Announcements

Drinks

Norway’s local government sector: robust framework supports credit profile; funding needs on rise

Scope Ratings says in its latest report on the sector that there are significant fiscal and financial interlinkages between local and central governments in Norway. They include a comprehensive fiscal equalisation system which helps address the challenges stemming from adverse demographic trends and specific territorial characteristics that affect service provision at the local level.

“The structural operating surplus in the sector indicates that their revenue is broadly commensurate to spending needs,” says Giulia Branz, Associate Director in sovereign and public sector ratings at Scope. “The effectiveness of the framework in addressing the main structural trends affecting spending supports our view of the solidity of local government finances in the medium term”.

Still, budgetary pressures arising from an ageing population, on top of those related to climate change, are set to exert growing fiscal pressure over the long run and will require striking a balance between implementing forward-looking investments while effectively utilising fiscal resources.

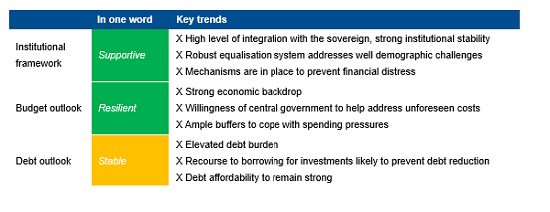

Scope’s views of Norway’s local government sector – a summary

Source: Scope Ratings

The local government sector has a record of robust budgetary performance despite some differences among entities.

The recent inflationary shock poses a challenge to maintaining prudent cost controls. This is particularly true at the municipal level, where personnel costs constitute a significant portion of operating expenditure.

“Nevertheless, we expect the sector’s budgetary performance to at least remain stable due to the positive economic outlook for Norway that will bolster tax receipts and continued support from the central government which is likely to help the sector address any unexpected spending pressures,” says Branz.

The sector does have growing funding needs, with role of green finance gaining in importance, but debt sustainability is good overall, says Jakob Suwalski, Senior Director at Scope.

“Debt burdens vary widely among municipalities but even entities with the highest debt look able to service it judged by moderate interest payment burdens and manageable debt ratios,” says Suwalski.

“All larger entities have ample liquidity and strong reserves. Given that the sector's investment funding needs regularly exceed internal financial resources, reliance on debt financing is unlikely to end, though borrowing is facilitated by the substantial fiscal buffers held by local governments. The role of green finance is set to grow as adaptation to climate change climbs up the policy-making agenda,” he says.