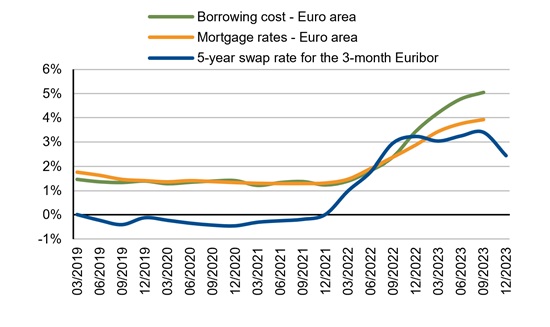

Announcements

Drinks

Real estate outlook: negative credit prospects in sector where scale, diversification crucial

By Philipp Wass, Managing Director, Scope Ratings

For companies lacking these attributes. Increased distressed selling of assets will lead to repricing of older properties, particularly those requiring investment to meet tightening environmental standards. The problem is concentrated in the offices sector, especially for non-prime assets, amid some signs that the market is bottoming out in the industrial and retail segments.

The European real estate sector is facing a cyclical downturn, expensive and/or limited refinancing options and increased liquidity requirements, as well as structural changes including a higher focus on environmental compliance and shifts in demand in some commercial real-estate segments.

The sector will continue to experience declining valuations and deteriorating interest coverage through 2024, leading to continued downward pressure on ratings.

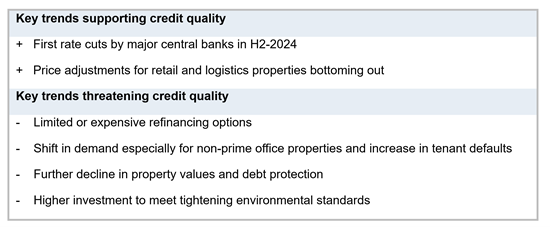

Figure 1: Scope’s rating actions in real estate sector 2020-23

Note: Negative rating actions: Outlook change to Negative from Stable or Stable from Positive; Downgrade; under review for possible downgrade. Source: Scope

Credit quality worsens in German, Nordic property sectors

Additional ratings pressure follows an increase in the proportion of negative rating actions taken on property companies in 2023. Eight of the 36 companies we track in the property sector have a Negative Outlook at the end of 2023.

Negative rating actions were concentrated in the Nordic countries and Germany. The drivers have been the sharp rise in borrowing costs, particularly in the Nordics, the widening of capitalisation rates, felt most acutely in Germany, and the collapse in demand for homebuilders and commercial developers.

Bankruptcies will run at elevated levels this year, but we do not expect the recent default of the Austria-based Signa Group to have significant consequences for the rest of the sector. Commercial and residential property developers will likely account for the largest shares of property company insolvencies in 2024 as they did in 2023 with the likes of Development Partner AG, Gerchgroup AG and Project Immobilien Group AG. This group of companies still faces high pre-financing requirements due to increased construction costs, even if inflation subsides further this year, and the longer time it is taking to close sales. These firms are also likely contending with hard loan-to-value (LTV) covenant breaches due to lower gross developed values. Underlying these challenges is the subdued demand from institutional and retail property buyers, which is likely to be slow to recover even though yields will likely cease widening to the degree they did last year.

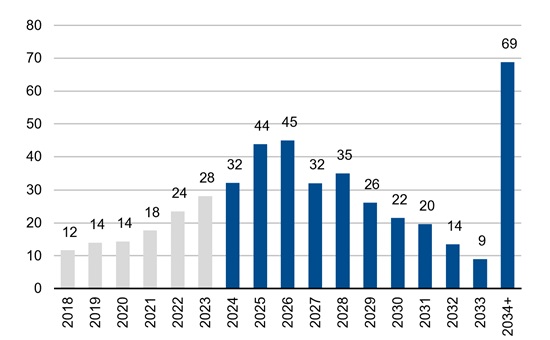

Mortgage rates should stabilise at or around current levels as confidence grows that the interest rate cycle has peaked.

Refinancing challenge looms amid rising liquidity needs

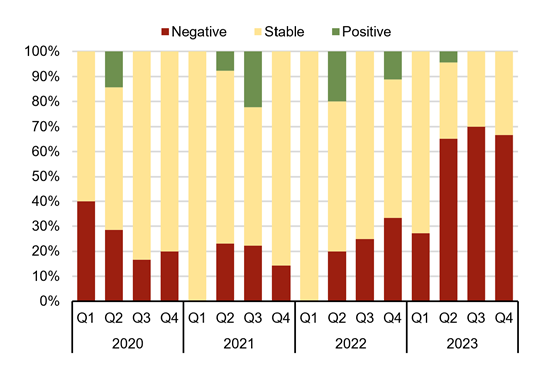

European real estate firms need to refinance capital market debt of around EUR 120bn maturing in 2024-26, an increase of around 75% compared with 2021-2023. At the same time, refinancing options are limited. Banks are not necessarily expanding their loan books in the sector.

If borrowing is available, it is expensive as pricing in debt and equity capital markets has soared, especially for high yield issuers. Often, the financing is simply unavailable if debt yields are below current borrowing costs or leverage is such that there is no buffer against a drop of up to 20% in property values in some segments by YE 2025 – hence the scale of the sector's refinancing challenge. Debt yields represent the ratio of total annualised cashflow generated by collateral and available for debt servicing relative to the outstanding principal balance of a commercial real estate loan.

At the same time, liquidity needs stretch beyond refinancing maturing debt. Real estate firms are grappling with weak demand for new property developments, high construction and borrowing costs, rising environment-linked capital expenditure, a crisis in affordable housing, increasing tenant defaults, and structural shifts in demand in some commercial property segments.

