Announcements

Drinks

Türkiye: balance-of-payments tension rises; stopgap efforts to stabilise lira increase risks

By Levon Kameryan, Associate Director, Sovereign and Public Sector

By Levon Kameryan, Associate Director, Sovereign and Public Sector

Türkiye (B-/Negative)’s economy will grow 5.8% in 2022 as households stock up in anticipation of even higher prices. We project growth to slow to 3.5% in 2023, with risk of even sharper slowdown unless government embarks on sustainable economic policy making.

Türkiye’s unconventional policy mix has raised risk to external and public finances, while failing to restore currency stability or materially increase foreign-exchange buffers.

Türkiye faces foreign debt repayments and financing of its current account deficit of around USD 225bn or 30% of GDP over the next 12 months, risking further deterioration of balance of payments, higher borrowing costs and depreciation of the Turkish lira against dollar and euro.

Balance-of-payments dangers are common to emerging-market economies with external imbalances such as Türkiye, but especially this year given spill-over effects from Russia’s war in Ukraine within a context of elevated and highly volatile commodity prices and rising rates globally.

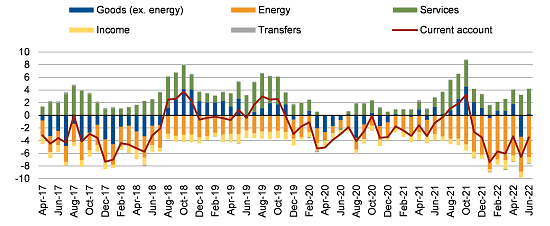

Figure 1. Current account balance by component (USD bn)

Source: Central Bank of the Republic of Türkiye, Scope Ratings

Türkiye’s current account deficit will widen to around 7% of GDP this year from 1.7% in 2021 due to the rise in energy prices as the economy is one of the largest net energy importers in central and eastern Europe. Net energy imports reached USD 42.2bn or 5.2% of GDP in 2021 and could exceed 9% of GDP this year, more than offsetting growth in goods exports and a rebound of tourism receipts (Figure 1).

Debt roll-over, servicing challenge grows as Federal Reserve, ECB tighten rates

To be sure, financing challenges of Türkiye are concentrated in the private sector. Of USD 225bn in gross external financing requirements, USD 182.5bn represent maturing external debt, which includes bank deposits, trade credit and other short-run private-sector debt, with only USD 3.6bn of this owed by the general government as of June 2022 plus another USD 30bn by state banks.

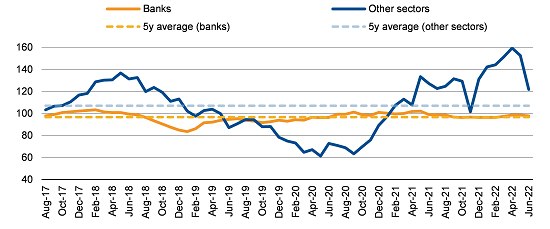

However, central bank reserves will come under further pressure should there be another sustained drop in the rollover ratio of private external debt (Figure 2) as occurred during pandemic crisis peaks of 2020. In addition, non-resident capital outflows resumed during the first half of this year. This added to pressure on reserves although the remaining amount of non-resident capital declined to a modest USD 1.5bn in domestic government debt and USD 15.1bn in equities by end-Q2 2022.

Figure 2. External debt rollover ratios (%, six-month moving average)

Source: Central Bank of the Republic of Türkiye, Scope Ratings

Tighter monetary policy pursued by major central banks has as well raised borrowing costs for emerging markets such as Türkiye. Türkiye issued a USD 2bn Eurobond, due in 2027, at yield of 8.625% in March, compared with 5.70% for a seven-year issue in September 2021.

Yet, at home, the Turkish central bank’s loose monetary policy, aligned with the unorthodox economic views of President Recep Tayyip Erdoğan, has plunged domestic real rates deeper into negative territory as inflation gallops ahead. The bank lowered its benchmark one-week repo rate by 100 basis points to 13% on 19 August despite annual inflation running at a two-decade high of 80.2% YoY in August.

Stopgap efforts to stabilise currency likely to prove self-defeating

It is no surprise that the Turkish lira remains under pressure, with risk of further depletion of foreign-currency reserves. The lira has lost nearly 30% of its value against dollar this year.

The government has sought to stabilise the currency and protect FX reserves with policies that artificially ease selling pressure, from protecting lira deposits against FX loss to requiring exporters to exchange 40% of forex revenue to lira.

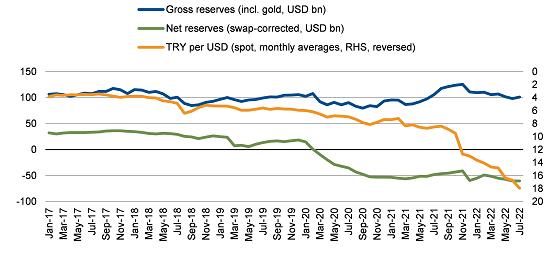

Ankara’s approach serves only to buy time at significant cost. Foreign-currency reserves of the central bank have recently increased (Figure 3), up to USD 63.4bn in late August (excluding gold reserves of USD 40.8bn), likely helped by a large inflow from Russia for construction of a nuclear power plant. However, when swap liabilities are deducted, net reserves are at a near record low of negative USD 60.1bn in July 2022 compared with positive USD 18.5bn as of end-2019.

Figure 3. Turkish reserves and exchange rate

Source: Central Bank of the Republic of Türkiye, Scope Ratings

Domestic political decisions around inflation undermine capacity of the economy to fund sizeable external imbalances. The lira savings scheme is weakening one of Türkiye’s core credit strengths – the health of its sovereign balance sheet – at a projected cost of circa 2% of GDP this year.

We see limited chance of material change of policy before the elections due next year. The run-up and follow-up to the elections could be bumpy. In the polls, President Erdoğan is behind potential presidential candidates of the main opposition Republican People’s Party. Possible political unrest, in addition to rising economic imbalances, represents a significant vulnerability for our B-/Negative Outlook foreign-currency credit ratings assigned to Türkiye.

Contributing Writer: Matthew Curtin