Announcements

Drinks

European corporate hybrids: issuance set to hold up this year after robust 2025 activity

By Azza Chammem, Corporate Ratings

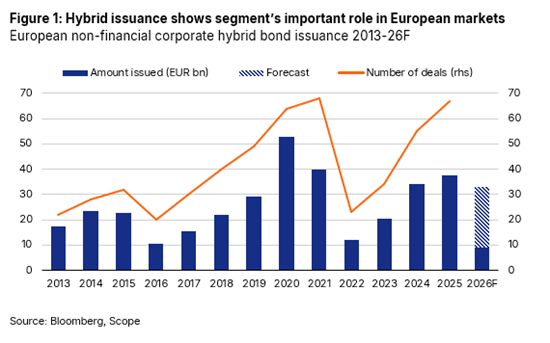

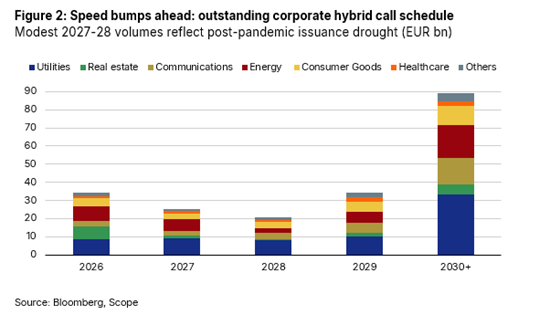

Refinancing will remain the main driver, with around EUR 34bn in first-call volume in 2026 and roughly EUR 25bn in 2027 outstanding, as of early February.

Indeed, non-financial corporate issuers have been quick to turn to the hybrid segment so far this year, in line with buoyant bond-market activity, with EUR 8.9bn of YTD supply, already ahead of EUR 8.6bn issuance in the first quarter last year. High demand and a reduced extension risk premium continue to support refinancing conditions and opportunistic liability management transactions for investment grade issuers.

While strong Q1 issuance suggests full year volumes could exceed 2025 levels, a significant portion of the large 2026 call schedule was prefunded in 2025. So, issuance for the rest of the year will depend on whether current favourable market conditions, especially tight spreads versus senior debt, persist in coming quarters.

Additional supply should come from capex funding, selective M&A and capital‑management needs, particularly among issuers seeking to preserve equity credit or extend maturities while managing elevated investment requirements. Utilities, oil and gas, and real-estate issuers are expected to lead volumes.

Early deals from Enel, Eni and Telefónica highlight hybrids’ strategic relevance as a financing tool. The clustering of call dates, especially for utilities and other energy-sector issuers, remains manageable from a credit perspective.

Outlook by sector

Sector issuance in 2025 showed some clear year‑on‑year shifts, though the overall sector mix was broadly stable.

Utilities remained the largest contributors, though issuance edged lower (EUR 12bn vs EUR 14bn). Political uncertainty delayed some energy‑transition and network‑investment programmes, holding back a capex‑driven issuance upswing with some funding secured with equity or internal resources. As postponed projects advance in 2026, utilities are well placed to reaccelerate hybrid issuance. Oil & gas issuance held steady (EUR 6.1bn vs EUR 6.1bn), with hybrids helping support balance sheets and long‑dated investment pipelines. Numerous upcoming call dates should sustain refinancing flows in 2026.

Telecom issuance declined (EUR 2.6bn vs EUR 4.7bn), reflecting reduced refinancing needs and stable cash generation. Issuance largely followed call schedules rather than incremental investment. Some operators could return in 2026 to support M&A or shareholder distributions. Real estate recorded one of the strongest rebounds (EUR 4.3bn vs EUR 2.1bn), supported by improved spreads and better investor sentiment, with large benchmark deals from Unibail‑Rodamco‑Westfield, Aroundtown and Heimstaden.

Issuance broadened into consumer, industrial and healthcare names, supported by investor comfort with hybrid risk and solid access across both investment‑grade and, in small volumes, higher‑yielding issuers, reflecting the strength of investor appetite for hybrid securities. Interest‑rate conditions kept coupons elevated, though spreads continued to compress as investors sought subordinated yield.

Review of 2025

Investor appetite for higher‑yielding subordinated instruments remained firm in 2025, supported by moderate economic recovery and ongoing geopolitical uncertainty. Issuance matched expectations, with established issuers such as BP, EDF, Iberdrola, Enel, Eni, TotalEnergies, Telefonica and Vodafone maintaining access, while Volkswagen’s return broadened the issuer base.

Large benchmark transactions – such as Enel’s EUR 2bn dual‑tranche, Volkswagen’s EUR 1.9bn, Wintershall Dea’s EUR 1.8bn, EDP’s EUR 1.75bn and EDF’s EUR 1.25bn – showed that issuers continued to use market windows to bolster balance‑sheet flexibility. The volume of outstanding hybrid bonds now exceeds EUR 200bn.

Tight credit spreads supported strong issuance as investors sought incremental yield. Even if spreads widen, hybrids should remain competitively priced within corporate capital structures. Hybrid risk premiums tightened through the year, with spreads near historic lows. Episodes of volatility linked to global trade tensions or equity‑market swings were brief and did not materially affect pricing dynamics.