Announcements

Drinks

ECB monetary normalisation welcome for Italian banks’ revenues but not without risk

by Alessandro Boratti, Analyst, Financial Institutions

by Alessandro Boratti, Analyst, Financial Institutions

The net effect of rising rates on banks’ net interest income depends on several factors, including the proportion of variable-rate loans on banks’ books, loan turnover (the higher, the better), liability structure and interest-rate hedging strategies.

For Italian banks, the shift towards more fixed-rate lending in recent years, especially in the household segment, has reduced their sensitivity to interest rates. The proportion of fixed-rate lending on new origination has doubled to 80% since 2009. The progressive reduction in banks’ reliance on capital market funding coupled with an increase in deposits has also made the cost of financing less sensitive to rising interest rates in recent years.

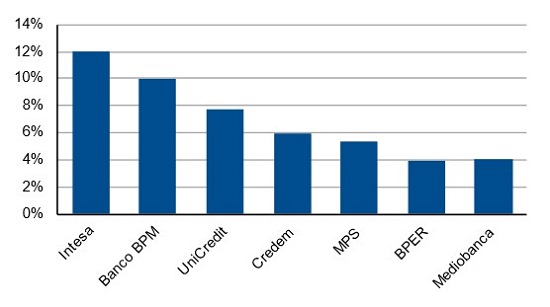

On their most recent investor calls, banks disclosed estimates of net interest income sensitivity to a 50bp increase in the reference yield curve. These ranged from +12% for Intesa to +4% for Mediobanca and reflected the characteristics of the banks’ business models and balance-sheet composition.

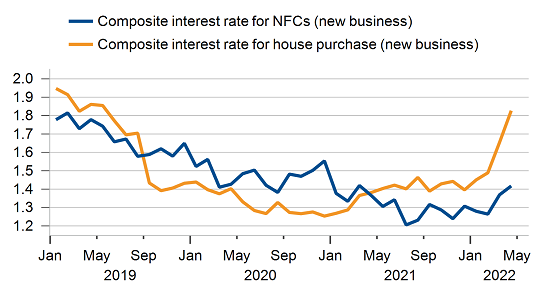

Parallel to the rise in inflation and anticipating the ECB’s new course, lending rates had already started to increase in the first months of the year, especially for new mortgages.

Estimated sensitivity* of banks’ net interest income

to a 50bp parallel increase in yields

*Net increase in % of 2021 NII as of YE 2021/Q1 2022

Source: Company data, Scope Ratings

Lending rates increasing since beginning of 2022 (%)

Note: latest data as of April 2022

Source: Macrobond, Bank of Italy, Scope Ratings

The shift in the interest-rate environment is not without risk, however. The ultimate effect on banks’ bottom lines will depend on the effects of higher rates on economic growth and in particular on asset quality. The ECB is walking a tightrope in raising rates as the economy rapidly decelerates. Monetary tightening will likely add to growth headwinds, with adverse repercussions on loan demand and borrowers’ creditworthiness.

In the short term, the ECB’s tightening stance could reverberate in financial markets. While reiterating a commitment to avoid fragmentation, the ECB refrained from detailing a plan to contain sovereign spread widening. On 13 June, the BTP-Bund spread, a core indicator of relative riskiness of government Italian bonds increased to a two-year high of 248bp. Ten-year BTP yields have reached their highest levels since 2014.

This development could negatively impact Italian banks, which hold large portfolios of government securities. At the end of 2021, the seven Italian banks in our sample held about EUR 115bn of Italian sovereign debt in addition to around EUR 102bn in State-backed loans.

In our view, the risk to Italian banks’ capital is limited. Following past mark-to-market losses due to BTP-Bund spread widening, banks have rebalanced their Italian BTP portfolio by reducing the proportion held through ‘other comprehensive income’. Capital ratios should therefore be relatively resilient to falling bond prices. However, volatile bond markets could raise funding costs for Italian banks, and potentially hamper bond issuance activity.

Scope has subscription ratings on the following Italian banks:

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions such as for Credit Sphere.