Announcements

Drinks

German banks: systemic crisis unlikely amid persistent concerns about real estate slump

By Christian van Beek, Director, Financial Institutions

German banks have reported much better results in recent weeks, thanks to high growth in net interest income and moderate increases in non-interest revenue. But the 10.2% slump in domestic commercial real estate prices last year and contagion risks, particularly stemming from varying degrees of involvement in the US CRE market, are persistent concerns.

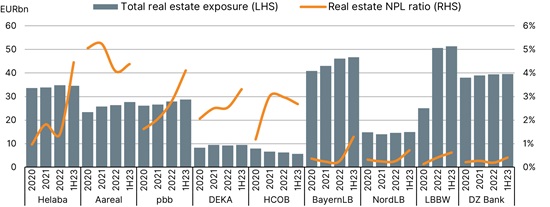

The total real estate exposure of the German banks that reported to the EBA as part of the transparency exercise amounted to EUR 333bn at end-June 2023. But while the deterioration in real estate markets started to be reflected in banks' balance sheets and NPL ratios in 2023, loan-loss provisions remained manageable for most banks.

Germany’s specialist mortgage lenders and Landesbanken have large real estate portfolios, however, and some of their exposure is outside Germany, particularly in the US office sector. These banks have had to contend with noticeable increases in NPL ratios and some have booked significant loan-loss provisions.

Other segments of real estate financing are less conspicuous. In particular, the German real estate market is fundamentally stable. Losses related to the collapse of real-estate group Signa proved to be manageable for German banks. In general, we expect loan-loss provisions for commercial real-estate exposures to remain at moderate levels through 2024. Banks have generally become more cautious about lending to distressed property segments so we expect the proportion of office property in portfolios to decline over time.

We note that NPL ratios for the real-estate exposures of Landesbank Hessen-Thüringen (Helaba), Deutsche Pfandbriefbank (pbb), DekaBank (DEKA) and Bayerische Landesbank (BayernLB) rose significantly – by 1.5 percentage points – in the first half of 2023 (see Figure 1) but we still consider the risks to be fairly contained at this level. The worst affected real-estate lenders constitute a limited share of the German banking sector. We have not included Deutsche Bank or Commerzbank’s exposures because of the high proportion of residential mortgages in their real-estate portfolios and their very stable nature.

Figure 1: Real-estate exposures and NPL ratios of selected German real-estate lenders

Aareal: since 1H23 reported as Atlantic Lux HoldCo S.à r.l., LBBW: 2021 not available

Source: European Banking Authority (EU-wide transparency exercise), Scope Ratings

In general, the solid performance of most German mortgage banks can be attributed to their sound underwriting standards resulting in low loan-to-values and healthy diversification, both in terms of property types and geographical distribution. The scope of the crisis is therefore limited to a few individual commercial real-estate financiers that have focused on revenue growth in recent years, particularly outside Germany. Refinancing risks for the overall real estate client base may lead to further credit losses in coming years but we do not see a systemic crisis emanating from these institutions.

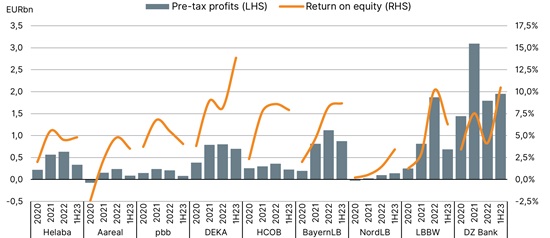

This is largely due to the efforts made by German banks over the past decade to sustainably reduce their cost bases and strengthen non-interest income in an environment of ultra-low interest rates and declining interest income. The result is much improved profitability at times of rising interest rates, which compares increasingly favourably with international peers. Even though we expect net interest margins to normalise in 2024, we believe the earnings base of German banks has been sustainably strengthened and that it has significant loss-absorbing capacity in the unlikely event of an intensification of a real-estate crisis.

Figure 2: Pre-tax profitability and return on equity of selected German real-estate lenders

Source: SNL, Scope Ratings

Regulatory requirements since the global financial crisis have resulted in more capital flowing into the banking sector, significantly increasing resilience to a deteriorating economic environment. Banks have also increased their risk reserves by post-model adjustments for the scenario of a sustained real estate crisis, a measure that helped in the face of the Coronavirus pandemic and the energy crisis resulting from the war in Ukraine.

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.