Figure 2: Maturing capital market debt bulges in 2024-26

European issuers with outstanding capital market debt of more than EUR 10m

(EUR bn)

Source: Bloomberg, Scope Ratings

Rental income subject to shift in demand and increase in tenant defaults

Property companies are also exposed to rising bankruptcy rates among their tenants, concentrated among some more fragile sectors, partly related to the withdrawal of Covid-related state support, such as information and communication (defaults increased YoY by 37% in the year to end-September 2023 according to Eurostat) and transport and storage (26%). However, the number of corporate bankruptcies is broadly in line with pre-Covid levels. Hence, companies with higher quality and diversified portfolios should avoid sharp declines in income by finding new tenants even if existing tenants’ default or their credit quality deteriorates. Vacancy rates remain low in the residential and logistics sectors, for example, with the vacancy rate for the latter at 4.3% at end-Q3 2023 according to JLL.

Shifts in demand – particularly out of non-prime office and retail properties as space requirements decline due to an increasing proportion of remote working and the continued growth of e-commerce – will weigh on future rental incomes after the fillip for rental income from CPI-linked leases fades, assuming inflation continues to moderate in 2024.

Figure 3: Are funding costs near their peak?

Source; ECB, Investing.com, Scope Ratings

Interest cover under pressure as borrowing costs remain higher for longer

Our base-case assumption is that higher rates will prevail for longer. The rapid rise in borrowing costs from 2022 onwards has hit hardest those companies that rely on short-term funding or have limited hedging such as Nordic companies and property developers. The median interest cover of our extended peer group fell to its lowest level in H1 2023 (3.2x) since 2016 (3.0x). This compares with 4.1x at YE 2022. While the cost of unhedged debt is expected to peak in Q1 2024, higher borrowing costs will take their toll across the sector as the refinancing of an ever-growing pile of maturing debt begins, putting more pressure on interest coverage.

Real estate firms exposed to sectors with a favourable supply/demand imbalance, such as residential and logistics, and with relatively low leverage, will be able to absorb the impact of higher interest rates due to stable and growing rental income in the short to medium term. For property companies in other sectors such as non-prime offices and/or those with high leverage, high interest costs will squeeze credit quality.

Further decline in property values

Uncertainty over the direction of interest rates this year is diminishing. However, asset sales, whether “motivated”* or distressed, are likely to increase, undertaken by more companies than those just with good access to investment markets, such as Vonovia SE. The German company plans to sell another EUR 3.0bn in 2024 after EUR 3.7bn in 2023. Bid-ask spreads will narrow, and the investment market will slowly reopen through the year.

However, asset sales will put pressure on values as sellers will have to accept steep discounts to enable buy-side financing. Some property companies will also need to undertake major revaluations to restructure their balance sheets to ensure the availability of future financing. In addition, pricing will likely fragment based on property quality, with the heavy repricing of older, less energy-efficient and less environmentally friendly buildings as investors are increasingly mindful of the investment challenges the industry faces.

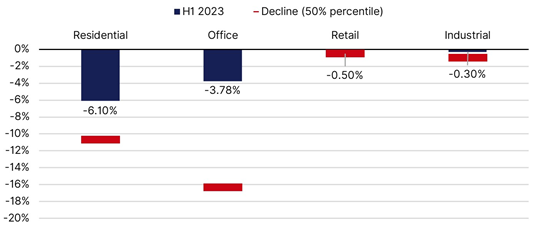

Real estate is the largest energy-consuming sector in Europe, accounting for around 40% of total energy consumption and a third of carbon dioxide emissions. In essence, financing the estimated EUR 225bn to EUR 600bn of annual investment across Europe's real estate stock needed to meet the EU's target of being carbon neutral by 2050, without compromising its social role in providing affordable housing and commercial space, may be achievable only through a massive revaluation of property assets and loss of economic wealth for owners – unless extra state support emerges. As a result, we expect further declines in the value of offices and residential assets, and non-prime property in general, even though valuations for retail and industrial assets have likely bottomed out (Figure 4).

Figure 4: Expected decline in fair values (YE 2022-25)

Note on calculation: European property stock: ¾ considered inefficient, needed renovation rate: 3% per year equalling 750 million sq m in floor space, estimated costs EUR 330-800 per sq m in deep renovation / Sources: European Commission, Buildings Performance Institute Europe, Scope Ratings.

Deleveraging vital to preserve credit quality

Companies will need to focus on deleveraging as fair values and interest cover remain under pressure. With market values set to decline across the sector, despite some signs of a bottoming-out in the industrial and retail segments, the release of capital through asset sales and debt repayments will remain essential for keeping credit metrics stable.

At best, large and moderately leveraged real estate companies will be able to defend their credit quality, while shrinking portfolios could impact other real estate companies' abilities to diversify cash flow and maintain profitability levels, putting additional pressure on credit ratings. At worst, capital release will not be sufficient, and companies will have to modify/restructure their liabilities, ultimately increasing the number of defaults within the sector in 2024.

Thomas Faeh, Rohit Nair and Fayçal Abdellouche contributed to this report.

*Motivated sales are sales that issuers are willing to make to free up capital to assure a smooth refinancing of maturing debt well in advance.

To download the full Corporates Outlook 2024, please follow this link.

Webinar: Tuesday, 20 February at 15:30 CET

Please join Scope Ratings analysts for an in-depth discussion of the European corporate credit outlook for 2024 by registering here.

Make sure you stay up to date with all Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds.