Announcements

Drinks

BBVA’s Sabadell bid reflects solid prospects for Spanish banking sector

By Carola Saldias Castillo, Analyst, Financial Institutions

The process is expected to take six to eight months and the outcome is far from certain, as BBVA first needs approval from regulatory authorities and then a minimum of 50.01% of Sabadell’s shareholders to accept the offer.

BBVA’s bid reflects its desire to grow in its home market, where strong economic momentum is creating an attractive risk-return profile for commercial and retail lending. Growth prospects in Spain (A-/Positive) are running ahead of the euro-area average while improving labour market dynamics support asset-quality trends. Better economic conditions have not only benefited major banks but regional players too, whose profitability had been lagging in the post GFC recovery.

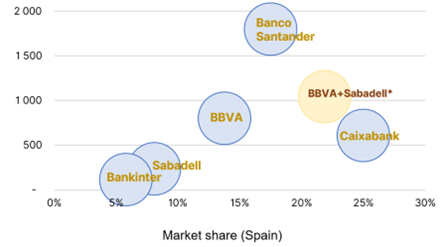

A BBVA-Sabadell merger would reshape the banking competitive landscape in Spain, enabling BBVA to close the gap with its historical rival, Santander, and reduce the number of second-tier players, leaving a barbell-shaped competitive environment with three universal banking giants controlling close to 65% of the market alongside a number of smaller institutions with low single-digit market shares, limited geographic franchises but still relevant footprints in their respective niche segments.

Total assets (EUR bn) vs market share: Top 5 banks in Spain

*Scope Ratings estimate. Data as of December 2023. Source: Bank’s data, Scope Ratings.

The strategic fit of a BBVA-Sabadell deal would be unmatched in Spain and even more apparent than cross-border transactions, recently championed by French president Emmanuel Macron, where idiosyncratic differences pose material challenges and cost synergies tend to be more limited.

A BBVA-Sabadell merger offers several strategic business-model advantages for BBVA: stronger pricing power, a more comprehensive domestic franchise combining BBVA’s strength in retail with Sabadell’s SMEs focus, a bigger budget to deploy in digital and ESG capabilities, a more balanced geographic split between developed and developing markets, and significant opportunities for cost synergies from overlapping distribution networks. The potential of higher profitability, supported by expected cost synergies, make the takeover appealing to shareholders.

However, the initial preference of the Sabadell board to go it alone shows its confidence in the management team’s ability to deliver on its strategic plan. The inability of the two parties to initially reach a deal on friendly terms is an important reminder that unless a bank is in distress, the gap between the seller’s own perceived value and the acquirer’s willingness to pay may be larger than the potential for value creation through a merger.

Despite the significant run-up in Sabadell’s share price since the beginning of the year, rejecting the offer was a clear indication, at least in the eyes of Sabadell’s board, that the valuation of just under 0.7x book value proposed by BBVA failed to reflect the bank’s stand-alone potential. After the release of Q1 2024 results, the management sees material upside in profitability. From a net profit of EUR 1.3bn and RoTe of 11.5% in 2023, management recently upgraded its RoTE guidance for 2024 to above 12%, with expectations of further improvement for 2025.

A traditional commercial bank primarily focused on the domestic market (although it also owns the UK’s TSB Bank), Sabadell’s profitability has been boosted by the favourable interest-rate environment, a trend that has benefited many European banks. Profitability has consistently surprised to the upside, largely driven by a steady increase in margins due to the bank’s large component of variable-rate SME loans as well as stickier deposit pricing than initially expected.

No need for deal at all costs

Standing by its initial offer and presenting it directly to Sabadell’s shareholders, BBVA has shown financial discipline but, it does not need a deal at all costs, especially considering recent government concerns about the merger.

BBVA’s business model is resilient and well tested with a well-balanced risk-return profile combining exposures in emerging and developed markets. This allows it to strategically deploy additional capital in Spain, enhancing the stability and predictability to the group’s performance and reducing potential volatility from the different growth dynamics in its emerging markets exposure, which tilt the risk and revenue profile at group level.

In the event of an unsuccessful offer, BBVA’s business model is strong enough to increase its footprint in Spain through organic growth, even though that takes time, while continuing to expand its presence in emerging markets through digital channels.

Stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.