Announcements

Drinks

South Africa: governance risk and rising debt challenge credit ratings

By Dennis Shen, Director and Thomas Gillet, Associate Director, Sovereign Ratings

We forecast GDP growth of 0.8% this year, down from 2.0% in 2022 and below the South African economy’s 1.5% potential annual rate, before a slow rebound to 1.8% next year. Years of weak economic growth have ensured GDP per capita remains near where it was in the early 1980s as structural economic bottlenecks, such as inadequate electricity generation, hinder wealth creation.

South Africa (BB+/Stable) can expect only modest near-term relief from the chronic electricity crisis with the declaration of a national state of disaster and appointment of a new electricity minister in the latest cabinet reshuffle. The cost of the now daily blackouts may be running at around USD 50m a day, according to the South African Reserve Bank.

The government’s latest conditional debt relief for Eskom, South Africa’s state-owned electricity utility, covers more than three quarters of its net borrowings of ZAR 423bn (USD 23bn) – equivalent to 5.9% of GDP – but will make it harder for the government to meet its objectives of stabilising public debt.

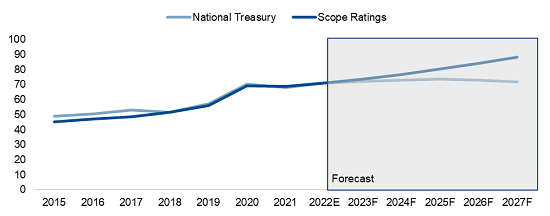

Figure 1. South Africa’s public debt burden rises under strain of Eskom rescue

% of GDP

Source: National Treasury (South Africa), Scope Ratings

Structural fiscal deficits, contingent liabilities point to rising debt burden

Government debt will exceed 80% of GDP in 2025, above the government forecast for it to peak at nearly 74%, having risen from 69% in 2021 (Figure 1). The government had previously forecast debt-to-GDP would peak at 71% in fiscal year 2022.

Weak governance limits the capacity to address some of the most pressing challenges such as rigid labour markets dampening productivity and economic growth. Rising interest payments, the rand’s depreciation and contingent liabilities also explain the rising debt trajectory. Net interest payments will rise to 28.3% of general government revenues by 2027, up from 13.4% in 2019. The government’s budget deficit will widen to an average of 7.2% of GDP between 2024 and 2027 from 5.8% this year.

Eskom is likely to need more state support, further pushing up state borrowing, for two reasons. First, the company, a pillar of the South African economy, faces hefty costs associated with the energy transition considering coal accounts for 70% of energy use and 85% of electricity generation.

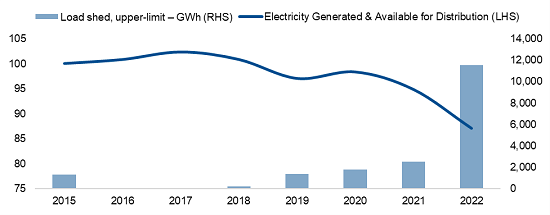

The second reason is Eskom’s poor record (Figure 2). The utility has received multiple public bailouts since 2008, amounting to ZAR 263.4bn, without materially improving its underlying performance, due in part to financial crime that the National Treasury has identified as one of the main risks for the economic outlook.

Easing Eskom’s debt burden requires profound change by improving governance and cracking down on corruption and theft, but inaction is a danger given vested interests in the status quo.

Furthermore, the utility’s challenges are common to other public-sector entities. The government may have to assume some of the ZAR 56.3bn in debt (0.8% of GDP) owed by municipalities to Eskom in addition to supporting other state-owned enterprises.

Figure 2. Multiple Eskom bailouts have failed to boost electricity generation capacity

Index (LHS), GWh (RHS)

Source: National Treasury (South Africa), Scope Ratings

Military exercises with Russia, FATF grey listing exemplify weak governance

Confidence that the current South African government can address governance weaknesses is waning. One reason is the diplomatic rapprochement with Russia despite the United States’ crack-down on Western sanctions evasion – the two BRICS countries recently held joint military exercises with China. Another is the decision by the Financial Action Task Force (FATF) to list South Africa as a “jurisdiction under increased monitoring”.

South Africa’s inclusion on the FATF grey list reflects a vulnerability of the financial system, otherwise one of the country’s main credit strengths, in line with conclusions of the State Capture Commission on corruption and fraud in the public sector.

Further crystallisation of liabilities on the government balance sheet together with governance risk and poor sentiment in financial markets could impair debt sustainability and exert downside pressure on the sovereign’s credit ratings. Scope’s next review of South Africa’s ratings is on 21 April.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope’s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.