Announcements

Drinks

Greece Q&A: Investment grade is an exceptional achievement but multiple challenges remain

Keith Mullin (KM): Greece lost its last investment-grade credit rating in early 2011. It seems to have taken a long time to regain it. Can you outline the journey that led to Scope Ratings upgrading Greece to investment grade on 4 August?

Dennis Shen (DS): Recapturing investment grade is a very significant achievement and has in fact occurred under very fast conditions for Greece from an historical perspective. We understand why it has seemed like a long time for Greece. Nevertheless, most sovereigns that experience sovereign default never get close to investment grade after that, let alone achieve this status 11 years after defaulting, which was in 2012 in Greece’s case.

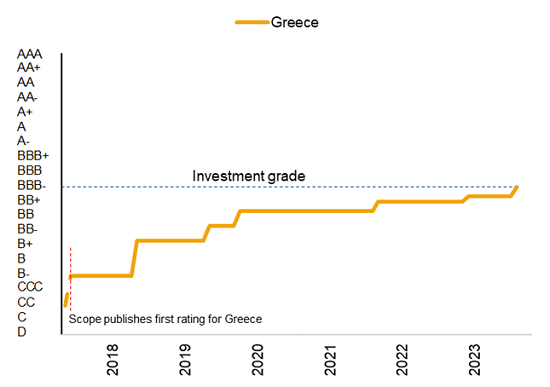

When we first started rating Greece in 2017, we upgraded the rating firstly from CC. So, Greece has been upgraded eight rating levels to reach IG within six years (Figure 1). That is the most rating upgrades of any sovereign we rate, and speaks to the significance of this achievement. Greece was a recipient of additional debt relief only earlier this year – not typical for sovereigns rated at investment grade.

Cyprus also comes to mind in this regard, returning to investment grade rapidly after its 2013 credit event. As such, there are certain advantages seemingly afforded to advanced economies after rare cases of their sovereigns defaulting. After defaulting, advanced-economy sovereigns obviously retain benefits of comparatively mature institutions and associated credit strengths, which historically afford them higher credit ratings and lower probabilities of default. This probably partly explains why Greece and Cyprus obtained IG quicker than many emerging economies after crisis.

But let’s not forget the exceptional experience the Greek economy and people underwent to get to this stage: a 30% peak-to-trough drop in output from 2008 to 2013, the most significant sovereign default in economic history, the disruptive speculation around exit from the euro area, austerity, banking crises, and more recently, Covid-19 and a cost-of-living crisis.

Through this, Greece has persevered, adopting ambitious reforms and significantly raising investment and economic competitiveness. The conclusion of post-bailout Enhanced Surveillance last year and this upgrade to investment grade are further meaningful steps towards normalisation, although there remains significant work to do.

Figure 1. Notch by notch: Scope’s upgrades of Greece sovereign rating

NB. Positive/Negative Outlooks are treated with a +/-0.33 adjustment. Credit Watch positive/negative with a +/-0.67 adjustment. Foreign-currency long-term issuer ratings are displayed. As of 11 August 2023. Source: Scope Ratings.

KM: In its rating rationale, Scope emphasised strong institutional support as crucial for any sovereign borrower to hold an investment-grade rating. Has anything changed in the institutional assessment of Greece to make the rating upgrade possible?

DS: We should recall that before Covid-19, Greece lacked access to EU policy instruments. The EU programme of joint bond issuance did not exist and Greece was not eligible for ECB asset purchases then. It has been only since the start of the pandemic crisis in 2020 that this started to change. The government gained temporary access then to new EU programmes. This temporary crisis-specific access to EU funding contributed to our September-2021 upgrade of Greece to BB+, one level below investment grade.

More recently, the transition to strengthened EU burden-sharing and EU steps in the direction of greater fiscal and monetary union have started to seem more permanent and likely to endure beyond recent crises. At this stage, we assume that if Greece falls into severe payment difficulties, the EU will be there to step in and prevent market failure. This assumed greater durability of European support for Greece alongside expanded EU facilities for aiding Member States underpinned the recent upgrade to investment grade.

In my opinion, a permanent financial backstop such as that provided by the ECB since Covid-19 for Greece is a requirement for any borrower to be evaluated at investment grade. A lender of last resort disproportionately provides uplift for the ratings of the most heavily indebted euro-area borrowers such as Greece and Italy.

KM: But are stronger lender of last resort features really “permanent”?

DS: Good question. The financial backstop from Europe is conditional. But as long as Greece remains compliant with Europe’s fiscal and structural-reform regulations, we believe the Eurosystem and EU are likely to help Greece under adverse financial-market scenarios.

The political stability secured after recent Greek parliamentary elections does strengthen government capacity and willingness to pass the needed reforms. This prudent policy framework reinforces Greece’s relationship with Europe – likely anchoring European support for at least the next four years in our view.

KM: You have mentioned debt reduction as a significant reason for Greece’s rating upgrades. Was this expected? Why is this so meaningful?

DS: Reduced debt is indeed meaningful as it makes Greece more resilient to market volatility if Eurosystem support were in the future to prove less forthcoming or less effective. As a result, continued debt reduction makes Greece’s rating more durable at investment grade. Importantly, substantive further convergence of Greece’s elevated debt ratio in the direction of that of other highly-indebted euro-area sovereigns like Italy is crucial for Greece’s future rating trajectory.

