Announcements

Drinks

Portugal: fiscal prudence and robust growth prospects improve debt sustainability

By Jakob Suwalski, Director, and Alessandra Poli, Associate Analyst, Sovereign Ratings

Portugal (A-/Stable) has demonstrated remarkable progress in enhancing its fiscal fundamentals in the past two years, surpassing efforts by Italy (BBB+/Stable) and Spain (A-/Stable) in terms of pace and efficacy. The country’s improved debt outlook and capacity to navigate long-term fiscal pressures underpin our recent rating upgrade.

Portugal has achieved the third-largest reduction in public-debt-to-GDP ratio in the EU between 2015 and 2023, with a decline of 23 percentage points, despite the Covid pandemic and energy shock. Only Cyprus (with a 65-percentage point reduction) and Ireland (39 percentage points) have done better. Debt-to-GDP is on course to continue to decline to around 91% by 2027, which is close to pre-financial crisis levels.

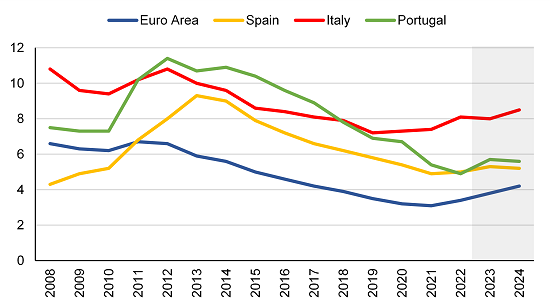

This consistent downward trend, particularly in the face of rising interest rates, allows Portugal to control interest expenditure, limit its borrowing requirements and contributes to overall financial stability. Portugal's interest spending as a share of government revenue is expected to remain above the euro area average but below pre-Covid levels and almost aligned with Spain’s. (Figure 1).

Figure 1: Interest-to-revenue ratio for Portugal, Spain, Italy and the Euro Area, 2008-2024

Source: AMECO, Scope Ratings

Portugal runs increasingly wide primary budget surpluses

Portugal has shown progress in restoring its fiscal balance despite the impact of the pandemic in 2020. The fiscal deficit, which had widened to 5.8% of GDP in 2020, has steadily improved and is expected to reach 1.1% of GDP in 2022, further declining to 0.4% of GDP this year.

Rebounding growth has helped. GDP rose 6.7% in 2022, up from 5.5% in 2021, though it will slow to 1.2% this year. So too has the withdrawal of extraordinary pandemic-linked support for households and business which has partially offset the increase in current primary spending related to public wages.

These improvements have driven a rapid recovery in the primary surplus, which is set to rise to 1.7% of GDP this year, up from 0.9% in 2022, 0.5% in 2021, and a deficit of 2.9% in 2020. The shift leaves Portugal well placed compared with Italy, projected to return to primary surpluses only in 2025, and Spain, which we expect to record primary deficits until 2027.

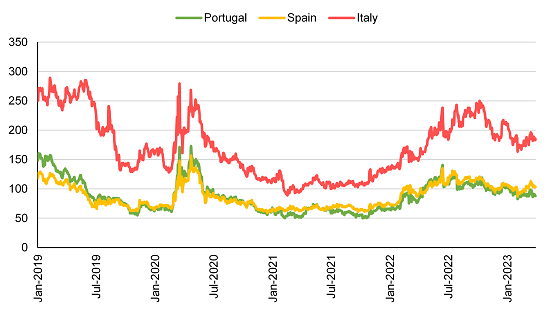

Investors have noticed these fundamental improvements with Portugal’s 10-year government bond yields consistently aligned with those of Spain, and in some cases, even lower since 2021. This also resulted in a lower bond spread over the German Bund since the second half of 2021(Figure 2).

Figure 2: 10-year government bond spreads over Bund for Italy, Spain and Portugal, 2019-23, bps

Source: Macrobond, Scope Ratings

Prudent policy making strengthens Portugal’s fiscal resilience to medium-term challenges

Portugal's prudent fiscal policy can be in part attributed to relatively stable politics, also crucial for the country’s sustained economic growth. The centre-left socialist party has committed to fiscal prudence and prioritised sustainable economic growth since taking office in 2015 while maintaining voter confidence, driving its solid parliamentary majority in 2022’s snap election. The situation differs from that of the Spanish government, which is currently preparing for a general election at the year-end.

The steady political situation in Portugal and advances made in fiscal policy also bode well for Portugal's investment of the large amount of EU funds (EUR 63.9bn including Next Generation and Multiannual Financial Framework funds, or 27% of GDP) it is set to receive over the next four years. The country has a good implementation record as captured in Portugal’s high absorption rate of 92% as of 2022 of the European Structural and Investment funds allocated over 2014-20, well above the EU average of 76%, Italy (62%) and Spain (57%).

Portugal’s prudent fiscal policy and stable politics are also crucial for strengthening the country's resilience to long-term fiscal pressures resulting from rising healthcare and pension costs, particularly given its ageing population. The IMF estimates the net present value of the additional pension and healthcare spending over 2021-2050 at around 58% of GDP, above that of Spain (50%) but below Italy’s (63%).

Finally, Portugal still faces significant structural economic challenges given its relatively smaller but open economy, which relies heavily on tourism, also compared with Italy and Spain. To enhance long-term growth, boosting productivity is critical. However, achieving this goal necessitates a transition away from low-wage services and towards higher-value added products.