Announcements

Drinks

France's fiscal consolidation is challenged by rigid spending, uncertain reform agenda

By Thomas Gillet and Brian Marly, Sovereign and Public Sector

A stronger commitment to budgetary consolidation has to be set against the delayed benefit of growth-friendly, supply-side reforms, due to successive external shocks, and the uncertainty over measures to reduce public spending.

Rather than a decline in debt-to-GDP that the government forecasts, we expect a moderate rise in debt-to-GDP to around 112% in 2028, slightly more conservative than the IMF projections but below the government’s projection in a no-policy-change scenario.

For its part, the government wants to reverse about a quarter of the increase in debt-to-GDP that occurred in 2019-22 – the result of measures introduced to reduce the impact of the pandemic and inflation shocks – by 2027.

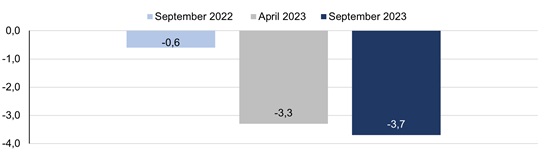

This corresponds to a reduction in debt of 3.7pps of GDP on a cumulative basis over the period compared with 2022. This trajectory will leave France with debt-to-GDP of 108.1% in 2027, more than 10pps above where it was in 2019.

The plan is more ambitious than the target set in April when the government aimed to reduce debt by only 3.3pps (Figure 1), though that was significantly more than the target of 0.6pps envisaged in September 2022.

Figure 1. France targets faster deleveraging that is still modest compared to Covid debt

Change in debt-to-GDP ratio between 2022 and 2027 on a cumulative basis (pps)

Note: government projections of September 2022 (Projet de Loi de Programmation des Finances Publiques), April 2023 (Programme de Stabilité) and September 2023 (Loi de Programmation des Finances Publiques). Source: Ministry of Finance, Scope Ratings

Government recognises importance of bolstering debt-reduction commitment

This more ambitious deleveraging, concentrated in 2026 and 2027, is underpinned by the government’s stronger commitment to fiscal discipline through more regular and comprehensive government-spending reviews, regulatory measures, and cracking down more on tax fraud. The enhanced governance framework for public finances could also contribute to rebuild buffers, as could the newly established high council of public finances for local governments.

Still, consolidation efforts are modest in comparison with the European Commission’s fiscal rules proposal of April 2023 that, if adopted, would require, according to Bruegel, an annual 1.1% of GDP adjustment in the structural primary balance on average between 2025 and 2028. But this would imply either additional cuts in expenditure and/or tax hikes, both of which are not on the government’s agenda.

Faster deleveraging driven by fiscal consolidation in the longer run

The government’s expectation of a decline in the debt-to-GDP ratio to 109.7% in 2023 (down 2.1pps from the previous year) would primarily stem from phasing out measures to address the cost-of-living crisis.

The government then projects debt-to-GDP to remain broadly stable until 2025. Only in 2026-27 does it forecast cuts to the primary deficit which would gradually reduce debt-to-GDP to 109.1% in 2026 and 108.1% in 2027. The efforts to rebuild fiscal buffers are projected to be partially offset by a rising interest burden.

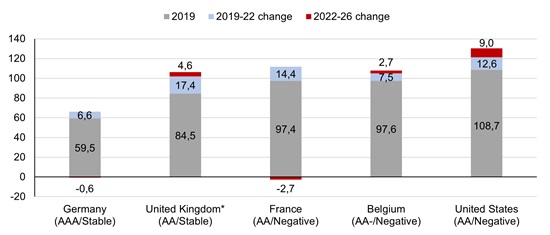

Yet, the government’s forecast of a 2.7pps reduction in debt-to-GDP in 2022-26 is larger than the 0.6pps cut expected in Germany (AAA/Stable), and also more ambitious than the 4.6pps increase in the United Kingdom (AA/Stable) and 2.7pps in Belgium (AA-/Negative). It contrasts favourably with the 9pps increase expected in the United States (AA/Negative) (Figure 2).

Figure 2. France’s planned cut to debt-to-GDP is more rapid that peers’

Debt to GDP (%), change in debt to GDP on a cumulative basis (pps)

Note: Based on Loi de Programmation des Finances Publiques for France; latest available Stability Programme for Germany and Belgium; and figures published by the Office of Management and Budget for the US. Figures published by the Office for Budgetary Responsibility for the UK show the change between fiscal years 2023/24 and 2026/27. 2026 as the most forward-looking projections among selected sovereign peers. Sources: National Ministries of Finance, OMB, OBR, Scope Ratings

Structural pressures, uncertain fiscal measures test the robustness of deleveraging

Investment needs, considerable compared with planned expenditure savings, and spending rigidities will hinder reduction of France’s primary deficits.

The 2024 draft budget includes a rise in spending of EUR 7.0bn for the green transition, EUR 5.6bn for education, and EUR 3.3bn for defence. Such expenditure is likely to grow further in coming years whereas the government is yet to detail where efficiency gains will materialise.

Debt-funded Covid- and energy-related support also have a long-term impact on public finances when borrowing costs are at their highest level since 2011. The government expects the interest burden to increase by 0.7pps over 2022-27 to 2.6% of GDP (EUR 74.4bn).

As the government has so far ruled out domestic tax hikes, revenues are primarily contingent on real GDP growth, which the government revised down to 1.4% for 2024 from 1.6% previously. This is still above our 1.0% projection for next year.

Political obstacles remain in the way of deeper economic reform

Structural reforms, including those on pension and unemployment benefit systems, support France’s GDP growth outlook. However, their positive impact will likely take more time to materialise due to the Covid pandemic and the cost-of-living crisis.

The introduction of more growth-enhancing supply side reforms also appears unlikely in the current socio-political context. Reform momentum could even fade further, partly related to the electoral cycle. The minority government of President Emmanuel Macron is preparing for European elections due next June, municipal elections in 2026 and presidential and parliamentary elections in 2027.

With an uncertain and evolving reform agenda going forward, the expectation that real GDP growth will run above potential between 2025 and 2027 – estimated at 1.35% by the government but only 0.8% by the European Commission – appears optimistic.

This is consistent with a weakening in public finances and implementation risks to the reform agenda that underpinned the Negative Outlook we assigned to France’s AA long-term ratings in May. Scope Ratings' next scheduled review date for France is on 10 November.