Announcements

Drinks

EU’s sluggish economy faces moderate growth slowdown from US trade tensions

By Dennis Shen – Scope Macroeconomic Council

An initial US-EU deal appears increasingly likely, even if the final terms are still being worked out. The recent trade agreement reached between the US and Japan has increased pressure on the EU and other trading partners to pursue a similar arrangement near term.

Ongoing negotiations suggest that a 15% levy on most EU exports to the US may be introduced, with EU officials pushing to have this rate applied to sectors such as automobiles. Steel and aluminium imports above a certain quota might face the current higher levy of 50%.

President Donald Trump has persisted with his policy of imposing higher tariffs on trading partners, so the EU faces a potential 30% tariff without an agreement, up from the 20% tax imposed in April and then paused, although still below the 50% rate threatened in May.

The EU has avoided direct retaliation to date, and we expect this cautious approach to continue – even as the EU prepares possible countermeasures. Nevertheless, the approach risks growing tariff asymmetries particularly if US levies on EU goods rise more quickly than EU levies on US exports.

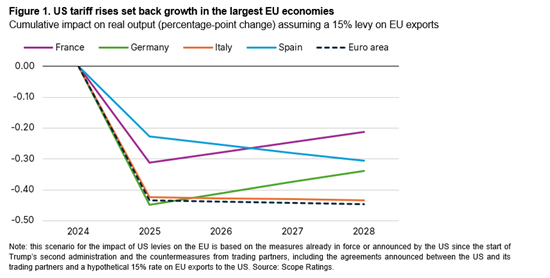

Our model-based estimates suggest that the implementation of a 15% US tariff would trim euro area and EU growth within a year by increasing the effective US tariff on EU exports by around 16pps, excluding the proposed across-the-board 30% rate (Figure 1). This estimate assumes threatened levies on pharmaceutical exports go into effect.

The most-exposed EU economies are those with an elevated trade surplus and/or significant trade with the US, such as Germany and Ireland, with the impact of higher tariffs also felt indirectly through their effect on global supply chains.

Among the EU’s four largest economies – Germany, France, Italy and Spain – Germany and Italy are the most vulnerable, each facing an estimated short-term output loss of 0.4pps. The higher tariffs will reduce Spain’s output by a moderate 0.3pps in the medium run. France is expected to experience a more modest cumulative reduction in output of 0.2pps in the medium term.

Trade tensions underpinned the reduction last month in our forecast for euro area growth for 2025 by 0.5pps to 1.1% though we expect growth to improve to 1.5% next year, lifted by fiscal stimulus in Germany and higher defence spending across the EU.

Threatened 30% levies would raise economic costs for the EU economy

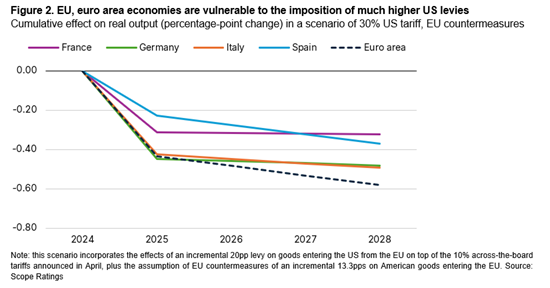

Alternatively, should the US go ahead with the threatened imposition of 30% tariffs on the EU on 1 August, equivalent to a rise in the effective US rates by around 26pps in aggregate this year, and the EU adopts countermeasures, the adverse effect on growth in the EU would clearly be more significant.

For illustrative purposes, if both the 30% levies imposed by the US and EU countermeasures come into force on or shortly after 1 August and hypothetically stayed at the higher rates in the years ahead, our estimates suggest an aggregate output loss of 0.6pps by 2028 for the euro area and 0.5pps for the EU economy (Figure 2).

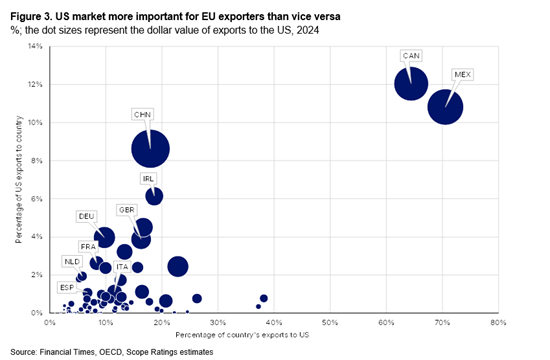

Averting this potentially damaging trade outcome for Europe depends on the negotiations underway in which the EU, even as the world’s largest and most-open trading bloc, is at a disadvantage partly due to the greater importance of the US for its exporters than vice versa (Figure 3). This is even as the EU seeks to bolster trade cooperation with other trading partners.

US, EU probably to achieve a preliminary “agreement”

Considering this, it appears likely that the US and EU achieve some form of a “framework agreement” even if this involves average US levies of above 10%. A preliminary agreement by 1 August remains firmly possible. Nevertheless, given the seesawing US trade policies of the recent months, the White House might in an alternative scenario impose the 30% levies – even if temporarily – as leverage in negotiations before settling on an agreement after 1 August.

Any preliminary agreement is likely to contain many caveats and carve-outs – with limited enforceability – serving only to avert further worst-case escalation and act as the starting point for further negotiations.

The EU has several ways to retaliate in the scenario of a worsening trade war, from the newly introduced but yet-to-be-used anti-coercion mechanism to possible tariffs on American exports and the imposition of export controls, though we expect any such retaliation to remain gradual.

Related material:

Report: Scope’s 2025 mid-year global economic outlook

Presentation: Scope's 2025 mid-year economic and credit outlook

Arne Platteau, analyst in Credit Policy at Scope Ratings, contributed to this research.

The Scope Macroeconomic Council brings together credit opinions from ratings teams across multiple issuer classes: sovereign and public sector, financial institutions, corporates, structured finance and project finance.