Announcements

Drinks

Credit Lines: Renewed focus on central bank balance sheets will tighten financial conditions

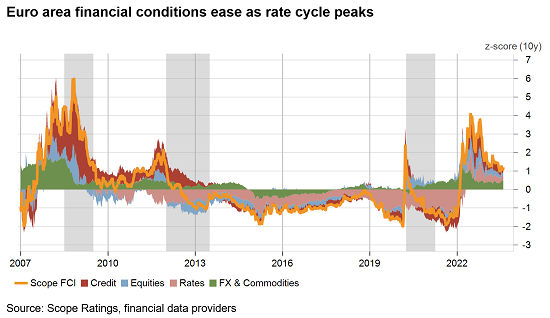

With major central banks seemingly reaching the end of their rate-hike cycle this summer, financial conditions are easing in anticipation of a soft landing for major economies. While all-in credit costs are still considerably higher than in 2021 and banks’ credit standards tighter, Scope’s European Financial Conditions Index suggests that the capital markets environment is not overly restrictive if viewed over a longer-term perspective.

Not surprisingly, issuance volumes have been high all year and markets feel buoyed by the prospect of a soft landing – as outlined in Scope’s mid-year economic outlook. Also, while banks report that they have tightened their credit standards, the overall system is in good health with low chance of a credit crunch, as outlined in our webinar on European banks on 26 July.

Given the constructive growth and financial stability outlook, it is fair to assume that policy rates will remain around current levels into next year and may stay elevated after that. This leaves the question of what central banks will do with heir huge balance sheets of low-yielding assets and how any asset reductions will affect the credit environment.

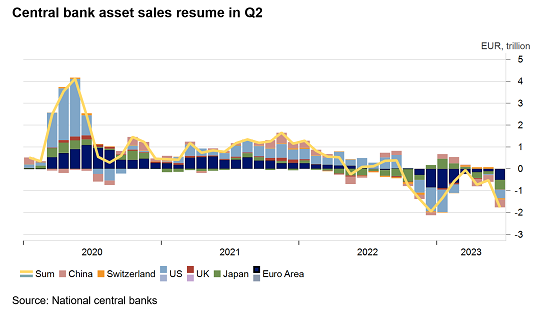

While there has been no lack of ambition among central banks to eventually shrink their balance sheets, very little has been achieved so far as efforts came to a near halt earlier in the year due to financial stability concerns. They have since resumed and the few measures that were undertaken, such as repayment of TLTROs, have so far had very little impact on financial conditions as excess liquidity remains high.

However, with rate hikes out of the way and inflation on the way down, central banks are likely to revisit the speed at which they reduce their assets. No longer constrained by the zero lower bound, net asset purchases have less of a signalling effect for monetary policy but the reduction of liquidity is likely to push financial conditions tighter, once excess liquidity has been removed and commercial lenders start reallocating portfolios, for example between loans and government bonds.

The ECB’s recent move to stop remunerating minimum reserves also suggests that central banks are sensitive to the liabilities side and the cost of remunerating excess reserves and deposits by governments. Central banks are therefore likely to intensify their balance-sheet management in the latter half of the year to ensure that policy rates are transmitted to markets as efficiently as possible.

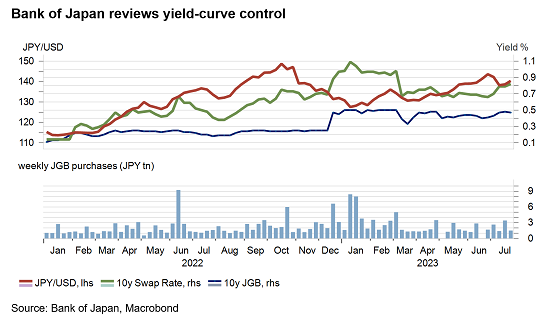

In the past weeks, the Bank of Japan has started tweaking its long-standing yield curve control regime by letting 10-year yields fluctuate up to 1%, signalling that it eventually intends to take back control over the volume of bonds it purchases. This risks affecting financial conditions globally if Japanese investors repatriate their substantial foreign holdingsof euro area government bonds or US Treasuries, for example. Markets are already concerned about rising US debt supply even as the impact of the debt limit standoff fades (Scope confirmed the AA rating on the United States on 29 June and assigned a negative outlook).

At the other extreme, the Bank of England has already liquidated its small corporate bond portfolio and may increase active Gilt sales from October, thus crystallising more losses on low-yielding bonds and de facto competing with the government’s own Debt Management Office for available demand, which could drive yields higher, even if monetary policy rates were to go on hold.

By contrast, the ECB has yet to fully stop sovereign bond reinvestments before considering other measures. Given the sheer size of the ECB’s government bond holdings, especially of periphery bonds, any major changes to their reinvestment, or even active QE, could negatively affect financial conditions and increase country fragmentation.

All these policy adjustments will take considerable time to implement in view of the vast size of central bank balance sheets and are likely to keep financial conditions tight, even when interest rates fall again, unless, of course, central banks once again change course and start purchasing assets again in support of their monetary policy targets.

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.