Announcements

Drinks

UK returns to fiscal orthodoxy, but budget discipline tested by difficult economic backdrop

By Eiko Sievert, Director, Sovereign Ratings, Scope Ratings

By Eiko Sievert, Director, Sovereign Ratings, Scope Ratings

Chancellor Jeremy Hunt’s 17th November “Autumn Statement” has confirmed a mixture of direct and indirect tax increases and sharp reductions in public spending amounting to about GBP 55bn (approximately 2.5% of GDP) needed for the government to meet its budgetary targets. The budget reflects the unusually difficult choices Prime Minister Rishi Sunak’s government faces, with limited options given the difficult macroeconomic context.

Investor confidence in the UK is particularly crucial at this juncture because any additional debt issuance the UK Treasury is planning comes on top of the approximately 30% of the UK’s total outstanding debt that will have to be re-financed over the next five years.

Chancellor Hunt set out a long-term strategy for balancing public finances supported by the forecasts from the independent Office for Budget Responsibility (OBR). Hunt has based budget plans on a growth forecast averaging 1.3% a year between 2023-26 compared with the Liz Truss government’s unrealistic target of 2.5% growth a year. This forecast is more aligned with our estimate of the UK’s medium term annual growth potential of around 1.5% as a result of the now envisaged large cuts to government expenditure through 2026 and the sharper than expected tightening in financial conditions.

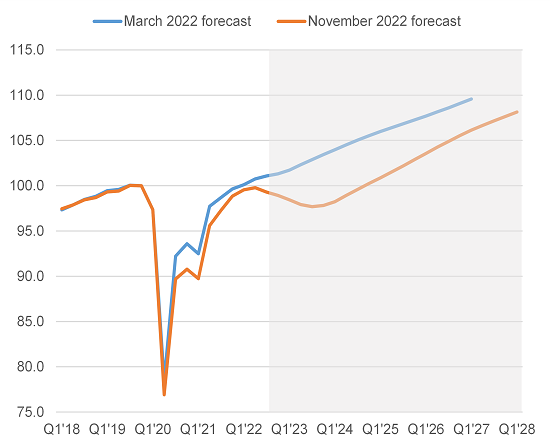

Figure 1. UK real GDP growth

Q4 2019 = 100

Sources: Office for Budget Responsibility, Office for National Statistics

Hunt relies on backloaded budgetary tightening

The fiscal tightening announced in the Autumn statement is backloaded with a significant part of the spending cuts taking effect only from 2025. Debt-to-GDP is expected to increase in the medium term, peaking at 97.6% in 2025-26 and subsequently declining to 97.3% in 2027-28, leaving much of the future debt consolidation to the next government given the next general election is due to take place in 2024. However, one of the biggest increases in taxation, through freezing national insurance thresholds for companies, will take effect from April 2023.

The fiscal framework is further diluted by the revision of two of its fiscal rules: with net debt as a share of GDP set to fall by the fifth year of the rolling five-year forecast horizon rather than the previously targeted third year, and public sector net borrowing targeted at less than 3% of GDP over the same period.

Since the targets within the fiscal framework are rolling targets, it offers a high degree of flexibility to adjust plans in future years. This makes it relatively easy for any ruling government to loosen fiscal policy to support the economy in future if needed.

UK loosens fiscal discipline; fiscal framework less tight than Germany, Sweden

However, it also instills significantly less fiscal discipline in the medium term, aligning the UK’s framework more closely to France (AA/stable)’s than those of higher, AAA-rated countries in Europe. These tend to have more binding targets such as Germany’s constitutionally anchored debt brake or Sweden’s debt anchor which keeps debt levels close to 35% of GDP.

Higher borrowing costs for the government, businesses and households will curtail economic activity in the near to medium term and is likely to result in a possibly severe correction in house prices. This comes on top of post-Brexit constraints on UK trade holding back future growth as the country’s dealings with its largest trading partner, the EU, have become more difficult and costly.

A period of political and policy stability will be important for the UK to solidify its restored fiscal credibility and to allow a more stable environment to support business investment, vital given the difficult economic context. Following the severe market reaction to the previous mini-budget, major political infighting within the ruling Conservative Party is likely to remain subdued in the near term.

Fundamental differences within the party remain. Political infighting may reignite in the future. Some of the planned spending cuts and tax rises are unpopular with influential wings of the ruling party – while many voters are struggling to cope with the rising cost of living, leading to opposition Labour Party’s large lead in opinion polls. Any future changes in Conservative leadership or the election of a Labour government would result in new shifts in fiscal policy.