Announcements

Drinks

Spain’s surging inflation sets back economic, fiscal recovery; growth to slow in 2022

By Jakob Suwalski, Director, and Giulia Branz, Analyst, Sovereign and Public Sector Ratings

We have preliminarily revised down real growth forecasts for this year and next. Spain’s output will grow 4.0-4.5% in 2022, below our December forecast of 6% for this year, and under the 5.1% growth of last year. Growth will then further slow to 2-3% in 2023.

Across Europe, the repercussions of the war and the imposition of international sanctions on Russia are aggravating price pressures and supply disruptions predating February’s invasion of Ukraine.

In the case of Spain, there were significant price shocks in January and February, confirmed by most recent data releases in March, with the headline inflation rate jumping to 9.8%, the highest in 37 years, mostly driven by energy and food prices, as core inflation remains relatively contained, averaging below 3% in the first quarter.

Very elevated inflation rates have been recorded this month also in the other large euro-area economies, although to a somewhat lesser extent. In Germany, inflation stood at 7.3%, in line with Italy’s rate at 6.7%, while price pressures were more modest in France with inflation of 4.5%.

In the current quarter, the interplay of raw materials shortages and rising prices is likely to maintain upward pressure on inflation. Ultimately, the short-term path of inflation will depend on the duration of the war and on the extent and persistence of sanctions on Russia.

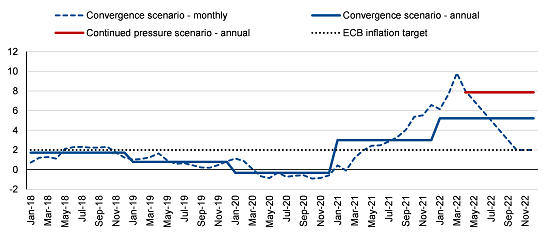

For the whole year, the inflation rate in Spain would average above 5% even under an unlikely scenario of convergence towards the ECB’s inflation target of 2% by the end of this year. If pressures should persist in line with the first three months of the year, annual inflation would average at 8%.

Inflation outlook for Spain

HICP inflation rate, %

Source: Eurostat, Scope Ratings GmbH

Spain’s and the euro area’s inflation surge presents a challenge for the ECB. Price stability is the core mandate of the central bank. However, the ECB is confronting a very specific situation, in which inflation is mostly driven by supply-side shocks, together with a slowdown in economic growth. In other words, rate hikes by the ECB in the current situation cannot directly address the inflationary effects related to the spike in energy prices from the war in Ukraine.

We expect flexibility to remain the cornerstone of the ECB response, with the central bank taking steps towards normalisation of monetary policy through a gradual reduction in asset purchases while adapting to economic circumstances as they evolve.

The Spanish government’s measures to alleviate the impact of elevated inflation on Spanish businesses and households include a reduction in the prices of fuel, caps on rent increases, increased income support for poorer households as well as provision of state-guaranteed loans. These support packages come at a budgetary cost of around 1-2% of GDP and therefore are also likely to affect Spain’s funding programme for 2022.

Though the Russia-Ukraine war and its economic ramifications have changed the global economic outlook, fiscal policy at the European level will likely remain supportive in the near term, helping national governments tackle some of the additional costs from high energy prices and refugee inflows. Still, it is unclear at this stage to which extent fiscal support will continue in 2023 and beyond, when the suspension of the Stability and Growth pact is scheduled to end. Discussions on possible modifications to the current rules as well as around additional EU-wide fiscal measures to address the energy, security and migration consequences of this crisis – including a new EU resilience fund, along the lines of the Covid-19 EU Recovery and Resilience Facility – are ongoing.

While we expect the policy response by the EU to entail some burden-sharing, additional flexibility of fiscal rules is likely. Spain’s own efforts to consolidate its public finances will be delayed due to the conflict as the government faces complex policy trade-offs as the economy recovers from the pandemic.