Announcements

Drinks

Spain: complex coalition politics put fiscal consolidation at risk as growth slows, spending rises

By Jakob Suwalski and Brian Marly, Sovereign & Public Sector Ratings

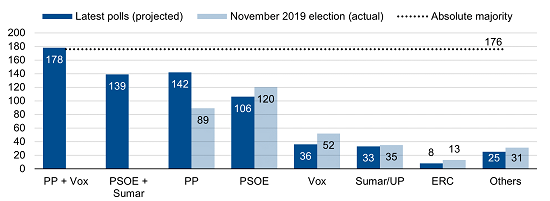

No single party is set to secure an outright majority in the vote on Sunday, 23 July, in Spain (A-/Stable) according to latest opinion polls which put a right-leaning group of political parties neck and neck with a potential left-leaning coalition (Figure 1).

The increasing influence of smaller parties has transformed the country’s politics nationally and regionally, making coalition-building more important and more difficult as the political stalemate in 2016 showed. Even if one party forms a minority government with smaller party support to pass legislation and pursue its policy agenda, to do so may require hefty concessions and fending off legislative challenges.

Such delicate negotiations to gain support for proposed policies can water them down and slow implementation, while Spain’s high budget deficits and debt-to-GDP limit a new government’s room for more fiscal stimulus.

Yet decisive and coherent fiscal policy is crucial. Pressures on social and healthcare budgets, due to an aging population and inflation-indexed pensions, require careful calibration of spending plans. Deploying Spain’s share of Next Generation EU (NGEU) funds requires a consensus on sustainable environmental- and social-related reforms and investment.

Figure 1. Tight race: national parliament voting intentions in Spain’s July elections

Number of seats in the Congress of Deputies

Note: PP: Partido popular, PSOE: Partido Socialista Obrero Español, UP: Unidas Podemos,

ERC: Esquerra Republicana de Catalunya

Source: datosRVTE, Scope Ratings

Strong economic growth coincides with rising cost of living

The elections also take place amid a challenging economic environment, characterized by tightening financial conditions and high core inflation at 5.9% in June, which are proving a drag on medium-term growth, as are persistent long-term challenges including Spain’s poor labour productivity gains.

Headline inflation in Spain has significantly decreased to 1.9% YoY from its peak of 10.8% in July 2022. However, we expect Spanish inflation to rise again in the second half of the year due to factors such as fading base effects, increasing oil prices, and the discontinuation of certain government measures. Projections estimate an average inflation rate of 3.4% for 2023 and 2.8% for 2024.

Still, the economy is benefiting from continued growth of the thriving tourism industry and increased public sector investment. The absorption of NGEU funds will contribute to maintaining consumer purchasing power.

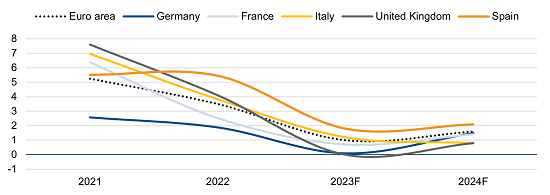

We have revised up our growth forecast for Spain this year by 0.5 pp to 1.8%, more in line with the government's projection of 2.1%, though sharply down from 5.5% in 2022. Spain is outperforming other large European economies (Figure 2).

Figure 2. Economic growth in Europe: Spain outpaces France, Germany, Italy and UK (2021-24F)

Real GDP growth %

Source: Macrobond, Scope Ratings forecasts

Budget deficit shows improvement due to robust, yet slowing economic growth

Stronger-than-expected revenue growth has helped the government offset extraordinary spending to mitigate the energy shock and rising living costs. The fiscal deficit fell to 4.8% of GDP in 2022 from 6.8% in 2021.

We expect further substantial fiscal consolidation will be tough to achieve given the upward pressure on social welfare and healthcare spending – hence our forecast that the deficit will narrow to 4.4% of GDP this year and 3.2% in 2024, more slowly than estimated by the government (3.8% and 3.0%, respectively) and the European Commission (4.1% and 3.3%). The forecast for a deficit of 3.2% of GDP for 2024 assumes that Spain does not implement further fiscal consolidation and that economic growth remains line with our base case. Spain will need to carefully manage fiscal policy to remain within the EU’s fiscal rules when they are reactivated next year.

Debt-to-GDP is set continue to decline gradually, falling to 110% of GDP by the end of this year and 108% by end-2024 from 113% in 2022. While this ratio remains significantly higher than before the pandemic, strong investor demand for Spanish government bonds, a favourable debt structure with an eight-year average maturity, and a substantial deposit buffer amounting to around 12% of GDP support the sustainability of public debt.

Still, Spain needs more public investment to boost growth. The economy relies on foreign capital inflows due to its structurally negative net international investment position. Spain has received 53% of allocated EU recovery funds totaling EUR 69.5bn (about 5.2% of GDP), indicating that much work remains ahead to implement the investment strategy, for which a broad political consensus is likely to be a crucial component.

Scope’s next review of Spain’s rating is on 6 October.