Announcements

Drinks

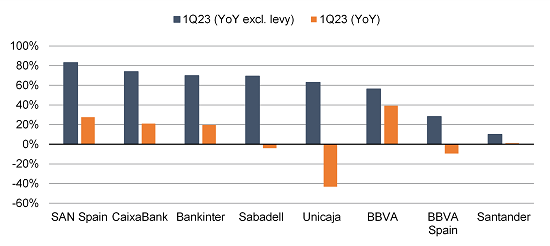

Spanish banks: net interest income boost more than compensates for bank levy

“Stronger pre-provision profitability supports the banks’ ability to sustain higher cost of risk in 2023 and potentially 2024,” said Chiara Romano, associate director in Scope’s financial institutions team. “Credit costs should remain in line or slightly above 2022 levels, supported by provisions accumulated during the pandemic but also by a resilient labour market.”

Profits rise despite temporary bank levy

Source: Company data, Scope Ratings

Despite significant TLTRO repayments, funding pressure should remain low, especially given the marginal lending growth expected in 2023. “A solid, mostly retail, deposit base coupled with limited needs to tap the markets for MREL funding will keep net stable funding ratios and liquidity coverage ratios adequately above requirements,” Romano said.

Funding comes mainly from deposits from retail and SME customers and close to 70% of eligible deposits are covered by the deposit guarantee fund. While Q1 showed some deposit outflows, this was matched by a broadly symmetric reduction in gross lending. Capital market access proved resilient in the first quarter: issuance across the capital structure was the highest in three years.

“Strong retained earnings, valuation effects and flat to declining RWAs support capital ratios, which should improve as retained earnings more than offset distributions, and risk weighted asset growth remains low,” Romano said.

The Q1 lending survey points to a broad tightening of credit standards across residential mortgages, corporate and consumer lending. Loan demand in the quarter declined across all segments and banks expect further decreases in the second quarter, albeit to a lesser extent. Scope expects that reductions in mortgage lending will lead to flat or slightly declining loan books in 2023.

In terms of asset quality, Spanish banks reported flat Stage 3 and coverage ratios in Q1. Lending classified as Stage 2 stands at around 7% of gross exposures for our sample (Santander, BBVA, Sabadell, Bankinter, CaixaBank, Unicaja), roughly 150bp above the figure at YE2019 but stable versus YE2020, the year weakened by the Covid crisis.

Download the Spanish bank report here.

Scope has subscription ratings on:

- Banco Bilbao Vizcaya Argentaria SA

- Banco Santander SA

- Banco de Sabadell SA

- Bankinter SA

- Ibercaja Banco SA

- Kutxabank SA

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions such as for Credit Sphere.