Announcements

Drinks

Spanish banks: solid 9m results, risks from real estate exposures manageable

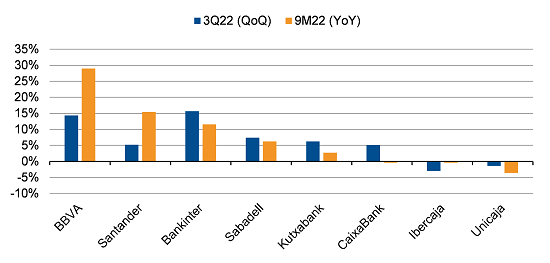

“Year-over-year, net interest income increased by 8% on average at the nine-month stage, compared with 4% in the first half as aggressive price competition in the domestic mortgage market seen in Q2 became more subdued,” said Chiara Romano, associate director in Scope’s financial institutions team “Domestic customer spreads showed strong quarterly improvements from higher-yielding business loans, the mortgage front book and consumer lending.”

BBVA and Santander showed the biggest nine-month increases in NII. The improvements were driven by Mexico in both cases, while the UK also contributed to better performance at Santander and BBVA showed some growth in Spain. For the mainly domestic peers, Bankinter led the way with a 12% YoY nine-month increase, followed by Sabadell with 6% (3% ex-TSB).

Net interest income growth

Source: Company data, Scope Ratings

Gross income trended up both in the third quarter and at the 9M stage. Domestically, some material one-offs compensated for slower growth in core revenues: Kutxabank benefited from a high contribution from equity investments and CaixaBank from the consolidation of Bankia Vida, leading to a strong insurance line. On the cost side, we saw the usual breakdown between international lenders with costs trending up – albeit below composite inflation – and domestic lenders showing a decline.

Despite the non-binding and less than positive opinion issued by the ECB on November 2, the Spanish government intends to move ahead with the windfall tax on banks. “We remain sceptical about the prohibition on passing the tax onto customers,” Romano cautioned, “as in practice it is hard to enforce. And even if it is enforced, it could be detrimental to credit supply.”

In the third quarter, with interest rates and core inflation rising, and Spanish economic growth forecasts revised downwards, the banks’ focused on providing more details about the credit standards of their portfolios, especially their mortgage books.

Although around 75% of Spain’s mortgage stock is still variable-rate, the proportion between fixed and variable has changed significantly over time. In August 2022, around 70% of new mortgage lending in Spain by unit was fixed-rate. In January 2009, by contrast, 97% of new mortgage business was variable-rate. Variable-rate mortgages in Spain are indexed to 12-month Euribor, which has increased considerably in 2022, from -50bp in January to +270bp in November. Consequently, the cost of borrowing for new mortgage business (both fixed and variable) went up from 1.4% in January 2022 to 2.2% in September.

“This implies, on one hand, a moderate to high sensitivity of Spanish banks’ NII to rising rates on the back book but also how the structure of the front book i.e. new production increasingly shields borrowers from rising interest rates,” Romano noted. This is especially true as the difference between fixed and floating-rate rates in the front book is not particularly wide and actually favours variable rate (2.4%) over fixed rate (2.8%).

Download the full report here.

Scope has subscription ratings on:

- Banco Bilbao Vizcaya Argentaria SA

- Banco Santander SA

- Banco de Sabadell SA

- Bankinter SA

- Ibercaja Banco SA

- Kutxabank SA

- Unicaja Banco SA

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope`s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.