Announcements

Drinks

RBI's STRABAG deal advances bank’s exit from Russia but faces execution risk

By Christian van Beek, Director, Financial Institutions

Completion of Raiffeisen Bank International’s acquisition, via its Russian subsidiary, of a 27.8% stake in Austrian construction group STRABAG SE from MKAO Rasperia Trading for EUR 1.5bn is still subject to various conditions. These include the satisfactory completion of sanctions compliance due diligence by RBI, regulatory approvals and antitrust clearances.

RBI said it has complied with all sanctions regulations in connection with the transaction and will continue to do so. We believe that both RBI and Russia are well prepared for the transaction, which has value for both sides, but whether RBI can complete the transaction given all the sanctions in place is a big unknown.

Successful completion would be positive for RBI. The Austrian group has been unable to upstream dividends from its Russian subsidiary – its most profitable unit by far over the last two years – owing to Russian government sanctions.

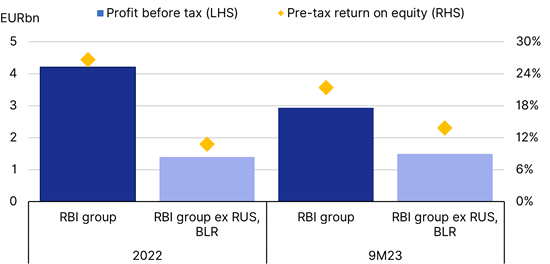

Figure 1: Profitability metrics RBI group vs RBI group ex Russia and Belarus

Source: Company data, Scope Ratings

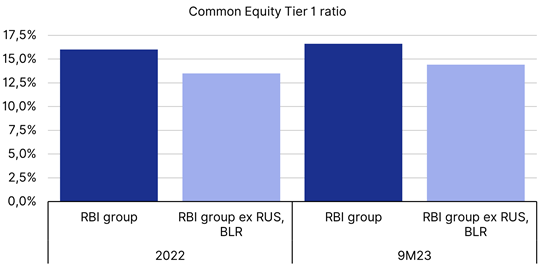

RBI said the transaction is expected to reduce the group's Common Equity Tier 1 (CET1) ratio by 10bp, based on a comfortable pro forma ratio of 16.5% at the end of September, including nine-month 2023 profits. Excluding the interim result, the ratio was 15.7%.

The CET1 ratio calculated by RBI excluding Russia, assuming a deconsolidation of the Russian subsidiary at a price-to-book value of zero, would increase by 120bp, based on a pro forma ratio of 14.4% including 9M2023 profits. This means that after deconsolidating Russia, RBI's capital adequacy ratios would not fall below its pre-war level.

Figure 2: Capital adequacy RBI group vs RBI group ex Russia and Belarus

Ratios for 9M23 include interim profits for the first nine months.

Source: Company data, Scope Ratings

After this transaction, RBI announced that it will continue to pursue the announced deconsolidation of AO Raiffeisenbank through a sale or spin-off. With the completion of the current planned transaction, RBI can take a much more positive view of this measure, as it would significantly reduce the loss from the planned spin-off of the Russian subsidiary. At the same time, we consider it unlikely that RBI will receive any further dividends from Russia.

The withdrawal from Russia will be a significant setback for the RBI's strategy in Eastern Europe, but successful completion of the transaction would create the capacity to actively drive growth in RBI's other key target regions of Central, Eastern and South-Eastern Europe.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope’s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.