Announcements

Drinks

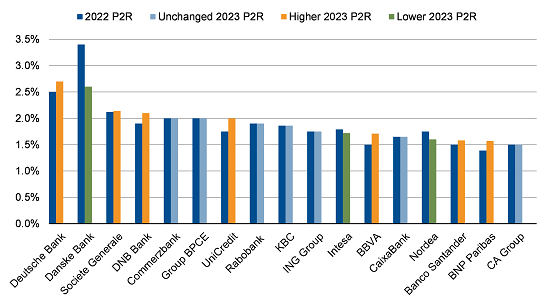

Asset quality, leveraged finance drive 2023 Pillar 2 capital updates

Major EU banks communicated their SREP requirements for 2023 at the end of last year. For the 17 EU banks in our sample, six saw an increase in their Pillar 2 requirements while three saw a decline; the rest remaining stable. UniCredit saw the biggest increase at 25bp while Danske Bank saw the largest decline at 80bp.

2023 vs 2022 Pillar 2 requirements

Source: Banks, Scope Ratings.

Higher countercyclical capital buffer rates will impact a greater number of banks. Despite the uncertain economic outlook, they are still set to increase in several European countries, including France (+50bp), Germany (+75bp), and the Netherlands (+100bp). On top of this, the eight EU G-SIIs (Banco Santander, BNP Paribas, BPCE, Credit Agricole, Deutsche Bank, ING, Societe Generale, UniCredit) have, since the start of the year, been subject to a leverage ratio buffer equal to 50% of their G-SII buffer, which must be met with Tier 1 capital.

For BBVA and Banco Santander, the driver for the increase in their Pillar 2 requirements was related to the ECB’s prudential provisioning expectations. Addressing non-performing exposures (NPEs) has been a key supervisory priority, with the ECB publishing initial guidance on supervisory expectations for prudential provisioning on new NPEs in March 2018.

This was followed by further supervisory expectations for provisions on stock NPEs in July 2018 and amendments to the Capital Requirements Regulation (CRR) in 2019. The revised CRR established the prudential treatment under Pillar 1 for NPEs arising from loans originated from 26 April 2019 onwards and require a deduction from own funds for NPEs not sufficiently covered by provisions or other adjustments.

The ECB can also use the Pillar 2 framework if in its view a bank’s provisions do not adequately cover expected credit risks. Importantly, Pillar 2 requirements can also be used to address NPEs from loans originated before 26 April 2019.

Unlike the CRR (Pillar 1) prudential NPE treatment, the ECB’s supervisory expectations for prudential provisioning under the Pillar 2 framework are not legally binding. As well, banks have the option to close the gap between provisions and prudential expectations by adjusting their CET1 capital. This may not be an optimal use of capital resources, though, as Pillar 2 requirements can be met with a mix of CET1, AT1 and Tier 2 capital.

For Deutsche Bank, the increase in the Pillar 2 requirement was driven by the ECB’s newly introduced assessment of risks stemming from leveraged finance activities. The ECB has voiced concerns about risks from the leveraged finance sector for some time and has increased its monitoring, including the use of the Leveraged Finance Dashboard – a supervisory tool sampling significant institutions’ reports on leveraged finance-related data on a quarterly basis. Leveraged finance is a key supervisory priority for 2022-2024, with the ECB ready to increase Pillar 2 requirements when banks fail to remedy perceived deficiencies in risk management.

DNB Bank received an updated Pillar 2 requirement of 2.1%, up from 1.9%. However, the group can now meet its requirement with a mix of capital rather than just CET1 capital, as with other European banks. This follows the implementation of CRR2 in Norway in June 2022.

Meanwhile, Danske Bank saw its Pillar 2 requirement fall to 2.6% from 3.4% as DKK 7.5bn of the DKK 10bn Pillar 2 add-on was removed following provisions made for the Estonia matter. In December 2022, the bank reached a final resolution with US and Danish authorities, agreeing to pay about USD 2bn. While the bank remains subject to ongoing civil litigation, the downside risk to future financial results and capital adequacy has been significantly reduced.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope`s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.