Announcements

Drinks

Germany: rating outlook stable despite near-term economic stagnation and fiscal challenges

By Eiko Sievert, Director, Sovereign and Public Sector

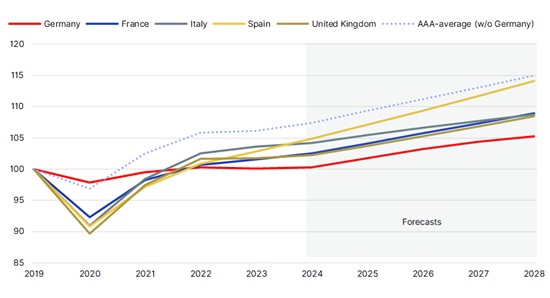

Germany’s (AAA/Stable) economic stagnation over the past five years is unprecedented in the country’s history since the 1970s. We expect the economy to stagnate again this year, with output increasing by just 0.2%. This would place GDP just 0.3% above pre-pandemic levels, well behind other large European economies such as the UK (+2.3%), France (+2.6%), Italy (+4.2%) and Spain (+4.9%), and AAA-rated sovereigns (+7.4%). Compared to Germany’s pre-pandemic growth trajectory, 2024 GDP is expected to be about 6pp lower than forecast in 2019, the highest differential among G7 countries.

Germany’s growth will pick up to 1.4% in 2025, more in line with other large European economies, before gradually returning to its medium-term potential of 0.8%. But even this modest growth outlook is vulnerable to geopolitical risks given the dependence of Germany’s high value-added, export-orientated economy on energy imports and global trade.

Figure 1: Germany falls behind in Europe’s post-pandemic economic recovery

GDP, end-2019 = 100

Source: Scope Ratings. Note: AAA-rated countries include Austria, Denmark, Luxembourg, the Netherlands, Norway, Sweden, Switzerland.

Debt brake adjustment crucial, but not sufficient to boost investment

Reforming the debt brake could help. The country’s large fiscal buffers have provided an effective shield against the impact of the pandemic, the energy crisis and repercussions of Russia’s war in Ukraine, but the German constitutional court’s strict interpretation of the debt brake is expected to hold back growth by curtailing public investment.

More ambitious reforms are also needed to provide incentives for the private sector to grow. Reducing administrative burdens on firms by simplifying planning laws and encouraging digitalisation are among the priorities. The latest Bureaucracy Relief Act IV promises annual savings for industry of up to EUR 944m but industry representatives see the proposed measures as inadequate. Germany’s National Regulatory Control Council notes that annual bureaucracy costs for firms have remained broadly stable at EUR 65bn (around 1.6% of GDP) since the 2021 federal election, despite the government’s stated goal of reducing bureaucracy.

Government also needs to address structural problems in the labour market, which are leading to shortages of skilled workers. Germany has one of the highest job vacancy rates of European economies at 3.9% compared with an EU average of 2.5%. Immigration reform and family-friendly policies and investments to encourage employment would help. Around 66% of mothers and 35% of women without children currently work part time.

Germany’s economic challenges can be overcome with ambitious policy reforms along these lines but it will take cross-party political consensus to achieve them, the next test of which is negotiation over the upcoming federal budget.

The coalition government will face difficult trade-offs to agree on the 2025 budget by the summer. Savings of around EUR 15bn to EUR 30bn (3.2% to 6.3% of the 2024 budget) need to be found, requiring spending cuts across most ministries. Such cuts often result in lower net investment, leaving the government less able to address Germany’s longer-term challenges.

Germany retains significant room for fiscal manoeuvre to tackle longer-term challenges

Germany’s fiscal position stands in sharp contrast to the public finances of Europe’s largest economies, including the United Kingdom (AA/Stable), France (AA/Negative) and Italy (BBB+/Stable), which all face high government deficits as well as high and, in the absence of credible fiscal consolidations plans, rising public debt over coming years.

Germany continues to have significant fiscal space to fund growth-enhancing investments. In the five years leading up to the Covid-19 pandemic, the country ran general government primary surpluses averaging 2.2% of GDP. Over the next five years, we expect continued deficits as the government faces rising spending pressures and makes use of existing flexibility within the debt brake permitting a deficit of up to 0.35% of GDP. Even with this looser fiscal stance, Germany’s debt-to-GDP ratio is expected to decline over the next few years, reaching 59% by 2028, down from 64% in 2023.

Near-term challenges to Germany’s sovereign rating relate to growing geopolitical risks including possible escalation of Russia’s war in Ukraine, uncertainty regarding the outcome of US elections in November and rising tensions between western governments and China, factors over which the German government has limited control.

The longer-term challenges to Germany’s sovereign rating relate to transition risks for its energy-intensive industries and rising spending pressures related to an ageing population. Higher net investments and raising the growth potential are important remedies for both.

Stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.