Announcements

Drinks

EU sovereign debt: climate but especially demographics present important long-term risk

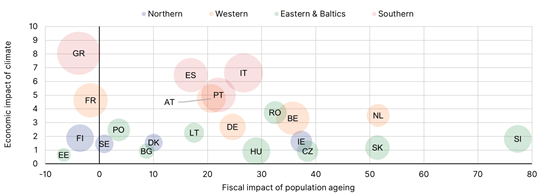

Population ageing presents the greatest challenge, potentially increasing public debt by up to 21pps of GDP on average across EU countries. The climate-related impact of a ‘disorderly’ transition could lead to a further increase of public debt of around 5pps of GDP on average, above the impact estimated under the ‘orderly’ (1pp) or ‘hothouse’ (3pps) scenarios, Scope says.

“Climate risks and demographic change are among the most important structural challenges sovereigns will face in coming decades and should be effectively understood and integrated into sovereign credit assessments,” says Thibault Vasse, analyst at Scope Ratings, co-author of the research report on EU climate risks, demographic change, and debt sustainability.

“This report builds on Scope’s established analytical frameworks, incorporating environmental, social and governance factors to lay the foundations for long-term debt sustainability analysis that considers the impacts of population ageing and differing climate scenarios for sovereigns, with a focus on EU countries,” says Vasse.

Impact of ageing and climate risks on EU public debt ratios, 2022-50

pps of GDP

Source: Scope Ratings

Debt impact of climate, demographics crucial for assessing long-term sovereign risk

“Global warming has led to widespread and rapid changes in the climate, while much-needed greenhouse gas (GHG) emissions reductions will have profound economic implications,” says Hazem Krichene, analyst at Scope ESG Analysis and report co-author.

“Similarly, population ageing has profound implications for countries’ growth and fiscal outlooks. Incorporating climate and demographic factors via longer time horizons for debt sustainability analysis is critical for properly assessing the materiality of these factors for long-term sovereign risk,” says Krichene.

Long-term impacts vary widely across the EU

In the report, Scope finds EU-wide averages hide wide regional differences. The impact of population ageing outweighs that of climate-related risks for most countries with the exceptions of Estonia, Greece, France, Latvia, Finland and Sweden where age-related costs will not increase much in coming decades.

Climate-related GDP losses mostly reflect transition risks and are highest in southern, northern, and western countries, while eastern and Baltic countries appear more insulated. These differences reflect both differing levels of carbon intensity and climate ambition, with more (less) stringent emissions reductions typically assumed in NGFS modelling for higher (lower) income countries.

The eastern and Baltic EU region has the weakest underlying debt dynamics, due to expectations of sustained structural deficits and weakening growth as countries’ income levels converge with that of other EU countries. Scope’s ‘benign’ scenario projects the average debt ratio to reach 67% by 2050, up by over 20pps from 2022. The region also faces the highest increase in age-related costs, which will place the average debt ratio on a firmly rising trajectory, reaching 91% of GDP by 2050 under the ‘ageing’ scenario.

Need to recognise uncertainties in long-term risk modelling

Scope recognises that modelling the complex interactions between population ageing, climate change, economic performance and public debt sustainability over very long-time horizons carries deep uncertainty and results from scenario analysis should be interpreted with caution.

“The scenarios presented in this report are not a forecast of what is likely to happen nor a prescription for what should happen, but they offer a narrative for what could happen. As such, they provide useful insights for assessing sovereigns’ relative exposure to demographic and climate risks. These projections are useful insofar as they identify long-term fiscal risks and signal whether fiscal, social and climate policy adjustments could be needed,” says Arne Platteau, analyst at Scope ESG and report co-author.

For now, Scope’s modelling of climate factors only includes chronic physical risk related to rising temperatures and transition risk. The inclusion of acute physical risks would likely exacerbate the impact of climate change across EU countries.

Still, adaptation, carbon tax revenues, economic windfalls from the green transition, and potential cost savings on green technologies can all help mitigate the impact for public debt level in the EU.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope’s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.