Announcements

Drinks

EU bank stress tests: resilience in the face of not-so-remote downside risks

“Credit risk, a key driver of losses in the 2025 stress test, has risen since the previous test and we believe risks are tilted to the downside, because even the adverse scenario does not fully capture the recent heightening of uncertainties in global trade and elsewhere,” said Ángela Cruz, an analyst in Scope’s financial institutions team. “At the same time, higher revenue generation which was a key mitigating factor in the stress rest results could come under pressure.”

Stress-test results point to the likelihood that capital requirements will remain stable. “In addition, any challenges European banks might face in continuing capital distribution policies as in the past few years are limited,” Cruz noted. “While test results provide insights into the non-negligible negative impact of fully phasing in transitional CRR3 arrangements under Basel III finalisation, we believe the 2033 implementation deadline gives banks ample time to undertake mitigating measures.”

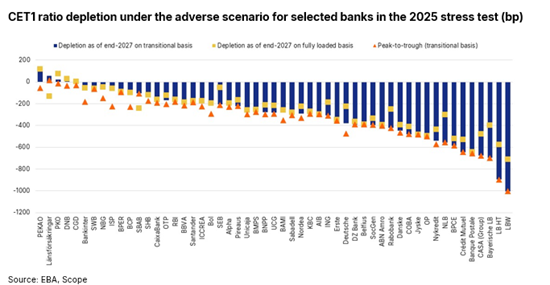

The stress tests show that European banks maintain relatively strong and resilient solvency levels. The system-wide CET1 ratio is about 12% for the total and EBA samples vs 10.4% and 10.3% in 2023. Capital depletion under the adverse scenario is lower, too. “Better sector profitability over the stress test horizon mitigates the impact of higher credit losses in this year’s test than in 2023’s exercise,” Cruz said. The 400bp decline in CET1 ratios in this year’s adverse scenario is almost 100bp less than in 2023.

The adverse scenario results in a meaningful compression of net income under the weight of higher funding costs and macro-financial shocks. “However, the benefits of higher initial profitability in the adverse scenario act as a first line of defence and reduce the pace and extent to which adverse conditions erode capital,” Cruz noted. For the EBA sample, net income adds 509bp to CET1 under the adverse scenario in 2025, while credit-risk losses deplete CET1 by 437bp.

“The outcome of the stress test is consistent with our views about the resilience of asset quality, although moderate asset-quality pressures are already emerging and risks are skewed to the downside,” Cruz cautioned. There can be significant dispersion among individual banks around the average, however, depending on their degree of exposure to pockets of risk, such as commercial real estate, and tariff-exposed economic sectors. In the adverse scenario, the contribution of credit losses to CET1 depletion in the EBA sample ranges from a very material level close to 900bp to a negligible 10bp.

We believe some scenario assumptions could plausibly fall under greater stress than the adverse scenario. “We do not believe the stress test fully captures the potential impacts of an asymmetric crystallisation of certain risks that start unfolding beyond baseline scenario assumptions since the stress test was designed and launched, such as trade tensions,” Cruz said. “We believe the scenarios for these variables and their impacts are closer to the adverse scenario.”

The greatest downside risks to the results of the adverse scenario stem from elevated geopolitical and global trade tensions, particularly in the Middle East and US tariffs. “These factors have led to some of the risks considered hypothetical in the adverse scenario materialising since the exercise was launched. This is testimony to the event-risk challenges in the current macro and economic environment,” Cruz said. “The crystallisation of these risks can lead not only to a weaker picture for European banks than that of the baseline scenario but to even greater negative impacts than those incorporated in the adverse scenario.”