Announcements

Drinks

Ukraine set for foreign debt restructuring next year; debt forgiveness likely medium term

By Dennis Shen, Director, Sovereign Ratings

G7 creditors said they would only extend their grace period for Ukrainian debt if private creditors agreed to a treatment at least as favourable. But since it is Paris Club creditors who frequently offer the most significant disposition for debt relief, their commitment to only extend the debt-service freeze at this current stage suggests external private creditors are unlikely to go much further than that next year.

Ukraine is only scheduled to pay USD 200m (0.1% of GDP) in debt service to the Paris Club next year but extending the debt-service suspension would deliver a more substantive USD 4.4bn (2.9% of GDP) in savings due to international bondholders in 2024. Negotiations with commercial creditors will begin late this year or in early 2024. We believe an agreement is likely to be concluded by mid-next year. If so, a (second) external debt restructuring after the 2022 debt suspension would most likely be likewise assessed with a ‘selective default’ foreign-currency issuer rating by 2024.

Further debt restructuring was already a key baseline assumption behind Scope’s decision to assign CC foreign-currency ratings and a Negative Outlook following the 2022 external debt agreement. A CC rating implies around a 62% probability of a credit event within two years from the date of assignment.

A third and more comprehensive debt treatment potentially by 2027

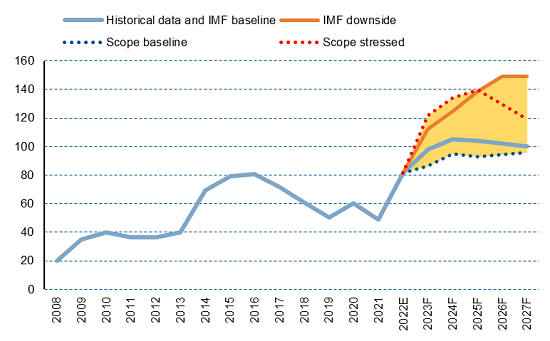

We currently project a rise in Ukraine’s general government debt to roughly 95% of GDP by 2024 from 82% in 2022 and double the 49% ratio in 2021 (Figure 1). By comparison, the IMF’s baseline economic scenario sees sovereign debt peaking at 105% by the end of 2024 before declining to 78% by 2033. The IMF foresees gross financing requirements to normalise from wartime peaks of above 27% of GDP between 2023-2024 to about 10% per year by 2027.

Figure 1. General government debt (percent of GDP), by scenario*

*Scenarios are pre-debt restructuring seen near the end of the forecast horizon (2027). Source: Ministry of Finance (Ukraine), Ukraine State Statistics Service, IMF and Scope Ratings forecasts.

Debt projections like these have not in the past automatically resulted in a conclusion that debt is unsustainable. For example, after Ukraine’s 2015 debt restructuring, the IMF deemed Ukraine’s 79% debt-to-GDP ratio sustainable. But Ukraine’s circumstances today cannot be compared to its past and certainly not to any off-the-shelf example of a distressed borrower receiving multilateral assistance.

Conventional debt-sustainability assessments are interpreted differently under exceptional circumstances such as those faced by Ukraine. The country will likely continue receiving heightened attention and support from Western creditors; more comprehensive debt forgiveness appears likely medium run, including for (geo)political reasons, even if baseline projections of the IMF do not signal such scale of support as being unequivocally compulsory.

Any decision concerning debt forgiveness will rest moreover on the IMF’s debt sustainability assessment under its downside scenario, under which public debt would rise to nearly 150%. On this basis, an expectation of multilateral and bilateral creditors of another (and third) external debt treatment near the end of the current programme (by 2026-27) – during which more comprehensive measures are discussed – seems sound.

A third and more comprehensive external debt restructuring by 2027 would potentially require more substantive losses, especially from private-sector creditors. This could set the stage for contentious talks around comparability of treatment by that point – especially as multilateral lenders refuse to participate arguing preferred creditor status, even as they provide significant concessional loans. The scale of losses the private sector ultimately faces may delay programme objectives for regaining international market access.

IMF programme reduces near-term risks for Ukraine’s domestic debt

The IMF’s USD 15.6bn 48-month Extended Fund Facility (of which USD 2.7bn is immediately available) opens up a suggested USD 115bn of aggregate funding support. This is an exceptional demonstration of support for Ukraine as the IMF does not usually lend to countries at war given extreme uncertainty as to whether it will be repaid.

Alongside complementary debt relief from the international sector, IMF funding reduces the significant financing gap in forthcoming years driven by general-government deficits of about 20% of GDP this year and 17% in 2024. The IMF is not, incidentally, making any assumptions at this stage around use of frozen Russian reserves to fill the financing gap.

Complementing actions from the international sector, Ukraine plans to enhance the domestic financing of the sovereign and eliminate monetary financing. The Ministry of Finance recently hiked rates on domestic debt to make it more marketable. Having the domestic banking sector increasingly shore up sovereign funding reduces the likelihood of any domestic debt restructuring over the coming period – as the anchoring of financial stability and domestic debt capital markets appears strategically core for the financing of war and reconstruction.

Scope rates Ukraine’s domestic debt CCC with a Negative Outlook, higher than the foreign debt rating.

Specific economic metrics have improved

Anchored by prudent macro-financial management and international assistance, specific economic metrics have improved recently. Foreign-currency reserves rose to USD 28.7bn by March, nearing a pre-invasion high. The hryvnia black market rate stabilised. Economic contraction during 2022 was a severe 30%, but nevertheless in line with an above-consensus estimate we had since July of -31%. Scope projects output growth of 4% in 2023 and 2.5% for 2024.

Following last month’s approval of the IMF programme and announcement of an extended debt suspension, Scope’s next scheduled review of Ukraine is 12 May.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope’s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.