Announcements

Drinks

The looming EU climate investment gap presents debt sustainability trade-off

By Thibault Vasse, Associate Director, Sovereign and Public Sector

With the EU (AAA/Stable) facing such a vast climate investment gap, it will be a challenge to achieve the Paris Agreement goals and ambitions.

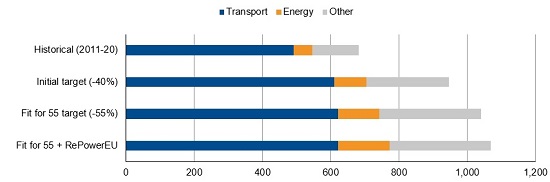

The European Commission estimates that the region will require annual climate investments of EUR 1,070bn (7.4% of EU GDP) per year, including EUR 1,040bn to meet the Fit for 55 target and around EUR 30bn under the REPowerEU plan to reduce dependence on Russian fossil fuel (Figure 1). This represents a rapid increase in investments of almost EUR 400bn a year.

Figure 1. EU wide average annual climate investment needs, 2021-30 (EUR bn)

Note: The Fit for 55 investment needs refer to the European Commission’s MIX scenario that assumes expanded carbon pricing and energy regulations. Source: European Commission, Scope Ratings

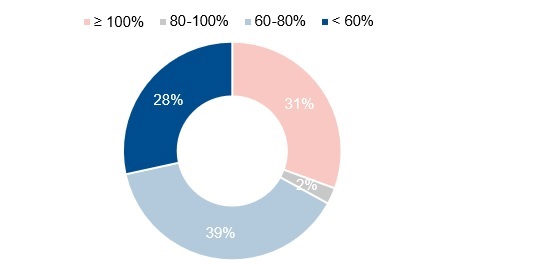

This also poses clear medium-term challenges for public finances which have already been hit hard by the Covid-19 and energy crises and are facing an increasingly challenging macro-economic outlook. These factors, combined with rising government borrowing costs, constrain governments’ fiscal space and risk hampering climate action in the region. After all, 39% of EU Effort Sharing emissions cuts under the Fit for 55 proposals are expected to come from countries with debt-to-GDP ratios of above 100% (Figure 2).

Figure 2. Effort sharing emission cuts per 2021 debt-to-GDP level

% of total Effort Sharing emission cuts, 2021-30

Note: Countries with debt-to-GDP ratios above 100% include Belgium, Cyprus, France, Greece, Italy, Portugal, and Spain. Source: IMF, European Commission, Scope Ratings

EU governments therefore face a difficult trade-off. Delivering on their climate ambitions presents a considerable upfront fiscal cost and can weigh on public finances in the short- to medium-term. Conversely, the cost of inaction will likely be massive, with a disorderly transition estimated to reduce GDP by around 25% by 2100, according to the ECB. This would undermine countries’ economic and fiscal sustainability longer-term, lead to heightened social and political tensions and result in more persistent damage to their creditworthiness.

The EU financial architecture can provide crucial support. First, increased use of common resources through the EU’s multi-annual budget and NextGenerationEU can help mitigate the cost for member states with weaker public finances amid rising rates. Potentially over EUR 670bn (30%) of the EU budget will support climate action among member states. In addition, EU funding conditionality can galvanise national governments and bolster increased investment with structural reforms.

On the positive side, the development of new, cost-efficient green technologies can be non-linear, as reflected by the price and competitiveness of renewables that has fallen dramatically in the past decade. Future investments may be lower than expected due to innovation. Also, green investments can have positive macro-economic effects via a Keynesian demand-side push and enhanced productivity. But these macroeconomic effects are still not fully understood when also accounting for other essential climate policies, such as carbon pricing, which tend to weigh on growth in the near term.

Long-term benefits are clear. Increased green investments are critical to setting EU economies on a path of sustainable growth and enhancing their resilience to shocks, as also demonstrated by the recent energy crisis. They can also place the EU in a leading position in developing the strategic sectors, products, and business models of the future, securing an important first-mover advantage.

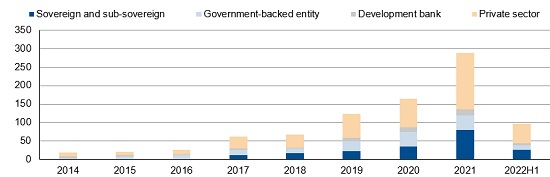

In this context, green bond issuance, which has already increased almost fivefold over 2017-21 (Figure 3), will accelerate in coming years as public and private actors look to fund rising climate-related expenditure and attract ESG-oriented investors. Countries with well-established and credible green bond markets – such as France (AA/Stable), Germany (AAA/Stable) and the Netherlands (AAA/Stable) – are likely to benefit from a ‘greenium’ and more flexible funding conditions as governments implement stronger regulations and policy incentives to channel financial flows to climate initiatives.

Figure 3. Public sector green bond issuance in Europe (EUR bn)

Note: Supranational bond issuance is included under ‘Government-back entity’ figures. The EU makes up 38% of issuance from this group. Source: Climate Bond Initiative, Scope Ratings