Announcements

Drinks

Spanish banks 2024 outlook: high earnings, clean balance sheets, adequate capital

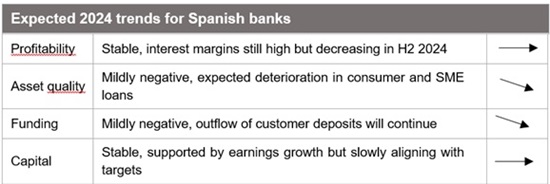

The main profitability driver has been net interest income. “We expect the improvement in NII to continue at least for the first half of 2024, as variable-rate mortgages still represent around 68% of the total,” said Carola Saldias, lead analyst for Spanish banks. “But a wider performance gap between domestic and international operations will emerge in 2024, mainly due to higher loan growth coming from emerging markets as loan volumes in Spain flatten and eventually decline as demand adjusts to lower growth expectations and still-high interest rates.”

Deposit repricing will also put pressure on margins. Banks accelerated the pass-through of interest rates in Q2 and Q3. The large retail funding base represents a strength of Spanish banks but customers are increasingly switching from current accounts to time deposits.

Asset-quality metrics have so far proved resilient, although the decline in NPLs appears to have reached a floor. “We expect some deterioration starting in H1 2024 driven initially by consumer loans, SMEs and highly leveraged corporates as well as volatility in emerging markets,” Saldias continued.

“Cost of risk is increasing but in a very controlled fashion and it remains below full-year 2023 guidance. For 2024, we expect cost of risk to increase for all banks slightly above 2023 guidance but still under control, as we foresee a transition to average levels across the cycle.”

It is worth noting that all four banks in Scope’s sample (BBVA Group, Santander Group, Caixabank and Sabadell) present NPLs below the average for the Spanish banking sector as of September 2023, partly a result of their geographic mix but also reflecting proactive management of exposures.

With regard to one-off costs, the windfall tax approved by the government for 2023 and 2024 was easily absorbed by higher earnings and is unlikely to dent performance in 2024. “An extension of the tax is not in our base case. However, the proliferation of bank windfall taxes in EU countries supports our view that banks are seen as quasi-utilities. Therefore, we do not exclude in the medium term new initiatives that could curtail banks’ profitability,” Saldias said.

Download the Spanish banking outlook here.

Issuer rating reports available to ScopeOne subscribers:

Banco Bilbao Vizcaya Argentaria SA

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.