Announcements

Drinks

President Macron faces narrow path to reform given less favourable socio-economic conditions

.jpg) By Thomas Gillet, Associate Director, Sovereign Ratings

By Thomas Gillet, Associate Director, Sovereign Ratings

Emmanuel Macron’s election victory on 24 April supports policy continuity for France (AA, stable) and for European integration, but popular support for his reform agenda is considerably weakened compared to five years ago.

Growing popular dissatisfaction with the political status quo is reflected in the highest abstention rate in over 50 years (28%) and in the strong rise in support of the far-right candidate Marine Le Pen in the second-round run-off (41.5%), which more than doubled compared to 2002 (17.8%).

Together with the performance of other far-right and far-left candidates in the first round of the presidential election, these results illustrate the growing polarisation and fragmentation of the French political landscape. This could significantly undermine the reform momentum should President Macron fail to form a coalition large enough to secure a majority following the legislative elections set for June 12 and 19.

Macron’s campaign platform focused primarily on education, healthcare, pension reform and defence spending (which could reach up to 2% of GDP). Supply-side measures are centered around labour incentives, investment in nuclear and renewables, as well as innovation and productivity to enhance competitiveness. Overall, Macron’s programme will increase the deficit by an estimated EUR 45bn, according to the think-thank Institut Montaigne, equivalent to around 2% of 2021 GDP, versus EUR 6bn estimated by Macron’s campaign team.

No major policy shift is foreseen in coming years; previous reforms (tax cuts for corporates, unemployment insurance reform, enhanced business environment) and the gradual introduction of additional measures to tackle France’s structural challenges will continue. Importantly, the unemployment rate declined over President Macron’s first term, from 9% in Q4 2017 to 7.4% in Q4 2021.

Even so, growing social discontent may lead to the partial postponing or scaling down of some politically costly but economically necessary reforms, as was the case following the breakout of the ‘yellow vest’ protests. We expect continued pressure on President Macron to implement policies that ease growing social tensions, which have underpinned support for the far-right. This is likely, however, to result in looser fiscal policies and thus complicate fiscal consolidation.

Growing social discontent comes on top of less favourable economic growth prospects, limiting economic opportunities and further narrowing the room for fiscal manoeuvre, hence reducing the social acceptability of new reforms.

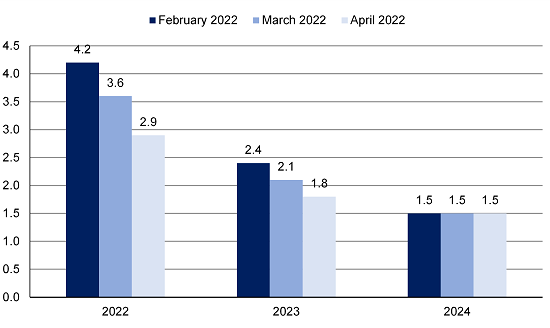

While the French economy appears less exposed to higher energy prices than euro area peers such as Germany (AAA, stable), thanks to its large nuclear power generation capacity among other factors, we have revised down France’s GDP growth forecast to 2.9% in 2022 and 1.8% in 2023 since the outbreak of the Russia-Ukraine war.

France’s real GDP growth in a baseline scenario (%)

Source: Scope Ratings

In addition, we expect upward pressure on France’s public finances both from long term investments related to healthcare, energy, and defence, and from measures to offset the impact of higher inflation (+4.8% YoY in April 2022) on households and corporates. France’s fiscal deficit (6.5% of GDP in 2021) is projected to remain above the 3% of GDP threshold through 2026, while public debt (112.9% of GDP in 2021) is likely to remain on a broadly stable trajectory.

Thibault Vasse, Senior Analyst, and Brian Marly, Associate Analyst, contributed to this commentary.

Scope’s latest research on France:

France: welfare state faces fiscal squeeze if no change in policy under next president, April 2022

France: will enhanced governance framework for public finances improve fiscal credibility? April 2022

Political fragmentation and polarisation in France could frustrate pursuit of economic reforms, March 2022

France: credit outlook hinges on decisive post-election action on structural challenges, February 2022