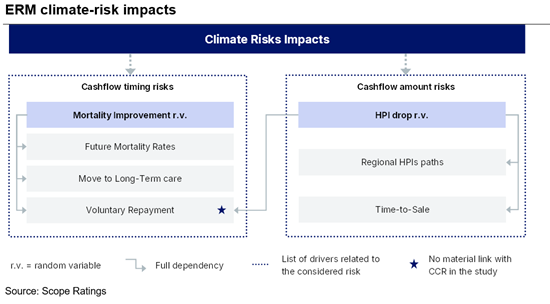

Excess credit losses under the NGFS orderly scenario on a sample ERM portfolio originated in England and Wales reach 6.4% over our baseline assumptions. That compares to 4.9% in the disorderly scenario and 2.7% in the hot house scenario.

“This is perhaps surprising at first glance, since the orderly scenario assumes that governments introduce ambitious policies early to mitigate climate risk,” said Olivier Toutain, Executive Director in Scope’s structured finance team. “This derives from the limited time horizon under consideration (30 years), with most of the cashflows being received over the medium term. The hot house scenario would become the most detrimental under a more backloaded cashflow profile.”

Early climate-mitigation action exposes property prices to the risks of transition to a low-carbon economy. From a timing perspective, transition risk materialises over the medium term while physical risk (direct losses linked to extreme weather events) is more meaningful over the long term.

Transition risk prevails

Transition can affect property prices in many ways, for example through stricter building regulations, energy-efficiency measures, retrofits, or green certification requirements, leading to additional capital expenditure. Older buildings may lose value due to the high cost of upgrades or because of higher usage costs than newer buildings. Also, market preferences are shifting to sustainable buildings, driving up their prices while reducing demand for carbon-intensive properties.

The expected cash flows of reverse mortgages are heavily dependent on property market dynamics. While the proceeds of property sales are likely to cover outstanding debt, any price depreciation may lead to shortfalls in recoveries. Recoveries are a function of property prices over the lifetime of the mortgages, dilapidation costs, sales costs, and No Negative Equity Guarantees (which ensure that borrowers do not have to repay more than the proceeds from the sale of secured properties).

“We account for climate risk through its potential direct impact on property values because of both physical risks or transition costs. Climate risk can also affect property values indirectly as a result of climate gentrification, where areas most exposed to climate risks can experience declines in property values as residents move away, or because of higher insurance rates. All these risks are partially mitigated by the granularity and diversified nature of ERM collateral portfolios,” said Rossella Ghidoni, Director, Structured Finance.

We also explored the effect of climate risk on mortality, as this is the primary driver of cash flow timing in most reverse mortgages (alongside long-term care risk and voluntary repayments). “Climate change is likely to have a severe impact on mortality in the hot house scenario, although impacts generally only materialise beyond the risk horizon of a typical ERM portfolio. The main drivers of cash flow timing uncertainty are voluntary prepayments, which are unrelated to climate change,” Toutain said.