Announcements

Drinks

Russia’s war in Ukraine tests governance of some of Europe’s multilateral development banks

Alvise Lennkh, Executive Director of Scope’s sovereign and public sector team

Alvise Lennkh, Executive Director of Scope’s sovereign and public sector team

The Black Sea Trade and Development Bank (BSTDB), downgraded by Scope to A-/Negative on 1 April, is a multilateral development bank (MDB) headquartered in Greece with a mandate to support economic development and regional cooperation in the Black Sea region through trade and project finance lending, guarantees, and equity participations in private enterprises and public entities in its member states.

The BSTDB’s strategic importance for its shareholder governments is visible in its recently expanded activities. Loans more than doubled to EUR 2.1bn in H1 2021 from EUR 1bn in 2015. An agreed capital increase before the escalation of the Russia-Ukraine war aims to support additional loan growth this decade.

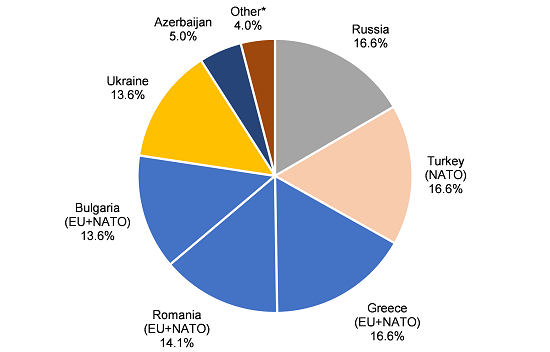

The main shareholder governments, which hold 91% of the bank’s capital and voting power, are Russia, Turkey and Greece (each with a 16.6% capital share). Romania (14.1%), and Bulgaria and Ukraine (both 13.6%). Azerbaijan, Albania, Armenia, Georgia and Moldova have stakes of 5% or less.

Russia, EU, NATO shareholders own and control the Black Sea Trade and Development Bank

% voting share

*Includes Albania (2%), Armenia (1%), Georgia (0.5%) and Moldova (0.5%).

Source: BSTDB, Scope Ratings

The bank’s shareholder composition raises difficult questions about its future in the context of the war and different post-war scenarios. Can Russia and Ukraine, which are de-facto equals based on their respective voting powers, continue to effectively cooperate in the BSTDB’s decision-making bodies? Will support from EU shareholder countries Greece, Romania and Bulgaria weaken as sanctions on Russia tighten? Will Russia continue its support for the BSTDB when about 44% of the bank’s votes is held by EU member states and about 60% by NATO members?

While similar issues face the European Bank for Reconstruction and Development (EBRD), rated AAA/Stable by Scope, and the Russia-led International Investment Bank (IIB) and International Bank for Economic Cooperation (IBEC), the answers will be different for the BSTDB.

This is because the weight of each shareholder in the BSTDB is broadly equal, and no shareholder has a blocking majority. The EBRD, on the other hand, is dominated by G7 and EU countries with more than 85% of the votes, compared with 4% for Russia and 0.8% for Ukraine. Conversely, Russia holds about half of votes at the IIB and IBEC, far ahead of Hungary with 17% and the Czech Republic with 13%, the second-largest shareholders respectively.

The EBRD has suspended access by Russia and Belarus to its resources, excluding both countries from receiving funds for projects or technical cooperation, and is in the process of closing its resident offices in Moscow and Minsk. Regarding the two Russia-led MDBs, the Czech Republic, Bulgaria, Poland, Romania and Slovakia are looking to end their involvement in both banks “acting together as EU Member States.” Hungary, a shareholder in both institutions, has so far made no such statement.

Critically, no BSTDB shareholder to date has signalled an intention to leave the bank. The BSTDB also maintains that its Russian disbursements had already met country-specific targets before the war, obviating the need to suspend operations there. Finally, as with most MDBs, a BSTDB member cannot be suspended unless its government “fails to fulfil any of its obligations to the bank”. This is clearly not the case.

We therefore expect the BSTDB shareholder composition will not change, although its weight might shift depending on the subscription to the agreed capital increase, due to be finalised this year. Still, this implies that these governments will continue to own, control and steer the bank throughout the war and well after it has ended as they have done to date despite Russia’s annexation of Crimea in 2014, the armed conflict between Azerbaijan and Armenia in 2020 and ongoing tensions between Greece and Turkey.

Throughout each crisis, the BSTDB continued to implement its strategy in line with its apolitical nature. Indeed, BSTDB members agreed, unanimously, to appoint a new president in line with its policies at the end of February this year – the week Russia invaded Ukraine.

The continued support and preferential treatment of all its shareholder governments, including Russia, where about 20% of the bank’s loans are disbursed, remain critical for the bank’s credit rating. But, more broadly, continued support from all shareholders would send an important signal that multilateralism and international cooperation can prevail even during and after a conflict such as this one.

After all, governments, leaders and policy objectives change, but geographical neighbours do not.