Announcements

Drinks

Covered Bond Quarterly: higher mortgage rates highlight need for macroprudential measures in Europe

Certainty around the timing of mortgage repricing, especially for borrowers who took out fixed-rate mortgages in the ultra-low interest-rate period and whose fixed periods are now coming to an end, will help borrowers adjust consumption patterns and mitigate default risk. To enhance financial stability, the European Systemic Risk Board continues to push for harmonised borrower-based macroprudential measures (BBM) across Europe.

“Loan-to-value, debt-to-income and debt-service-to-income limits are widely in place in 18 of the 21 banking union countries and have proven effective in curbing systemic risks, particularly in overheating property markets,” said Mathias Pleissner, Deputy Head of Covered Bonds. “But Germany, Spain, and Italy have yet to formally implement borrower-based protections. They rely instead on internal bank practices and supervisory guidance.”

Without uniform BBM adoption, the ESRB fears that markets may remain vulnerable to credit-driven housing booms and sharp corrections, reinforcing the need for a consistent regulatory framework across the EU.

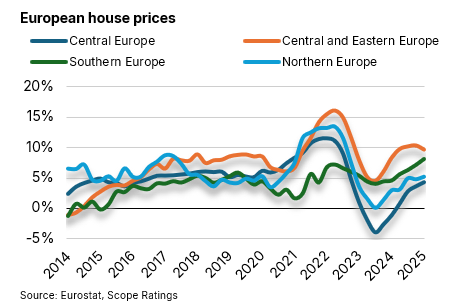

European property markets have entered a new phase of regional divergence, following a decade that went from stability to extreme volatility. After a period of broad-based growth from 2015 to 2019, the Covid-19 pandemic sparked an unexpected housing boom, which gave way to a sharp correction in 2022 amid aggressive monetary tightening.

Southern Europe, led by Spain and Portugal, has emerged as the current growth engine, with double-digit annual house price increases amid strong macroeconomic support, including robust GDP growth and untapped mortgage potential. Central and Northern European markets are stabilising after recent declines, while Eastern European markets may be approaching their own turning points. “The European property cycle now appears increasingly shaped by region-specific fundamentals rather than broad, synchronised trends,” said Pleissner.

When it comes to new issuance, the covered bond market staged a striking comeback: June delivered a blockbuster EUR 20.4bn in the EUR benchmark segment, catapulting the second quarter to its strongest showing since 2019, counterbalancing the early-year lull and setting a positive tone for the year. “With EUR 100bn issued year-to-date, the current momentum suggests a solid foundation for meeting our full-year forecast of EUR 155bn,” said Pleissner.

Demands for ESG transparency has bumped against operational constraints among issuers. While information requirements as laid out in Article 14 of the covered bond directive can be adapted for ESG, issuers are lobbying for implementation disclosure into their Pillar 3 reporting.

“Transparency reports provided by banks in compliance with Article 14 of the European covered bond directive can offer a clear, consolidated platform that could also be used for ESG data. We would prefer issuers to embed this information into the industry standard Harmonised Transparency Template,” said Karlo Fuchs, Head of Covered Bonds. “As would investors, as it would allow comparability and provide for more regular updates. Integrating data into Pillar 3 risk disclosures presents a less burdensome approach for issuer but risks fragmenting information and makes investor due diligence more cumbersome.”