Announcements

Drinks

French bank quarterly: net interest income and strong CIB performance support revenue momentum

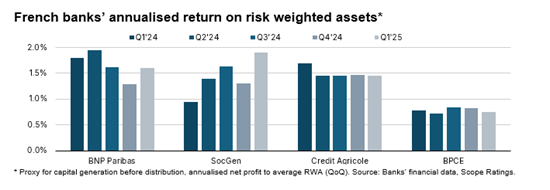

Our sample of French banks (BNP Paribas, BPCE, Crédit Agricole, and Société Générale) improved their return on risk-weighted assets (RoRWA) in Q1 to 1.43% from 1.3% a year earlier.

Higher net interest income underpinned the recovery in French retail banking. At the same time, funding costs have eased thanks to both lower ECB rates and lower regulated savings rates (Livret A has remained at 2.4% since February 2025 vs 3% in 2023). But the expectation of further interest-rate cuts in 2025 could limit the banks’ ability to sustain the positive trajectory in retail banking.

Higher net interest income underpinned the recovery in French retail banking. At the same time, funding costs have eased thanks to both lower ECB rates and lower regulated savings rates (Livret A has remained at 2.4% since February 2025 vs 3% in 2023). But the expectation of further interest-rate cuts in 2025 could limit the banks’ ability to sustain the positive trajectory in retail banking.

The average cost-income ratio slightly improved in Q1. “We expect higher revenues will support French banks’ efficiency in coming quarters, but staff cost pressures such as rising variable remuneration from CIB segments, and M&A integration costs could challenge further reduction efforts,” said Carola Saldias Castillo, lead analyst for French banks.

French banks are actively seizing opportunities to expand outside their home market into markets offering higher profitability (BPCE/Novo Banco in Portugal; Credit Agricole increasing its stake in Italy’s Banco BPM; Credit Mutuel/OLB in Germany). “Given the size of the French banks’ domestic operations, these acquisitions will not materially shift business models but they will definitively strengthen the contribution of retail banking,” Saldias Castillo noted.

Non-performing loan (NPL) ratios remained constant at 2.3% in Q1 25. “For the full year, we expect asset quality to normalise at slightly higher levels for most banks, reflecting the volatile economic environment and the structurally higher risk in consumer and SME lending, which will weigh on provisions,” Saldias Castillo said. “We also expect moderate upwards pressure on cost of risk in the following quarters but the impact on profitability should remain contained.”

Capital levels are expected to remain stable as organic capital generation will allow banks to support shareholder remuneration and further business growth. The average CET1 ratio for French banks was 14.9% in Q1. “We take comfort from the combination of capitalisation and loss-absorption capacity, which provides stability in a scenario of still limited growth in RWAs,” continued Saldias Castillo.

Download the full report here.

Scope has public ratings on BNP Paribas and Crédit Agricole:

Scope affirms and publishes BNP Paribas’ AA- issuer rating with Stable Outlook, December 2024

Scope affirms and publishes Credit Agricole SA’s AA- issuer rating with Stable Outlook, December 2024

Scope also has subscription ratings on Banque Fédérative du Crédit Mutuel, BPCE, and Société Générale. To view the ratings and rating reports on ScopeOne, Scope’s digital marketplace, or to register, please click on the following links:

Banque Fédérative du Crédit Mutuel

BPCE S.A.

Société Générale S.A.