Announcements

Drinks

UK Banks Quarterly: credit fundamentals remain solid but asset quality expected to weaken

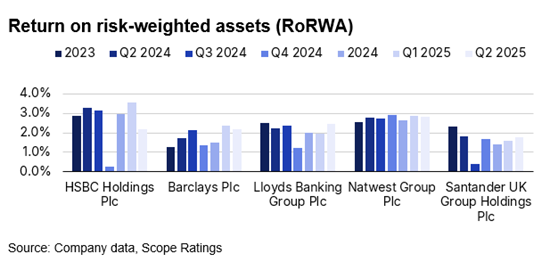

All the banks in our sample (Barclays, HSBC, Lloyds, NatWest, Santander UK) reported solid Q2 profitability. The aggregate return on risk-weighted assets was 2.3% and return on equity was 11%, both marginally higher than the 2023-2024 average. Robust earnings were primarily driven by solid net interest income (NII) and income from structural hedges. Higher loan volumes will continue to bolster NII.

“Although our base case is for UK bank profitability to remain elevated, we do not rule out the impacts of a worsening geopolitical scenario, which would slow global trade, worsen the UK’s economic situation, increase market volatility, and weaken consumer confidence, all of which could impact credit,” cautioned Alvaro Dominguez Alcalde, an analyst in Scope’s financial institutions team.

Although the UK banking sector is relatively concentrated, “we expect consolidation to continue for the large players as long as bolt-on deals present strong financial rationales, an improvement in efficiency, operational synergies and greater scale and controlled growth,” Dominguez Alcalde said. Challenger banks and neobanks, some of which have developed an interesting presence in specific market niches, are potential targets. We also do not rule out further M&A among building societies.

Even though the Leeds Reforms are the most comprehensive in over a decade, they do not radically alter the UK’s highly regulated operating environment. “But we are cautious about the potential risks of relaxing current strict loan-to-income ratio limits, as it could weaken underwriting standards and increase household debt levels,” Dominguez Alcalde warned.

When it comes to asset quality, the average stage 3 ratios of UK banks improved marginally in Q2 2025 to 1.7%. However, we are also cautious about this mild improvement as it mainly reflected increased lending in the wake of interest-rate cuts. High geopolitical risks and worsening trade due to US tariff policies puts pressure on asset quality.

Despite dividends and share buybacks, UK banks’ capital levels marginally increased in the second quarter, owing to strong organic generation. The average CET1 ratio among the banks in our sample stood at 14.2%, with all banks reporting above their capital targets. Capital buffers above regulatory requirements ranged between 1.8% and 3.7% across the sample.

“We expect capital levels of the UK banks in our sample to remain broadly stable. Solid organic capital generation will offset expected returns to shareholders. We consider regulatory headwinds to remain manageable,” Dominguez Alcalde noted.

Most UK banks saw a minor uptick in deposits in Q1 2025, continuing their recovery from the declines seen in the first half of 2024. “We anticipate a gradual recovery in deposits during H2 2025, supported by expected interest-rate cuts and customers’ preference to preserve liquidity amid geopolitical and market uncertainties,” Dominguez Alcalde said.

Download the UK bank quarterly here.

Scope has subscription ratings on the following UK banks. To view the ratings and rating reports on ScopeOne, Scope’s digital marketplace, or to register, please click on the following links:

Barclays plc

HSBC Holdings plc

Lloyds Banking Group plc

NatWest Group plc

Santander UK plc