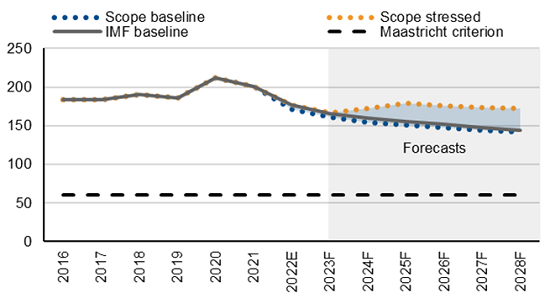

Following more than a decade and many initiatives from European and international partners for setting Greece’s government debt ratio on a sustainable trajectory, Greece’s debt ratio had instead reached fresh all-time records of 206% of GDP by 2020. However, rather surprisingly for us, anchored by robust recovery since Q3 2020, alongside very elevated recent inflation, we see the debt ratio reversing to about 161% by the end of this year – if so, 46pps off 2020 peaks (Figure 2).

Past official and private-debt restructurings and concessional-loan programmes have ensured a low average cost of debt, which has brought about a meaningful differential against nominal growth once this nominal growth finally appeared. This drove the speedy debt decrease of late. Although this declining trajectory of debt will slow, a continued, gradual decline in debt could nevertheless make Greek debt more sustainable and reduce the need for further debt restructuring.

Figure 2. Greece’s general government debt, % of GDP

Source: IMF and Scope Ratings forecasts.

KM: Have high interest rates affected Greece’s credit ratings?

DS: Certainly. After Greece exited the economic-adjustment programmes of its past and associated concessional loans and debt relief, the transition to market financing is not all “good” – especially under currently higher interest rates for new borrowing. Issuing on markets and enhanced market access has a reputation of being credit positive. But transition from bailout back to favouring capital markets also gradually adversely affects Greece’s strong debt structure. The weighted-average maturity of new borrowing declined to 5.5 years in 2022 and again to 4.6 years in 2023 year to date. The average length of outstanding Greek debt is 19.6 years.

As Greece borrows in markets, repays some of its bailout loans early and the ECB accelerates quantitative tightening, publicly-held Greek debt will gradually transition back to private hands. Furthermore, as sovereign ratings are assigned on privately-held debt, this rising commercial debt share is credit negative. Higher borrowing costs in capital markets gradually elevates average interest costs. Finally, an increased share of Greek debt held by commercial creditors rather than by the official sector may, in our opinion, gradually re-subordinate Greek bonds to a degree.

Presently, with most Greek debt being official-sector loans, debt relief since 2012 has concentrated strictly on official-sector loan restructurings. This might change farther in the future if the composition of Greek debt shifts more significantly.

KM: Where does the banking-system clean-up stand?

DS: Structural-reform policies have brought about a reduction in the high non-performing loan (NPL) ratio and bolstered banking-system stability. The Hercules programme spearheaded this effort, and system-wide NPLs dropped impressively to 8% by Q1 2023, having peaked at 49% in June 2017. But we do acknowledge that removing NPLs from bank balance sheets does not per se mean the non-performing loans have disappeared.

The Greek banking sector still remains burdened by the highest NPLs in the euro area. Bank capitalisation is moderate even if it has meaningfully improved. The high dependence for capital on deferred tax credits is a challenge, and the sovereign-bank relationship is a more considerable contingent liability than in the past.

KM: What challenges remain that could affect Greece’s credit outlook?

DS: Greece’s ratings are constrained at BBB- by several meaningful credit challenges. The elevated level of government debt remains a core challenge. High debt exposes Greece to ongoing risk whenever there is a pivot of market sentiment towards questioning the debt sustainability of the euro area’s more-indebted sovereign borrowers. Further reducing this debt could make Greece more resilient.

Furthermore, policy risks prevail as Greece transitions from dependence on conditional official-sector credit towards favouring less-conditional market-based funding. Thirdly, the banks and external sector display fragilities.

Another challenge is modest long-run potential growth of around 1%. Environmental challenges are relevant here as climate risk curtails long-run growth if heatwaves and wildfires damage Greece’s crucial tourism and agriculture sectors. A Bank of Greece-commissioned analysis from 2011 concluded climate change may cost the Greek economy anywhere from EUR 577bn to EUR 701bn by 2100. That is three times the size of the Greek economy today. Climate risk represents a meaningful long-run risk relevant for Greece’s ratings as the most exposed economy of the European Union.

KM: How concerned are you that Greece repeats mistakes of its past?

DS: History does tend to repeat itself. So, this is one of our main concerns – maybe not so much near term but certainly in the medium to long term. In 2015, the positive early progress of the Greek government in the aftermath of the Greek crisis was sharply reversed following a change of government. Greece ended up missing payments due to the IMF the same year. A change of policy orientation in the future could similarly compromise the progress made recently and challenge the European support resting on reform execution. The main opposition – SYRIZA – may go in a more moderate or in a more radical direction following recent electoral defeat.

Even today, available fiscal space is being deployed by the incumbent government led by Prime Minister Kyriakos Mitsotakis, with EUR 9bn of one-off hand-outs to pensioners, pay rises in the public sector, and a rise in the tax-exemption threshold for households with children. The abolition of a bailout-era solidarity tax and pledge to abolish a special tax on interest on Greek Treasury bills and bonds are further examples of reversals of crisis-era policy.

As borrowing conditions ease for Greece and reform straight-jackets are taken off, the concern is a slow drift towards reversal of reforms of earlier years and return to easier fiscal policy to compensate for severe income losses of the previous decade.

At this stage, the scale of such policy reversal is comparatively moderate and Greece strongly maintains its pursuit of debt reduction and primary fiscal surpluses as core objectives, alongside structural reforms under the EU Recovery and Resilience Facility. There remains European oversight. But policy slippage needs to be closely monitored – as far as ensuring mistakes of the past are not repeated after Greece achieves investment grade and after achieving the normality sought for the past decade.

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.